Demystifying Nvidia's Revenue Increase

Taking a look at the filings from last quarter to hopefully clear up some confusion about their accounting practices

There’s been some threads going around claiming that Nvidia is a fraud & is cooking it’s books. The thesis seems to stem from the large increase in revenue last quarter without a corresponding increase in the costs. On the surface it may look weird but let’s check it out for ourselves.

Nvidia’s revenue increased dramatically in the 2nd quarter this year compared to last year. this was largely due to an increase in data center revenue from customers placing orders for H100s. A product that commands a high price point and one that Nvidia earns very high margins by selling.

So while some of this increase in revenue was certainly due to the pricing power that Nvidia is able to wield over the market (because there’s nearly infinite demand for H100s right now) it was mostly due to the incremental margin earned by the mix of revenue shifting towards more H100s, rather than an increase in overall sales volume.

While some have placed the spotlight on Nvidia’s relationship with CoreWeave & the recently announced line of credit that CoreWeave secured that was collateralized by the Nvidia chips they own, there is nothing inherently nefarious about vendor financing (CoreWeave ordered $2.3B worth of H100s to continue building out their special purpose GPU cloud.) Especially as the AI arms race heats out & some of Nvidia’s hyperscaler customers may look to develop their own hardware for customers to run AI workloads. Vendor financing is when a customer pays for your product before it’s delivered.

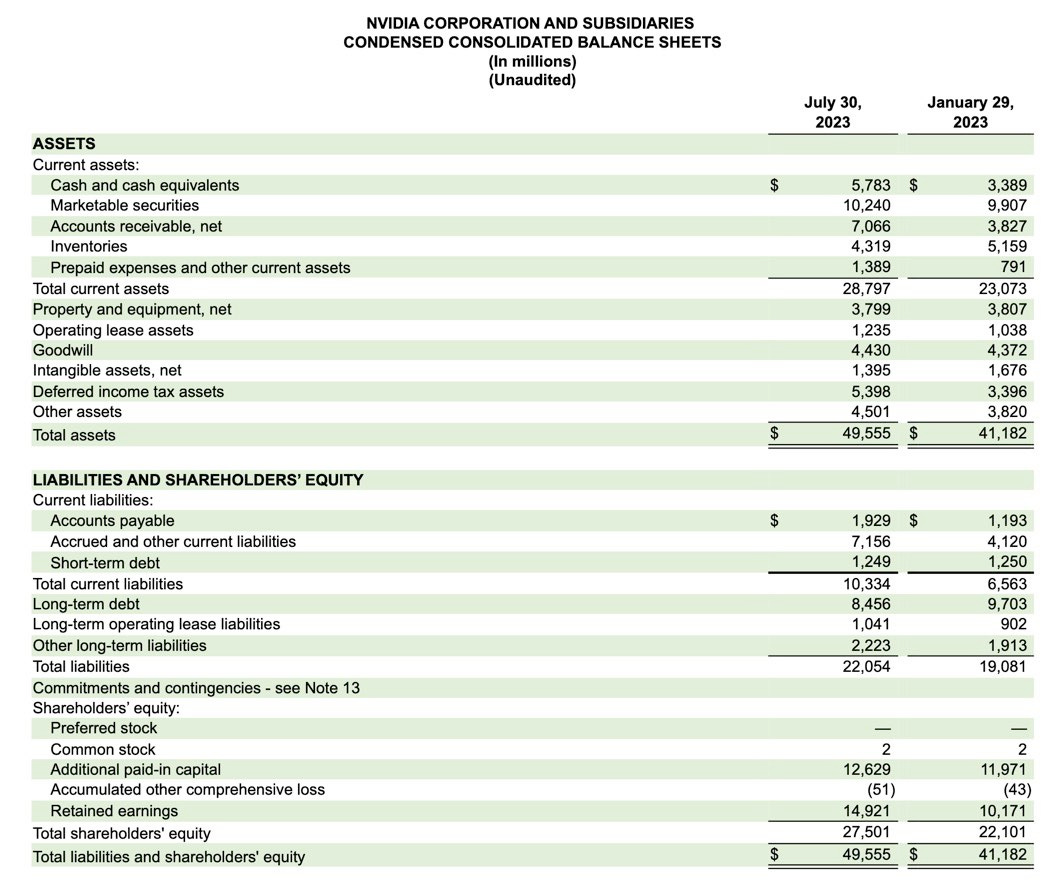

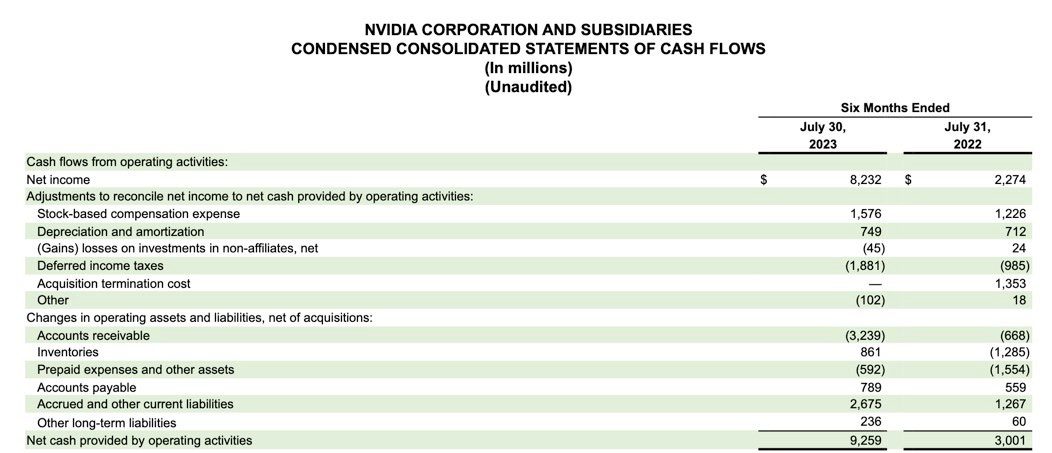

This brings us to the question of the increase in accounts receivable & revenue without the corresponding increase in costs during this quarter. Nvidia books licensing & services revenue when the order from the customer is placed and product revenue

when the products they make are delivered to their customer. Yes their Accounts Receivable went up by $3.24B last quarter but there was also an increase in Accounts Payable & Accrued Liabilities of $3.47B. These might not all the Cost of Goods Sold associated with the sales but they are expenses

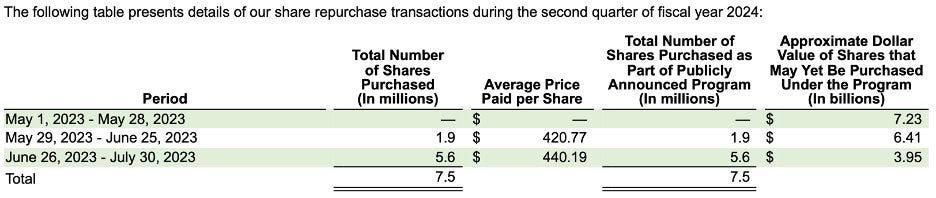

that Nvidia owes that have not yet been paid. With respect to 10b5-1, the share buyback plan, this quarter’s buybacks were small purchases (much bigger ones were done previously at a lower price) that were preplanned & limited by knowing the results of the quarter on 7/31, done to cancel out stock compensation.

It’s also unlikely that ~$1B of purchases (done over 3 weeks) would affect the price of the stock for insiders that much when Nvidia can sometimes trade $30B worth of volume in one day. I’m sure

could add some more color and nuance here but I hope this clears up some of the confusion around Nvidia’s last quarter & their accounting practices. We’re witnessing a somewhat unprecedented demand for GPUs & since the market is fighting for them, many customers are willing to prepay in order to secure their allocation of Nvidia products.

Thanks for the info.

Thanks a lot for this, though I doubt this will change the mind of the tin foil hat crew.

One question that remains for me is the following statement:

"On August 21, 2023, our Board of Directors approved an increase to our share repurchase program of an additional $25.00 billion, without expiration. From July 31, 2023 through August 24, 2023, we repurchased 2 million shares for $998 million pursuant to a Rule 10b5-1 trading plan. As of August 24, 2023, a total of $27.95 billion was available for repurchase."

Did they really toptick their shares at $499 for the entire period? Think what I might be missing here is

1) there is some rounding error included in the '2 millions shares' total (e.g. if it is actually 2.15 million shares the average drops to $464). I haven't been able to find exact numbers though.

2) that the program was only renewed on the 21st, so it's only 4 days (but then they drove repurchases really hard in the few days before earnings)

Thanks a lot!