Arista Networks: Software Driven Networking for the AI Revolution

A potential winner in the inevitable AI arms race. Written with the assistance of chaptgpt and valueinvesting.io

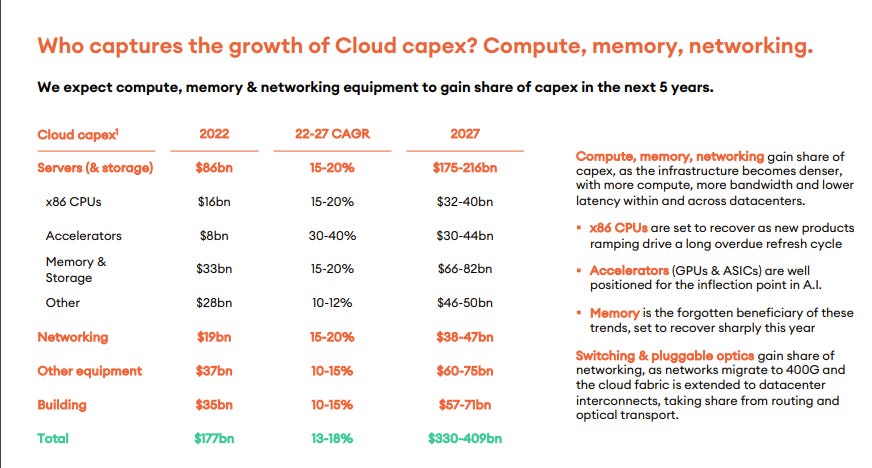

One phrase you might hear often in investing is “when there’s a gold rush, sell picks & shovels.” With the recent surge of interest in AI, it makes sense to try to understand which companies stand to benefit from the increase in investment and activity in the space. Another way to think about investing in “picks & shovels” is to look for companies that are beneficiaries of the increase in capital expenditures from companies participating in that gold rush. Two companies that are heavily invested in the AI arms race are Meta and Microsoft. These two companies are also Arista Networks biggest customers, representing 42% of their total revenue in 2022. While this presents a risk in the form of customer concentration, it appears that Arista is well positioned to capitalize on the AI boom as they have become an industry leader in the market for high speed switching and software driven networking.

TLDR; As companies look to participate in the AI arms race, we should see an increase in cloud/data center capex over the next 5-10 years and Arista is well positioned to capitalize from this trend as one of the industry leader in high speed cloud networking. Close to fair value on a 5y DCF but potentially worth adding to a watchlist and probably belongs in a basket of like “AI picks & shovels”. Industry leader in a mission critical technology, strong gross margins and a healthy enough moat to continue earning excess economic profits in the near future.

I asked ChatGPT for a brief overview of the company -

Arista Networks is a technology company that provides software-driven cloud networking solutions for large-scale data center and campus environments. The company designs and sells multilayer network switches to deliver high-performance, low-latency, and scalable solutions for virtualization, cloud computing, and software-defined networking (SDN).

Arista Networks focuses on developing its operating system, EOS (Extensible Operating System), which is based on Linux and is designed to provide a single-image network operating system that allows network administrators to manage and automate their networks more efficiently. The company's switches are designed to be highly programmable and are compatible with a wide range of third-party software and hardware.

Arista Networks serves a broad range of customers, including cloud service providers, internet service providers, financial services organizations, media and entertainment companies, and government agencies. The company was founded in 2004 and is headquartered in Santa Clara, California.

One thing that I think is important to note is the sales model Arista uses - instead of a more traditional model a company like Cisco uses (sell proprietary hardware, lock customers in to their universe) Arista relies on 3rd party merchants (Broadcom, Marvell, Intel) for its hardware so it can focus on providing its software to its customers, which seems to have resulted in a fairly significant economic moat. Arista’s single image, highly programmable network operating system (EOS) is a cutting edge solution for hyperscalers & enterprise data centers alike, and a valuable intangible asset that should position the company well to take advantage of the increase in cloud networking capex. Arista has a relatively diverse portfolio of products, and it has been leveraging its innovative approach to cloud networking to take market share over Cisco. The main risks would appear to be the concentration of their customer base (42% of revenue from Meta & Microsoft combined), a slowing capex cycle as hyperscalers look to reduce investment in the short term (2019 & 2020 saw Meta skip an upgraded cycle, which hurt Arista’s toppling), less pricing power with their largest customers and the risk that some of its largest customers could reach a saturation point, from which there is not significant room for future investment in networking technology for their cloud services.

The overall TAM is expanding as investment in AI projects continues to accelerate. Estimates for the total addressable market in 2027 fall between $38-$51B. On the low end of that estimate, if Arista is able to maintain ~20% market share, that would be roughly ~$7.6B in 2027 revenue.

Next, I asked ChatGPT a few questions to help get an overview of the industry in which Arista operates.

Why is high speed networking important for AI?

High-speed networking is critical for AI (Artificial Intelligence) because it enables the efficient transfer of large amounts of data between computing resources. AI applications, particularly deep learning, require vast amounts of data to be processed and analyzed, which can be computationally intensive and time-consuming. Therefore, it is essential to have a high-speed network infrastructure to enable the rapid transfer of data between devices, such as GPUs (Graphics Processing Units), CPUs (Central Processing Units), and storage systems.

High-speed networking also allows for the development of distributed computing architectures, where computing resources are interconnected and can work together to process and analyze data. With distributed computing, AI workloads can be parallelized and distributed across multiple computing devices, which can lead to faster processing times and more efficient use of resources.

In addition, high-speed networking is critical for real-time AI applications, such as autonomous vehicles and robotics, where data must be processed and analyzed in real-time to make decisions and take actions. High-speed networks can enable these applications to operate in real-time by reducing latency and enabling faster decision-making.

Overall, high-speed networking is essential for AI applications to operate efficiently, process large amounts of data, and enable real-time decision-making.

How do large language models (LLMs) use cloud networking resources?

Large language models, such as GPT-4, use cloud networking resources to enable their development and deployment at scale. These models require vast amounts of computational power and storage to train and deploy, and cloud networking provides a flexible and scalable solution for these requirements.

Here are some ways that large language models use cloud networking resources:

Training: Large language models require significant computational resources to train. Cloud networking enables the use of distributed computing, where the computational workload is spread across multiple computing devices, such as GPUs and CPUs, which can significantly reduce training times. Cloud providers offer specialized computing instances that can be customized for training large language models.

Deployment: After a language model has been trained, it needs to be deployed to serve requests. Cloud networking provides scalable and flexible infrastructure to deploy language models in a variety of ways, including APIs, web applications, or mobile applications. Cloud providers offer services such as serverless computing, containerization, and virtual machines that can be used to deploy language models.

Storage: Large language models require vast amounts of storage to store their parameters and data. Cloud networking provides scalable and cost-effective storage solutions, such as object storage and file storage, that can be used to store language models and their associated data.

Collaboration: Large language models are often developed by teams of researchers and engineers, who need to collaborate on the development and training of the model. Cloud networking provides collaborative tools, such as version control, shared notebooks, and chat, that enable teams to work together efficiently.

In summary, cloud networking provides a flexible and scalable solution for the computational, storage, and collaboration requirements of large language models. It enables researchers and engineers to develop, train, and deploy language models at scale, which can lead to breakthroughs in natural language processing and other AI applications

Why is high speed networking crucial for cloud computing?

High-speed networking is crucial for cloud computing because it enables the efficient transfer of large amounts of data between computing resources, which is essential for the performance and reliability of cloud services. Here are some reasons why high-speed networking is crucial for cloud computing:

Data transfer: Cloud computing services rely on the transfer of data between computing resources, such as virtual machines, storage systems, and databases. High-speed networking enables data to be transferred quickly and efficiently, reducing latency and improving performance.

Scalability: Cloud computing services need to scale up or down quickly to meet changing demand. High-speed networking enables the efficient allocation of resources between computing instances, allowing services to scale up or down as needed.

Real-time processing: Some cloud computing applications, such as real-time analytics and AI, require fast data processing and decision-making. High-speed networking reduces the time it takes to transfer data between computing resources, enabling real-time processing and decision-making.

Reliability: Cloud computing services need to be reliable, with high availability and minimal downtime. High-speed networking enables data to be replicated across multiple data centers, providing redundancy and fault tolerance.

Collaboration: Cloud computing services often involve collaboration between teams of developers and IT professionals. High-speed networking enables teams to work together efficiently, with fast data transfer and access to shared resources.

Overall, high-speed networking is crucial for the performance, scalability, reliability, and collaboration of cloud computing services. It enables cloud computing services to handle large amounts of data and support real-time processing, which can be critical for businesses and organizations that rely on these services.

Ok cool, thanks ChatGPT. So what were interested in as far as the story is -

How well positioned is Arista to continue growing revenue/earnings at an above market rate? and can they maintain healthy gross/net margins while doing so?

Does the stock being near an all time high reflect some of this sentiment being priced in, during a period of time in which they may be over-earning and how sensitive will their earnings be to the Capex cycles of their major customers?

A bit more about the business and it’s 3 main segments -

Core Data Center & Cloud Networking

Cognitive Adjacencies - Campus & Routing

Network Software & Services

From the latest 10K:

Core Data Center & Cloud Networking

Our data-driven cloud networking platform enables data center networks to scale to hundreds of thousands of physical servers and millions of virtual machines with the least number of switching tiers. We achieve this by leveraging standard protocols, non-blocking switch architectures and EOS to meet the scale requirements of cloud computing, including AI workloads. We have used active-active Layer 2 and Layer 3 network topologies to enable customers to build extremely large and resilient networks.

High Availability

Our highly modular EOS software architecture was designed to be fault-isolating and self-healing in order to deliver higher availability compared to legacy network operating systems. In addition, customers can non-disruptively upgrade switches running in the network using Arista’s Smart System Upgrade ("SSU") application, without interrupting the network service.

Open and Programmable

EOS is built from the ground up using an open Linux microservices architecture, with publish and subscribe state sharing at its core, and open Application Programming Interfaces (APIs) for reliability and extensibility. We offer multiple types of extensibility for EOS that provide granular control and management, including our eAPI, OpenConfig, NetDL Streaming, CloudVision Studios and our EOS SDK. These programmability options are imperative to enable automation and customization of our Cloud Networking platforms.

Workflow Automation

Our EOS software enables enterprises to provision networking resources in minutes with no manual intervention through our Zero Touch Provisioning (ZTP). EOS also natively supports Ansible, CFEngine, Chef, Puppet, virtual network orchestration applications and third-party management tools. Our CloudVision is a network-wide approach for workload orchestration and automation that delivers a turnkey solution for enterprises looking to modernize their networks and move to cloud-class automation and operation without significant internal development. In addition, we deliver continuous testing, version control and change management services through our Continuous Integration (CI) pipeline.

Network Visibility

Our EOS software provides a set of tools and applications that proactively monitor, detect and notify network managers when network issues arise, delivering real-time data to third-party network performance and security applications to provide detailed application visibility. Our network visibility applications provide real-time insight into the status of the network.

Through the integration of DataANalyZer ("DANZ") features native to Arista switches with Big Switch’s monitoring software, we provide the DANZ Monitoring Fabric (DMF). DMF delivers network traffic analysis, data analytics and contextual insights to enterprises looking for network-wide observability.

Security

We focus on securing the network through features native to EOS, such as segmentation, as well as Network Detection and Response (NDR). Our NDR is an advanced solution that delivers answers, not alerts. By combining AI with human expertise, Arista NDR autonomously hunts for both insider and external attacker behaviors, while providing triage, digital forensics and incident response across the entire network — campus workspace, data center, IoT, operational technology (OT) and cloud networks.

Lower Total Cost of Ownership

Our cloud networking platform offers architectural and system advantages that provide our customers with cost-effective and highly available cloud networking solutions. We believe our programmable, scalable leaf-spine architectures, combined with our applications, significantly reduce networking costs when compared to legacy network designs, enabling faster time to service and improved availability. Our automation tools reduce the operational costs of provisioning, managing and monitoring a data center network and speed up service delivery. Our tools provide visibility into complex network environments without the need for additional data collection equipment.

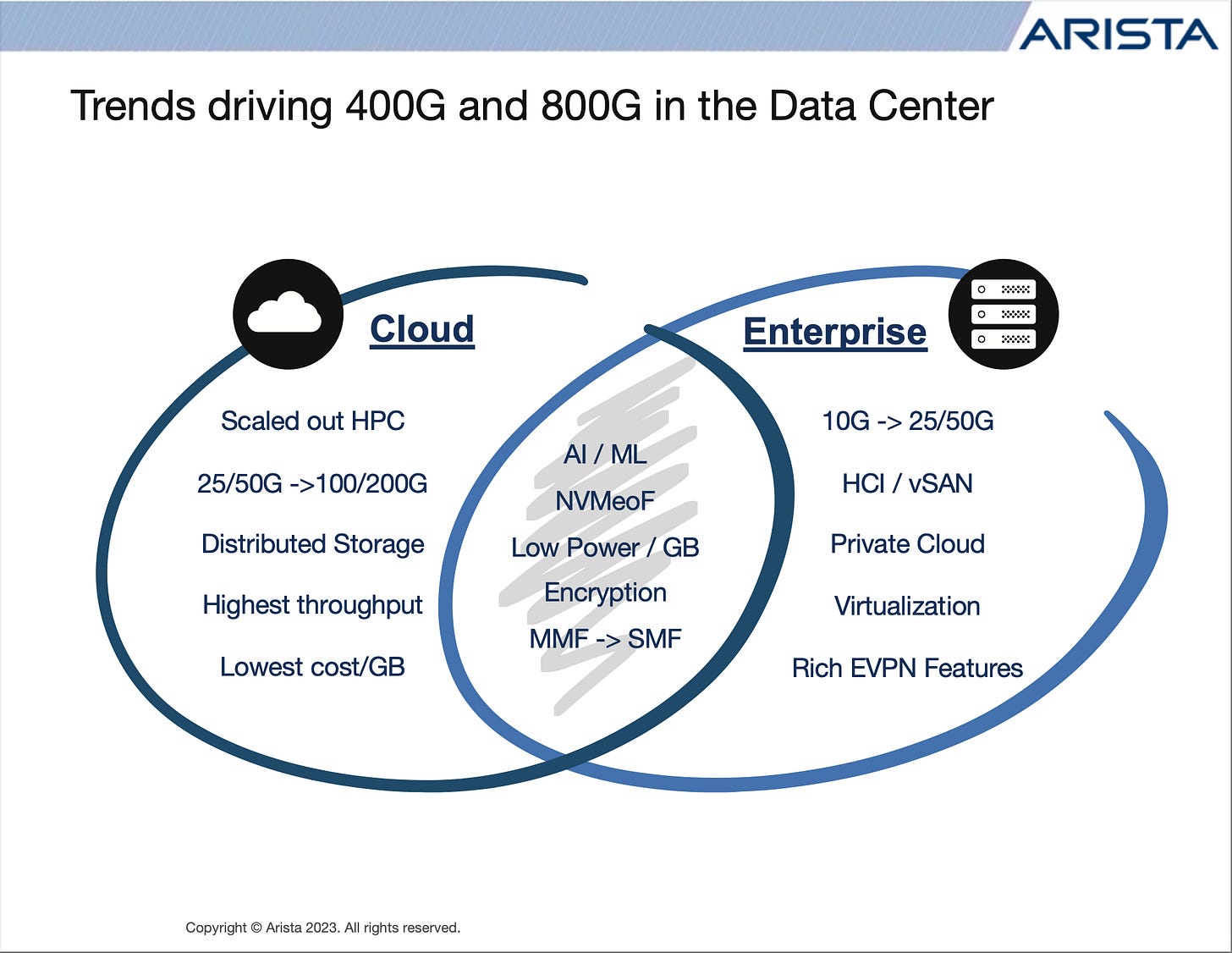

Arista earned roughly 68% of it’s revenue from its cloud and data center products, which management attributed to strong cloud and enterprise spending cycles, and they expect to continue to gain market share in high performance switching. The company is the #1 provider in the 100-400G category and saw their 400G customers double from 300 in 2021 to 600 in 2022.

Cognitive Campus Workspace

Our solutions extend the principles of cognitive cloud computing to campus networks, with the intent of disrupting the wasteful, oversubscribed legacy three-tier architecture of access- aggregation-core. The recent IoT-related expansion of devices to more disparate locations and functions has significantly increased the complexity and importance of campus networks. We are addressing these campus trends by leveraging our single-image EOS extended across wired and wireless workspaces, data center, routing and multi-cloud to drive consistent cognitive controls and analytics for the network end-to-end.

Using this cloud-based approach reduces operational costs by incorporating a network that is a seamless end-to-end solution rather than silos of different places in the network. Our cognitive campus workspace is a data-driven model coupled with a unified dashboard for wired/wireless edge for next generation zero touch campus deployments. Together, with zero trust security, the cognitive campus drives multifaceted visibility for IoT and OT applications.

Our Cognitive Campus Networking solutions are based on three principles:

Universal Cloud Network - We offer our Universal Cloud Network as an alternative to brittle, proprietary solutions from legacy vendors. Our Universal Cloud Network is an open, standards- based design focusing on data-driven control principles. Our collapsed SplineTM approach consolidates traditional campus core and aggregation layers into a simple single tier with high availability.

Cognitive Management Plane - There is a void in management plane consistency and a need for data-driven analytics in the campus, as in the data center. We believe that a common model can be applied across both footprints, saving customers operational costs. The Cognitive Management Plane (CMP) is a data-driven repository for the automated actions across network analytics.

Securing The Campus - Securing the campus requires a holistic approach to network segmentation, device compliance and auditing, as well as service integration with our security partners. We deliver these capabilities through EOS, DMF, NDR and CloudVision.

Networking Software and Services

CloudVision

CloudVision is our network management plane solution for workload orchestration and workflow automation, which delivers a turnkey solution for cloud networking. CloudVision’s abstraction of the physical network to a broader, network-wide perspective provides a simplified approach for consistent network operations across network domains, including data center, campus wired and wireless, routing interconnect, and multi-cloud networks.

CloudVision highlights include: Centralized representation of distributed state based on NetDLTM, allowing for a single point of integration and network-wide visibility and analytics; Controller-agnostic support for physical and virtual workload orchestration through open APIs; Turn-key automation for zero touch provisioning, configuration management and network-wide upgrades and rollback; Compliance dashboard for security, audit and patch management; Cognitive AI/ML, driven by our Autonomous Virtual Assist ("AVA") for dynamic insights and recommendations, built on a modern approach of real-time streaming for telemetry and as a replacement for legacy polling per device; Granular visibility and historical troubleshooting with predictive insights across the unified edge wired and wireless networks, including IoTvision; and finally Multi-domain segmentation for the zero trust enterprise, enabling macro-segmentation services (MSS®) for an open and scalable approach for network policy management and with dynamic integrations into security management systems from Arista’s security ecosystem partners.

DANZ Monitoring Fabric (DMF)

DANZ Monitoring Fabric (DMF) is a next-generation network packet broker (NPB) designed for pervasive, organization-wide network observability and security visibility, enabling IT to deliver multi-tenant monitoring-as-a-service. Leveraging Arista's high-performance and versatile 1G/10G/25G, 40G/100G and 400G Ethernet switch platforms with DMF, IT operators can pervasively monitor all user, device/IoT and application traffic (north-south and east-west) by gaining complete visibility into physical, virtual and container environments. DMF switch licenses are procured as subscription software. Additionally, DMF’s advanced services include deep hop-by-hop visibility, predictive analytics, contextual insights and scale-out packet capture — integrated through a single dashboard — to provide simplified network performance monitoring (NPM) and SecMon workflows for real-time and historical context. For enterprises, service providers and cloud providers, DMF provides a one-stop network observability solution for production data centers, enterprise campus/branch and 4G/5G mobile networks.

Arista Network Detection and Response (NDR)

The AI-driven Security Platform, driven by our AVA, deeply analyzes billions of network communications to autonomously discover, profile and classify every device, user and application across any network. Using a multi-dimensional ensemble machine learning approach, Arista NDR then models complex adversarial behaviors and detects threats by connecting the dots across entities, time, protocols and attack stages. By combining artificial intelligence with human expertise, Arista NDR hunts for both insider and external attacker behaviors, while providing triage, digital forensics and incident response across the entire network.

CloudEOS

CloudEOSTM is our multi-cloud and cloud-native networking solution enabling a highly secure and reliable networking experience with consistent segmentation, telemetry, provisioning and troubleshooting for the entire enterprise. It can be deployed across the enterprise edge, WAN, campus workspace, data center, on-premises Kubernetes clusters, and multiple public and private clouds. CloudEOS provides multi-cloud connectivity across the entire enterprise cloud environment with high-performance virtual and container-based instances of EOS software that simplify network operations and integrate with declarative cloud provisioning toolchains like Terraform, Ansible, and other popular CloudOps and DevOps tools.

CloudEOS is designed for consumption on Amazon AWS, Microsoft Azure, and Google public clouds via their marketplace and service catalogs, and it is also available as a cloud-native instance for deployment in Kubernetes clusters. With CloudEOS and CloudVision, customers can integrate their cloud network deployments with the elasticity and automation of the public cloud, private cloud and cloud native platforms.

Arista A-Care Services

We have designed our customer support offerings, Arista A-Care Services, to provide our customers with high levels of support. Our global team of support engineers engages directly with client IT teams and is available at all times over e-mail, by phone or through our website.

We offer multiple service options that allow our customers to select the product replacement service level that best meets their needs. We stock spare parts in over 200 locations around the world through our third-party logistics suppliers. All of our service options include unlimited access to bug-fixes, new-feature-releases, online case management and our community forums.

Management’s Overview of the Business

Arista Networks is an industry leader in data-driven, cognitive cloud networking for next-generation data center and campus workspace environments. At the core of Arista's platform is our EOS, combined with a set of network applications and our Ethernet switching and routing products using merchant silicon, delivering a cloud networking solution with high performance scale and availability, and enabling network automation, visibility, and security.

EOS, combined with a set of network applications and ethernet switching and routing platforms using merchant silicon, provides improved price/performance and time to market, delivering a cloud networking solution with high performance scale and availability, and enabling network automation, visibility, and security.

We generate revenue primarily from sales of our switching and routing platforms, which incorporate our EOS software, and related network applications. We also generate revenue from post- contract support ("PCS"), which end customers typically purchase in conjunction with our products, and renewals of PCS. We sell our products through both our direct sales force and our channel partners. As of December 31, 2022, we had delivered our cloud networking solutions to over 9,000 end customers worldwide. Our end customers span a range of industries and include large internet companies, service providers, financial services organizations, government agencies, media and entertainment companies, telecommunication service providers and other cloud service providers.

Historically, large purchases by a relatively limited number of end customers have accounted for a significant portion of our revenue. We have experienced unpredictability in the timing of orders from these large end customers primarily due to changes in demand patterns specific to these customers, the time it takes these end customers to evaluate, test, qualify and accept our newer products, and the overall complexity of these large orders. For example, sales to our end customers Microsoft and Meta Platforms in fiscal 2022 represented 16% and 26% of our total revenue, respectively, whereas sales to our end customer Microsoft in fiscal 2020 and 2021 amounted to 22% and 15% of our total revenue, respectively, with our end customer Meta Platforms representing less than 10% of our total revenue in both fiscal 2020 and 2021. This variability in customer concentration has been linked to the timing of new product deployments and spending cycles with these customers, and we expect continued variability in our customer concentration and timing of sales on a quarterly and annual basis. Furthermore, we typically provide pricing discounts to large end customers, which may result in lower margins for the period in which such sales occur.

We believe that cloud computing represents a fundamental shift from traditional legacy network architectures. As organizations of all sizes have moved workloads to the cloud, spending on cloud and next-generation data centers has increased rapidly, while traditional legacy IT spending has grown more slowly. Our cloud networking platforms are well positioned to address the growing cloud networking market, and to address increasing performance requirements driven by the growing number of connected devices, as well as the need for constant connectivity and access to data and applications.

The markets for cloud networking solutions are highly competitive and characterized by rapidly changing technology, changing end-customer needs, evolving industry standards, frequent introductions of new products and services, and industry consolidation. We expect competition to intensify in the future as the market for cloud networking expands and existing competitors and new market entrants introduce new products or enhance existing products. Our future success is dependent upon our ability to continue to evolve and adapt to our rapidly changing environment. We must also continue to develop market-leading products and features that address the needs of our existing and new customers, and increase sales in the enterprise data center switching, and campus workspace markets. We intend to continue expanding our sales force and marketing activities in key geographies, as well as our relationships with channel, technology and system-level partners in order to reach new end customers more effectively, increase sales to existing customers, and provide services and support. In addition, we intend to continue to invest in our research and development organization to enhance the functionality of our existing cloud networking platform, introduce new products and features, and build upon our technology leadership. We believe one of our greatest strengths lies in our ability to rapidly develop new features and applications.

Our development model is focused on the development of new products based on our EOS software and enhancements to EOS. We engineer our products to be agnostic with respect to the underlying merchant silicon architecture. The programmability of EOS has allowed us to expand our software applications to address the ever-increasing demands of cloud networking, including workflow automation, network visibility, analytics and network detection and response, and has further allowed us to integrate rapidly with a wide range of third-party applications for virtualization, management, automation, orchestration and network services. This enables us to focus our research and development resources on our software core competencies and to leverage the investments made by merchant silicon vendors to achieve cost-effective solutions. We work closely with third-party contract manufacturers to manufacture our products. Our contract manufacturers deliver our products to our third-party direct fulfillment facilities. We and our fulfillment partners then perform labeling, final configuration, quality assurance testing and shipment to our customers.

So the main driver of revenue are the “cloud titans” who are looking to continuing building and upgrading data centers with cutting edge networking capabilities. Arista offers these companies a solution that meets those needs, and one that can scale as the cloud providers scale their own offerings or enterprise data centers scale up their operations. EOS checks almost all of the important boxes for customers - high performance, scale & availability and enables network automation, security and visibility. Arista has built a strong economic moat in an industry that is experiencing strong secular growth and appears well positioned to continue capitalizing on their status as an industry leader. Their strong gross margins are driven by outsourcing their hardware to 3rd party merchant silicon providers and by their focus on providing a superior experience for their customers through their software platform, which not only drives performance improvements, but does so in a manner that provides cost savings for their customers. Arista’s strong competitive position allows it to earn an attractive ~22% return on invested capital (10yr median) and a 25% return on equity (10yr median). The company has a strong balance sheet with ~$3B in cash & equivalents and no long term debt. The company’s valuation is perhaps a bit stretched vs the market at ~30x EV/EBITDA, but high margins (60% Gross, 30% EBIT & 24% FCF, 10 yr medians) and the opportunity to earn a high return on capital reinvested in the business, combined with their position as a market leader in an industry experiencing high growth, makes Arista an interesting opportunity for investors looking for exposure to the “picks & shovels” of the AI gold rush. It is a perhaps rare case of a technology company that is able to innovate at the cutting edge of the state of the art in their industry while also earning a profit and generating solid cash flow.

Management seems to be committed to a prudent capital allocation strategy, and shares outstanding have stayed relatively flat since 2017, with buybacks offsetting modest stock based compensation.

The company is not only a quantifiable industry leader, but is also beloved by its customers, reflected in its net promoter score of 80.

I used valueinvesting.io to get a quick DCF model for Arista. This isn’t sponsored or anything like that, but they offer a pretty cool excel template that imports financial data for the company you choose and then allows you to adjust assumptions in the DCF. As with any model, it’s hopefully a useful starting point that you can use to get an idea of the assumptions embedded in the current valuation, and adjust the assumptions to understand the sensitivity of the value to the changes in those assumptions.

Financials & Valuation

5 year DCF Model

Historical Income Statement

Revenue Projections

Summary

If Covid saw big tech companies pull forward years of demand, the macroeconomic chaos and uncertainty of 2022 forced the same companies to drastically cut costs and rethink their near term capital allocation strategies. It can be difficult to cut through the noise and understand which companies can weather the storm. Arista Networks is a rare company that is positioned as a market leader in cutting edge technology, and is earning a high return on it’s invested capital with consistently high margins as it continues to add customers and the market, as a whole, continues to expand at a solid pace. There are definitely risks - the current valuation is a bit stretched vs the market, they are probably marginally over-earning as a result of a heightened capex cycle from the cloud titans and their revenue is particularly sensitive to the spending habits of a few concentrated customers. If these companies were to choose another provider, or decide to build their own cloud networking products, it could materially affect Arista’s business. These large customers could also reach a saturation point where there is less of a need to invest aggressively in Arista’s products, or they may command such a position of power, that they could negotiate much lower prices than they currently pay, which could also reduce Arista’s earnings. The company also faces strong competition from companies like Cisco, as well as Extreme Networks, Dell/EMC, Hewlett Packard Enterprise, Juniper Networks and VMWare amongst others. However, for investors looking for “the picks & shovels of AI”, cloud networking will play a crucial role in the entire lifecycle of AI development, and the capex required for companies to invest in developing and upgrading their AI technology, should be a strong tailwind for Arista’s business moving forward. Because of the “lumpy” nature of their customers spending, it can be helpful to look at longer term trends for the company’s revenue, earnings, margins, cash flow generation & ROIC, all of which appear to reflect a company with a strong economic position in a growing industry. This post was written as an attempt to see how quickly I could ramp on a new idea with the assistance of ChatGPT and other free tools on the internet (I used valueinvesting.io for the models, which saved some time vs building it from scratch. In the future, i’ll upgrade it with different assumptions that result from further research on the business, but the basic model serves as a useful starting point for assumptions embedded in the current valuation.). As i’ve mentioned in a couple of tweets, I’m super interested in using ChatGPT for equity research and think it would be amazing if it could generate this sort of post I just wrote, so that an investor wondering “What’s the story with Arista?” could have a general overview before digging deeper into their filings and building their own financial model.

A program that could generate a summary based on the latest 10K, Earnings Calls & Investor Presentation, along with a DCF based on historical averages and street estimates, would help investors understand the business a high level quicker than is currently possible, and provide a helpful starting point for doing further diligence. Thanks for reading, please let me know any thoughts or feedback you have and feel free to reach out about any ideas you’d like to see me write about in the future.

Nothing in this post is investment advice, it’s solely my reflections and thoughts from learning about Arista Networks over the past few days. It is not a recommendation to buy or sell any securities. In the spirit of putting my money behind my ideas, I acquired one (1) share of Arista Networks ($ANET) yesterday for my personal account. The company will face difficult comps in the final three quarters of 2023 and I will be following along and updating my model assumptions. I will also be closely monitoring how their large customers are talking about cloud/data center capex and other general industry trends.

Appendix:

Additional Historical Financials