A Recap of Twitter's LBO

Using Twitter to make suggestions to Twitter's management about the best path forward for the company & its capital structure

Executive Summary:

A convertible note private placement could allow Twitter to reduce debt burden from LBO by raising capital from investors aligned with long-term vision. This would lower interest costs and reduce bankruptcy risk.

New investors would get equity upside if Twitter grows in value above a premium to current price. This incentivizes supporting growth decisions even if they reduce near-term cash flow.

Elon would likely need to accept dilution of his equity stake to entice investors, but it would increase the chance the stake would be worth much more by the time the dilution is realized and would preserve control, allowing for a potential longer term vision to be executed.

Alternatively, a group of investors could purchase the underwritten LBO debt from the banks at a discount to par (e.g., 60 cents on the dollar) and simultaneously negotiate a deal with Twitter to swap the acquired debt into new secured (if permitted) PIK notes (e.g., 80 cents on the dollar), helping to alleviate the cash interest burn on Twitter’s FCF.

Incentives would be better aligned between investors and Twitter, compared to investment banks focused on near-term returns. This allows product innovation and exploring new monetization models without worrying about short-term cash flow for interest payments.

A few days ago, I tweeted my thoughts about a potential way for Twitter to recapitalize so that the shareholders would be more aligned with the longer term vision of the company.

The thesis is pretty simple if you understand a few basics. Essentially - if a group comes together to buy the debt and Elon agrees to swap the bonds/loans for convertible notes (a fixed income security with some clauses for how they may eventually convert into equity), he (Elon) will essentially be taking dilution to his equity stake in Twitter in exchange for relieving the company of the interest burden that is currently sitting around $1.4bn per year. First, some definitions:

Convertible Note

A convertible note is a fixed income security, effectively a bond with an embedded call option that allows for investors to participate in the growth of the value of the company with certain conditions. Above a certain price, notes may be “converted” into equity by exercising the option (a call). If conversion doesn't occur by the maturity date (because the value of the company has not grown past the “conversion price”), the company repays the loan. The shares issued in association with the exercise of a convertible note are dilutive to existing holders, but since there is a delay between issuing the convert and the actual conversion it is less dilutive than an equity offering at the money - especially if the company’s valuation is currently depressed.

LBO: Leveraged Buyout

To quote an old Bloomberg headline that’s been memed countless times on fintwit, “private equity transactions are usually financed with a mix of debt and equity”. In the case of a leveraged buyout, the buyer utilizes debt in order to pay more than they’d otherwise be able to afford - debt that becomes the obligation of the acquired company. This is why they call it a "leveraged" buyout. That word "leveraged" is about a ratio that looks at a company’s debt compared to their earnings. In LBOs, that ratio is usually pretty high. Around roughly 6 to 8 times the company's earnings.If things go south, the company they bought is left holding the bag, not them. Typically, the acquirer only pays for a portion (anywhere between 20-50%, but it can be more or less depending on the transaction) with equity (called “sponsor equity”) and finances the rest with debt (usually provided by investment banks, who go on to “syndicate” the loan, or sell the debt to investors).

The investors who buy these bonds or loans want a return stream that is more predictable than equity (the yield on the bonds) and forgo the potential upside in exchange for consistent interest payments and (in the case of the most senior loans) claims on the company’s assets in the case of bankruptcy (sort of similar to the structure of how one purchases a house with a mortgage).

This is why companies with relatively stable cash flows and opportunities for enhancing operating leverage are common targets for private equity companies (the stable cash flows allow them to reliably cover interest payments and eventually earn a higher return than they would’ve had the company been financed solely with equity).

It’s also why startups are usually financed with equity only (since the profits won’t come until someday in the future, it makes sense for the startup to focus on developing their product and growing the company vs making short term decisions to cover interest payments that may hamper the company’s long term growth prospects). A company sells shares to investors willing to take the risk in exchange for sharing potential upside if a company is successful.

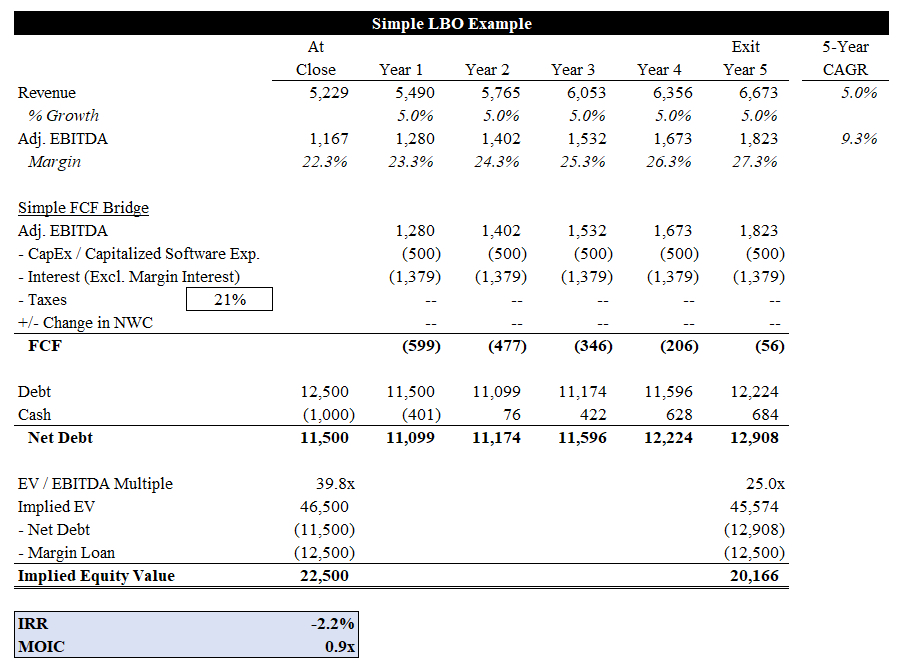

Here’s an example of what a “typical” LBO looks like:

In general, debt financing is cheaper than equity financing. The expected returns for investors are lower with debt (the “equity risk premium”) & the interest payments are tax-deductible. However, this does not always mean that debt is a better option (especially for a company that is having difficulty generating free cash flow). In the case of a company that’s having trouble meeting their debt obligations, selling equity (provided they can get a decent enough price) instead can mean an environment where it is easier to take risks that pay off further down the line - you cannot “default” on equity and the only times when equity holders have claims on the assets of the company are in a bankruptcy liquidation (after the holders of secured/unsecured debt and other senior claims).

The problem with this is if the company is selling equity to get out from under a stifling debt burden, the valuation is probably pretty depressed. This means the dilutive effect of issuing shares is magnified (raising 50m at 500m means a dilutive effect of 9.1%, versus only 4.8% at 1bn).

The Twitter LBO

In the case of Twitter, Elon - with a $7.1bn equity investment from the likes of Larry Ellison and others - was able to finance most of the $44bn acquisition with equity (including Musk’s shares of Twitter purchased on the open market, which were rolled over, the refinancing of Twitter’s existing debt, Elon’s margin loan on TSLA stock & the cash on hand of Twitter) and the remaining ~$13B or so was financed with debt. Now, usually, when a deal like this takes place, the banks that underwrite the transaction will then go on to sell the debt to interested investors (known as the syndication process).

However, the deal came at a time when financial markets took a turn for the worse and investors’ appetite for risk dried up, leaving the banks holding the loans on their balance sheets. Loans backing LBOs fell 39% to US$114bn, and bringing this much supply of junk rated loans to market risked pricing that was sub par, if they could even get it all placed. A few months ago, there was talk of investor interest in bidding 50 cents on the dollar for Twitter debt, a very bad break for the banks.

This has created a dilemma for the banks who risk taking a multibillion dollar loss if they are not able to sell the debt at par value or close to it. If this situation had been purely influenced by broader market conditions (i.e. a pullback in markets that decreased the risk appetite of investors and slowed overall transaction volume), the banks could likely wait it out and sell the loans once demand picked back up. However, in the case of Twitter, the stability of near term earnings is in question which makes debt investors uneasy about how reliably the company will be able to meet its interest payments and therefore reluctant to purchase the bonds and loans near par value.

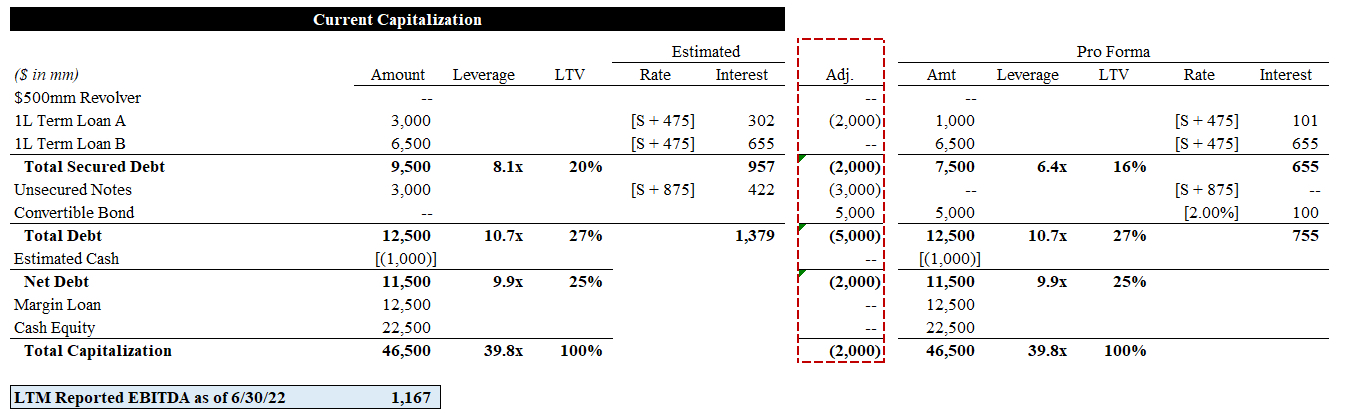

As part of the acquisition, Elon secured $12.5bn of traditional financing that was provided by investment banks. Specifically, the banks involved were Morgan Stanley, Bank of America, Barclays, MUFG, BNP Paribas, Mizuho and SocGen. In addition, Elon secured a $12.5bn margin loan from Morgan Stanley against his other holdings. Despite the headline price, Elon’s actual cash equity investment as part of takeover was only $22bn, a large but relatively small portion of his ~$255bn net worth.

The below chart illustrates the pro forma and current capitalization. While loan-to-value (“LTV”) based on the “equity” component is fairly low at <30%, the headline leverage at 8.1x / 10.7x is incredibly high, even for levfin standards. With SOFR at over 5%, the blended interest rate burden is ~11% resulting in a cash interest expense of $1.4bn dollars. This is 118% of the Adj. EBITDA the company was generating prior to acquisition. Without any revenue growth or margin expansion, it is very difficult to generate positive FCF. With the ad market in a recession and largely out of Elon’s control, it’s no wonder that Elon chose to attack the only variable that he could: costs.

A Solution, Potentially

It appears that Elon Musk is running the company like a startup - taking lots of risks, making lots of changes to the product (he does seem to be actively interacting with folks on the platform who are giving earnest product feedback), and experimenting with different monetization routes. All of these things are fine for a startup whose investors are usually aligned with the founder's long term vision but are risky for either one whose investors are not or a company with a significant debt burden. This is due to the problem of incentivization: if incentivized towards generating free cash flow in order to get out from under a significant amount of debt, the company is more likely to jeopardize long-term vision and potential in the short-term just to make interest payments and avoid bankruptcy.

My recommendation would involve Elon and other original equity investors taking a degree of dilution to their equity stake in Twitter, contingent on Twitter’s value rising above a certain premium to the current valuation (which back of the napkin math puts at about 40% lower than the acquisition value) in exchange for relieving the company of the interest burden that may restrict the ability to grow Twitter in a way that defers payoff immediately for a more significant reward in the future.

Given Twitter's current financial situation and market conditions, equity financing is likely more expensive than debt financing for them in terms of cost of capital, but it’s also a point worth considering in the analysis of these costs that equity financing carries the least risk to Twitter of eventually ending up in a fire sale out of bankruptcy lead by Morgan Stanley. Additionally, any new equity issued would substantially dilute existing shareholders (mainly Elon Musk but also those who invested 7.1bn at the acquisition price), especially given Twitter's (likely) low valuation right now. The heavy interest burden makes it incredibly difficult to invest in the business and therefore grow revenues. Below is an illustrative LBO example that highlights that even with 5% revenue growth per annum coupled with 500bps of margin expansion, it is incredibly difficult to make a solid return on equity investment outside of a high multiple at exit. The most likely exit for Elon would be an IPO or merger with a strategic (one of his existing portfolio companies).

This makes the true cost of equity capital quite high.

So, what are the possible logical solutions?

Right now, banks own debt from the Twitter leveraged buyout that they can't sell for full value. Instead of Twitter buying back that debt directly, a group of investors could purchase the debt from the banks at a discount, let's say paying 60 cents for every dollar of debt.

So the investors would pay $6 billion for $10 billion of Twitter debt owed to banks.

Then, those investors could make a deal with Twitter to exchange the acquired LBO debt for new secured debt called PIK notes. PIK stands for "pay in kind" - meaning interest payments are added to the principal rather than paid in cash.

In this example, the investors would swap the $10 billion of acquired LBO debt for $8 billion in new PIK notes from Twitter. So Twitter gets relief on its debt principal and pays interest by issuing more debt rather than cash.

Overall, this allows Twitter to reduce its debt burden from the LBO by having investors buy the debt at a discount from banks, and then further reduce it by exchanging it for PIK notes. This helps Twitter's cash flow by reducing the cash needed for interest payments.

One can look at the recent Carvana debt restructuring/deal for inspiration.

Convertibles Note Refinancing - Convertible notes sold to a group of growth and tech investors who share Elon’s vision for Twitter, the proceeds of which would be used to purchase back the LBO debt from MS at a discounted price, are the optimal solution here. Convertible bonds oftentimes carry very low coupons ranging from [0-2%]. In return, investors get equity upside above a certain equity price (often 30% premium to today’s value, but variable depending on situation). Twitter would benefit as it would lower the interest burden meaningfully.Why?

Equity dilution would be delayed, attracting investors & giving Musk time to execute on his vision and get the value of Twitter closer to the original acquisition price or perhaps even above it (which he has demonstrated to investors he can get markets on board with his visions)

Coupon payments would likely still be cheaper than an equity stake, definitely cheaper than a straight bond or the current LBO debt.

It would not be such a slap in the face to the original investors who’s equity stakes reflect a cost of $54.20 and who are important, potentially, as strategic partners, investors and advisors to the future of Twitter.

With reduced debt burden, Musk and investors can focus on long-term growth to boost the valuation before any note conversion happens. This aligns incentives.

Clearly, if possible, this is the best path: a reasonable middle ground that provides liquidity, avoids imminent bankruptcy, doesn't massively dilute near-term, and sets up the company for growth execution. Creditors also benefit relative to a messy bankruptcy scenario. As mentioned, the existing debt would need to be reduced given the high interest burden.For these reasons, it is the most palatable solution for multiple stakeholders. What would need to occur is:

Twitter negotiates a deal with Morgan Stanley et al to repurchase the secured loans at 60 to 70 cents on the dollar.

Twitter issues convertible notes to raise capital in a private placement Twitter offers new convertible notes to the existing investors as well as new investors.

Twitter uses convertible note proceeds to repurchase LBO debt - Twitter takes the cash raised from the convertible note issuance and uses it to buy back the secured debt portion of the LBO debt it took on at a discount to face value.

LBO debt is retired - The LBO debt repurchased by Twitter is retired and taken off the balance sheet. This immediately reduces Twitter's debt principal and future interest costs.

Interest expense reduced going forward - With lower LBO debt outstanding, Twitter's interest expense is decreased in future periods as it has less debt accruing interest.

Cash flow improves - The reduced interest burden on smaller LBO debt balance helps improve Twitter's future cash flow.

Balance sheet strengthens - Paying down debt meaningfully improves Twitter's balance sheet by reducing leverage ratios.

Alignment of Incentives - By shifting the lender from investment banks to growth investors with investment horizons that are much longer, Twitter has the room necessary to maneuver in anticipation of 5 year forward earnings rather than one quarter forward free cash flow.

In another scenario, this same group of investors could be organized to purchase the LBO debt from the Investment Banks and then forgive it in return for convertible notes - perhaps that would result in a more advantageous situation for the investors and entice more demand.

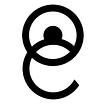

Here’s an illustrative example of what this could look like. If Elon were to issue $5bn of new convertible bonds to take out a mix of secured/unsecured debt, he could potentially lower his interest burden by 45% to $755mm - see below.

Other considerations would be:

Conversion Terms - The notes convert to equity at a future fundraising round, typically at a 15-30% discount to the valuation. This rewards the note investors. The lower the conversion price (higher the conversion ratio), the better for investors in the notes and worse for investors in the original acquisition and vice versa. A careful balance will need to be struck to avoid unnecessary dilution but also entice enough investors to meaningfully set Twitter up for success.

Valuation - The conversion valuation would be determined by business performance. If Twitter grows, the valuation will be higher, rewarding note holders.

Coupon/Interest Rate - A 2-5% coupon rate could be sufficient to make this issue attractive for investors vs. high yield debt, depending on the conversion terms.

Maturity - Likely a 5 to 7 year maturity, which gives time for a turnaround and room to execute on Elon’s vision for Twitter before conversion.

Investors - Deep pocketed individuals like founders/CEOs of tech companies, VC firms who align with Musk's vision and growth focused hedge funds like Coatue or Tiger Global may be incentivized to participate.

Dilution - Conversion dilutes existing shareholders, but likely significantly less than issuing new equity now while in distress and with a delay that grants breathing room.

Control - Musk/board will likely need to cede some control and seats to large note investors, which makes it imperative that it is attractive to investors who he believes will be accretive as partners to Twitter’s goals.

Overall, it would provide substantial new capital to handle debt, while incentivizing growth that rewards both note and equity investors. This would also make the LBO math much more palpable. As you could see below, the company would be decently FCF positive. More importantly however, Twitter would have the breathing room to invest in the business and explore new revenue streams without the heavy burden of debt payments and constant need to monitor liquidity. There would be a more significant margin for error, things like lawsuits & settlements (e.g. from Twitter’s landlord in San Francisco, Analysis group, Blueprint Studios, Innisfree M&A and Private Jet Services Group or the 500m in severance pay alleged to be owed) would not be as significant a concern if bankruptcy was not a looming threat.

Here are the details for how a convertible note could work for Twitter’s recapitalization:

It does appear that Elon appreciates that Twitter is a fundamental part of the internet and, while there seemed to be a wide consensus that Twitter was woefully under monetized as a public company, I’m not sure he’s in it for the money. Twitter represents the freedom of ideas and information that was promised by the pioneers of the internet, and while there are certainly some downsides and negative externalities, there’s really no other place on the internet quite like it. Where else can you find anonymous folks with cartoon avatars that are far more knowledgeable about a field than the credentialed experts? Where else can you engage with world leaders and CEOs of major companies and see the discussion unfold in real time? Maybe it means that ad revenue won’t scale as well as Meta’s pristine walled gardens but Twitter is a systemically important website.

This is why I believe that, for the long term success of the company, it would be best if the business in its current state is financed with convertible notes (and later, if successful, equity) ideally held by shareholders whose incentives are aligned with the long term vision for Twitter. Whether that’s a billion users generating ad revenue on the scale of Meta, payments, subscriptions, an “everything app” (in the style of China’s WeChat), or something entirely different, this would be the optimal way to achieve growth and a longer term goal. Why do I think that this is a better course of action than continuing to face the risk of bankruptcy head on? If Twitter went bankrupt due to being unable to service the debt obligations taken on during Elon Musk's leveraged buyout, there are a few likely outcomes for the fate of the platform:

- Twitter would undergo Chapter 11 bankruptcy restructuring in order to negotiate with creditors and seek to reorganize the company. This allows continued operation.As part of restructuring, equity shareholders would likely be wiped out, with debt holders and other creditors taking over ownership. Musk would lose control.

- Twitter operations would come under oversight of creditors, an appointed trustee, or a court. Strategic direction could drastically change.

- Parts of the business and assets could be sold off to raise money to repay creditors. This could include selling the platform's data, technology, brand name, or real estate. With the advent of Large Language Models, Twitter’s data is likely the most valuable asset held by the company right now, and in a firesale scenario it would be sold for a fraction of its actual value. If Elon can manage to recapitalize with converts or equity and buy Twitter some time, he could find that the data ends up being the only asset necessary to reach positive cash flow in a few years time.

- Twitter possesses one of the most valuable and unique data sets in the world - real-time posts covering news, events, opinions, and conversations across every topic imaginable. For training LLMs, it is unparalleled as it provides up-to-date, topical information and discussions on current events. With Elon Musk's ambitions in artificial intelligence through XAI, he is well-positioned to leverage Twitter's data for next-generation natural language processing models. A bankruptcy is likely out of the question if he wishes to retain his equity and thus his claim on the future value of this data.

Specifically, combining Twitter's real-time data feeds with advanced AI and machine learning techniques could lead to innovative applications in areas like search, recommendations, speech recognition, and sentiment analysis. As large language models continue to advance, Twitter's data could provide a competitive edge in developing AI assistants, bots, and other services that understand conversational nuance and context. Given the rapid pace of progress in AI, monetizing Twitter's unique data set through advanced language models could potentially happen within the next 2-3 years. The synergies between Twitter's platform strengths and Musk's plans for AI make this a very compelling growth avenue to explore and one that necessitates longevity.

- If no restructuring path is found, Twitter could face complete liquidation under Chapter 7 bankruptcy. However, a liquidation of the platform itself is unlikely since the user base and data would still hold value.

Of course, nothing comes for free. This would inevitably mean there's a tradeoff. In order to convince a group to come together and buy the convertible note issue (or the debt from the banks, which the banks are willing to offer below par per the last report), they would need favorable terms regarding how the debt they purchased will eventually convert into equity. This would almost certainly mean a lower valuation for Twitter than the $44B purchase price and would result in some potentially pretty heavy dilution for Elon’s equity stake.

However, if he truly cares about the long-term success of Twitter, and believes in how vital a platform it is for the freedom of information, he may be willing to take what would be a multi-billion dollar loss on his equity position in order to stabilize the capital structure of the company by having shareholders who are aligned with the long-term vision. I’m not sure if Tencent breaks out segment revenue for WeChat but I feel like I remember seeing they were around ~$20B USD of sales at one point in the past couple years, which may be a relevant comp for an “everything app.”,

Twitter’s management would be free to experiment with product decisions and monetization options without interest payments looming each quarter. It seems unlikely without a strategy similar to this one that Twitter will be able to reach cash flow positive status soon - Musk seems to be implementing strategies that work over longer horizons, similar to his approach to Tesla, but Tesla never had a significant debt burden. For example, the drive to get people to pay for verified Twitter blue seems to be a loss leader strategy aware of the costs of paying the accounts with the most reach as an acceptable expense as long as those accounts are likely to share the fact they were paid - enticing other (less expensive accounts for who revenue sharing is unlikely to outweigh the Blue subscription fee) to sign up for Twitter Blue. This seems like a good strategy, but only if there’s enough breathing room for it to organically spread.

In my own opinion, the problem with a subscription tier on Twitter is that - because the tweets only go to your subscribers - it is nearly impossible to get a subscription tier tweet to go viral. Because of this, the most likely competitor for Twitter’s subscription tier is adult entertainment like OnlyFans.

This clashes with the ad revenue sharing model of Twitter Blue which ultimately attempts to compete with Substack or YouTube. Twitter needs a Unified Theory of Growth in which all of these actions converge towards a singular goal - right now even focusing on growth is clashing with the fact that free cash flow is negative. This convertible proposal would fix this, and the market seems pretty hot for new issues right now (with most growth investors, at least in public markets, doing pretty well YTD) and it would result in a group of investors that are excited to grow twitter rather than concerned about the NTM impact of LT decision.

This was the essence of my suggestion, as someone who loves Twitter and believes it to be such a fundamental and important part of the internet, I would prefer it not to fall into the hands of creditors and ideally be a company that has shareholders aligned with management, allowing it to operate as close to its optimal state as possible and optimize the decision making process solely for the long term vision.

Hi, could you share the excel file undelying your analysis? There some calculation that I cannot easily understand and I would like to see the assumptions that you made. Thank you!

🔥