Much has been written about the history and current business operations of Nintendo. Acquired did a great podcast on the history and Ryan O’Connor from Crossroads Capital did a great write up about their current business operations and the potential upside if Nintendo is able to unlock more value from their underlying business for shareholders. As a lifetime Pokemon fan and Nintendo product user, I wanted to try to better understand the story surrounding Nintendo as a business and potential investment opportunity.

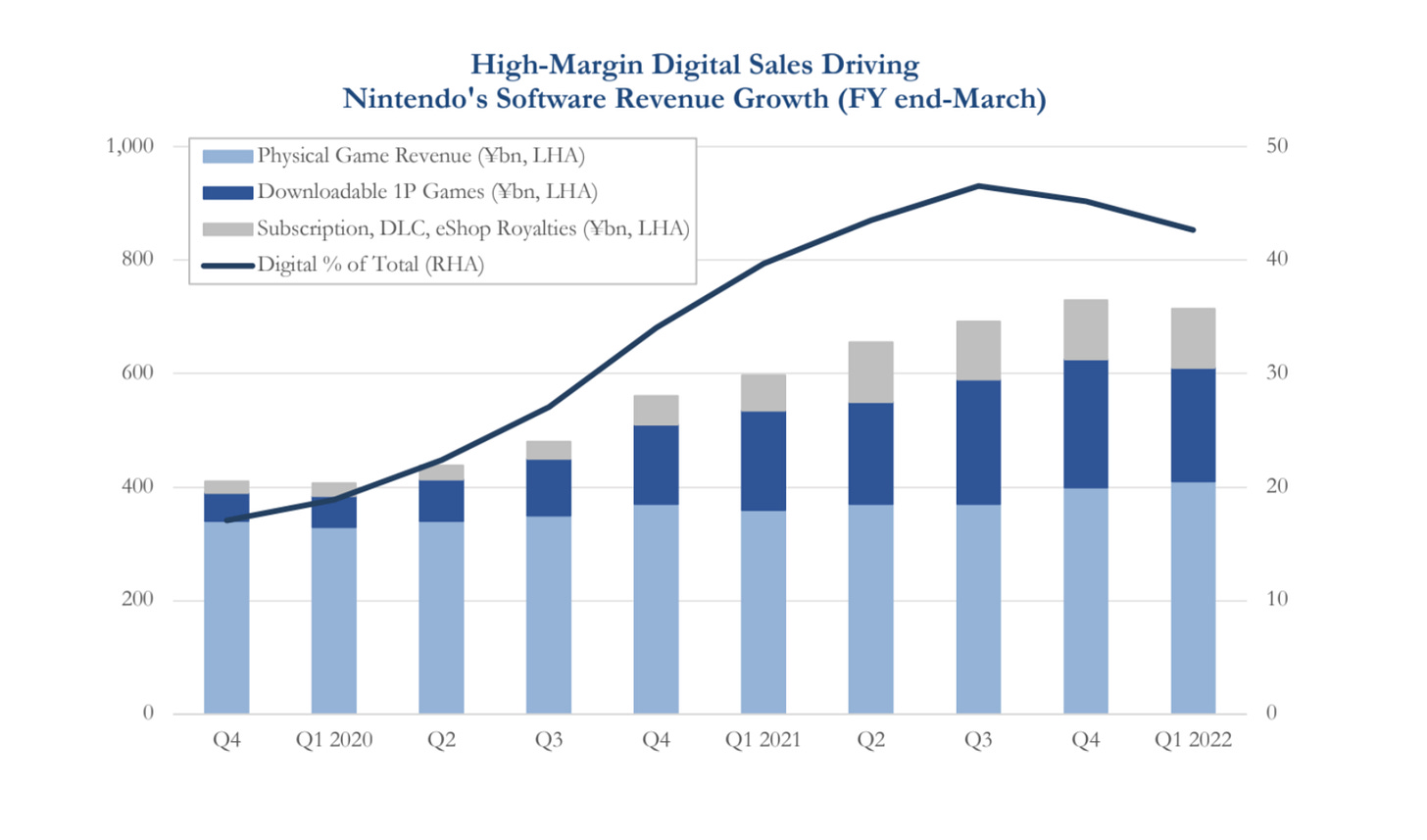

TLDR; Nintendo appears cheap on valuation metrics because the market views them as having a hit-driven, cyclical business model where they need to reestablish their user base every time they launch new hardware. The market seems to think we’ve reached “peak Switch” meaning that sales of the popular gaming console, the Nintendo Switch, have peaked and revenue is likely to decline in coming years, which will put pressure on margins and depress earnings. The market also doesn’t place much value on the ~$13B of cash & short term investments on their balance sheet, as management has conveyed their intent to build a cash buffer as a potential safeguard against things going wrong in the future (a failed hardware launch, for instance, could be expensive and hurt the company economically, which is why - in management’s opinion, it is prudent to hold a large amount of cash). If you had to pay a multiple of earnings for a given earnings stream, would you prefer one that is stable and experiences low but steady growth? Or one that is dependent on major product launches, and will have rather “lumpy” sales cycles where the first few years after a successful launch see dramatic revenue growth, only for that growth to taper off as everyone who wants a device eventually wants one? The market, as it stands today, does not seem willing to award Nintendo a high multiple of earnings, which seems to reflect a view that the company will always be chasing their next hardware launch and it’s financial success will depend it’s ability to reestablish its user base with the next “hit console”. The bull case is that Nintendo is evolving as a company (and Japan is simultaneously evolving its corporate governance laws to be more aligned with shareholders) and shifting towards a stabler revenue mix where a greater percentage of their sales comes from higher margin opportunities like software games (selling the games digitally through their eshop vs a physical retailer) and subscription revenue from their online service offering, Nintendo Store Online.

I want to try to understand the assumptions implied by the current valuation, and then understand how the sensitivity of those assumptions may affect the return we’d realize if we were to invest in the equity.

There are a few key metrics for the business:

Total Devices (cumulative install base) - 123M

Active User Base (some % of install base accounting for some device churn) - 112M

Cumulative Sales Per Hardware Units Sold - roughly 60,000 JPY or ~$460

Hardware Sales & Growth - Declined by 21.3% yoy

Software Sales & Growth - Games declined 4% yoy but NSO subscriptions are up 21.5% yoy

Revenue Mix (what % from software vs hardware) - 52% Software 48% Hardware

Gross/Operating Margin & Changes Year over Year

Basically - how many switches can the company sell, how many games will the average user buy, how many switch users can the company convert into NSO subscribers & how accretive will (in theory) a more stable mix of revenue (more recurring revenue via NSO subs, more games bought digitally) be for Nintendo’s margins?

(Sorry in advance for the use of tables in both JPY & USD.)

First lets take a look at how revenue has increased in years since the switch was launched. Revenues and Gross Profits saw a big uptick in 2018, after the launch of the Switch in 2017. A similar boost came in 2021, as Nintendo saw a large pull forward of demand during COVID.

Financials

Commentary From Management

From the company’s earnings release regarding the 9 months ended December 2022:

Looking at the Nintendo Switch business during the nine months ended December 31, 2022, Pokémon Scarlet and Pokémon Violet got off to a strong start, recording total sales of 20.61 million units during the period. Other new titles released during this fiscal year also performed well, with Splatoon 3 selling 10.13 million units, and Nintendo Switch Sports selling 8.61 million units. In addition, among the titles released through the end of the previous fiscal year, Mario Kart 8 Deluxe sold 6.66 million units (for cumulative sales of 52.00 million units) and Kirby and the Forgotten Land sold 3.47 million units (for cumulative sales of 6.12 million units). As a result of these factors, the total number of million-seller titles during this period was 27, including titles from other software publishers.

As for hardware, units sold declined 21.3% year-on-year to 14.91 million units, mainly due to a shortage of semiconductors and other component supplies that impacted production until around late summer. Total software sales declined 4.0% year-on-year to 172.11 million units, affected to some extent by the decline in hardware sales.

Turning to the digital business for our dedicated video game platform, sales of downloadable versions of packaged software for Nintendo Switch performed well, and revenue related to Nintendo Switch Online increased, helping to push digital sales to 310.0 billion yen, up 21.5% year-on-year.

For the mobile and IP-related business, royalty income was stable but income from smart-device content declined, with the result that overall sales declined 2.3% year-on-year to 38.9 billion yen.

The end result is that total sales reached 1,295.1 billion yen, with overseas sales of 988.8 billion yen accounting for 76.4% of the total. Operating profit was 410.5 billion yen, ordinary profit was 482.5 billion yen, and net profit attributable to owners of parent totaled 346.2 billion yen.

Valuation

So in looking at projections, the company is anticipating ending FY23 with revenue of 1,600Bn JPY vs previous estimates of ~1,660Bn JPY.

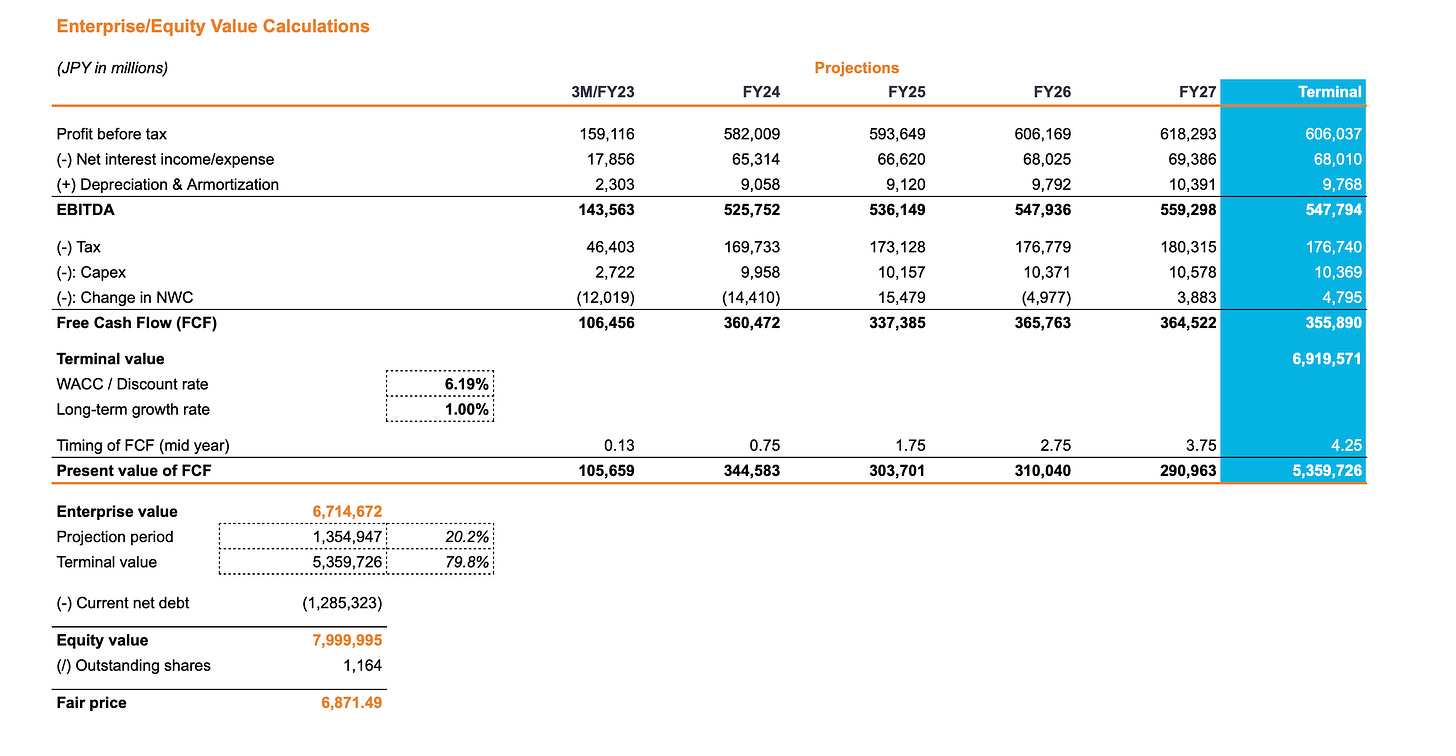

With a quick DCF (with very conservative growth assumptions and little, if any, margin expansion from a higher mix of software revenues) we get a fair value of 6,871.49 JPY, an upside of about 33% from today’s price of 5,173 JPY.

Pretty quickly, we can use these numbers to understand the key drivers of the story. How much can we expect revenues to increase (or decline) based on 1. future Switch sales 2. future sales of software games & NSO subscriptions (currently 36M online subscribers, a roughly ~32% conversion rate for users who purchase devices and choose to subscribe to Nintendo Switch Online). Using conservative assumptions (a 9% decline in revenues next year followed by a steady 2% growth rate in the following years and a 1% terminal growth rate) Nintendo is still “undervalued”. You’d have to take the view that switch sales will fall off a cliff, and that Nintendo will be unable to convince its current install base to buy any of their new offerings. This does seem unlikely considering roughly 1/6 of Switch users bought the new Pokemon game. Looking at Gross/EBITDA/Net margins, the increase over the past few years does seem to confirm the narrative that Nintendo is focused on shifting to a stabler and higher margin revenue mix. Let’s take a look at a few charts from Crossroads Capital letter -

So taking a step back, the classic video game model was to sell a console, and then for users to buy games to play on the console. This trend has evolved to buying a console and buying games digitally through the console’s online store, and further, an option to subscribe to an online service that promises features like additional downloadable content and access to other games amongst other offerings. Nintendo is a vertically integrated video game company, meaning they sell both the console and the games played on the console. With the release of the Switch in 2017, users were able to buy physical versions of the game as they have always done but they could also choose to buy the games digitally via Nintendo’s eShop. This is accretive to Nintendo’s margin as they no longer have to pay the middleman (the retailer) for the sale of the physical game (nor do they have to pay the incremental cost associated with each sale of a physical game, put another way, there’s no additional cost per unit of software game sold) and we see this trend reflected in the increase of Nintendo’s operating margins. In 2018, Nintendo began offering Nintendo Switch Online, a tiered subscription service promising access to DLC, as well as future offerings like the ability to play various classic games emulated on the Switch. The highest tier subscription is $50 a year and this is also an incredibly high margin opportunity for the company. We see this reflected in the charts above, as Nintendo has enjoyed margin expansion from the increase in digital sales (both software games & subscriptions) and also how subscription revenue has increased as a % of overall digital sales (crucially, this is recurring revenue, something that is important if the company is to achieve a “stabler” mix of revenue than the past when sales were nearly solely dependent on selling consoles and physical games). Nintendo earns a 55% margin on physical game sales and 90% on digital games sold.

So in coming to your own conclusion about Nintendo as an investment opportunity, we’d need to have a sense of a few metrics over the next 5 years -

Switch consoles sold per year

Software units sold per year & “Tie Ratio” or, how many games the average switch user buys

Switch users converted to NSO Subscribers

Mix of physical vs digital game sales

For me, the hardest aspect of the forecast is Switch sales. The company will report FY23 earnings on May 9, and hopefully we can get a sense of management’s expectations for the coming year in terms of both hardware and software projections. If the sales decline is truly due to the shortage of semiconductors, we should expect a moderate increase in device sales, which should in turn drive additional game sales and some increase in subscriptions. (Assuming demand for the Switch remains robust and not in secular decline). A promising trend has been the demand for the newer switch models, both the Switch Lite and the more expensive Switch OLED model. However, future Switch demand does seem to depend on the company releasing an upgraded version, speculatively known as the “Switch Pro” (rumored to include an upgraded System on a Chip designed alongside Nvidia, capable of rendering state of the art 3rd party games with frame rates and graphics comparable to other leading gaming consoles like Sony’s PS5 and Microsoft’s Xbox). Which, sort of ironically for the bull case, does make the company somewhat dependent on another hit console. That being said, Nintendo’s overall strategy is what matters more than just last year or next year’s numbers. In Crossroads letter, he lays out the case for Nintendo attempting to follow in Apple’s footsteps, where they incrementally upgrade hardware (with newer versions still having a familiar user interface and all the user’s data) and users are locked into the Nintendo software ecosystem via their Nintendo Account (much as Apple releases incrementally better iPhones and users access their data via iCloud). A user who has lots of saved game data stored on Nintendo’s cloud servers (which, by the way, Nintendo has announced their intent to invest $4B in network infrastructure for their online services and cloud gaming) will still be able to access their saved data on newer devices, and can expect a similar experience with the software even as they upgrade their device. This strategy definitely makes sense, and Nintendo’s launch of the Nintendo Switch Online (NSO) in 2018 does seem to reflect an ongoing commitment to the Switch device and ecosystem, which should somewhat alleviate concerns that Nintendo will try to reinvent the wheel with their hardware, as they have done in the past. With an install base of over 100m Switch users, the company doesn’t have to sell an enormous amount of new devices, if they are indeed able to generate more revenue per Switch user and convert a higher % of their overall install base to NSO subs.

Assumptions

Crossroads assumptions include an average 22.5m devices per year (which is high compared to the forecast for this year) which gets us to ~205m units in 2027 and ~130m active users. They assume a 40% conversion (or “attach”) rate for device owners to NSO subs, so ~50m subscribers and assume a $50 ARPU for NSO subs. They also assume a conservative Tie Ratio of 2.3x (lower than the historical average of ~3) meaning the average Switch user buys just over 2 games per year. They assume a game sales mix of 60% Software 40% hardware (and an overall mix of 67% software sales and 33% switch console sales), which should equate to a gross margin of ~65% and an operating margin that scales linearly with gross margin, of about 45%. They also assume a ~6% growth rate in Cumulative Sales per Hardware Unit Sold (one of management’s key KPIs), going from 60k JPY to 80k JPY. Their assumptions work out to about $1Tn JPY of FY27 EBITDA (vs $560Bn JPY of EBITDA in our conservative DCF). They assume a terminal EBITDA multiple of 12.5x vs the ~8x fwd EBITDA multiple the company currently trades at. Crossroads assumptions are definitely optimistic, as they reflect strong execution by Nintendo’s management on continuing to deliver upgrades to the Switch hardware, new game releases that are popular with users and a higher % conversion of Switch users into NSO subscribers. The risks to the downside seem to be mainly execution risk, as well as the overall uncertainty of future demand for consoles and related software.

Interesting points / considerations

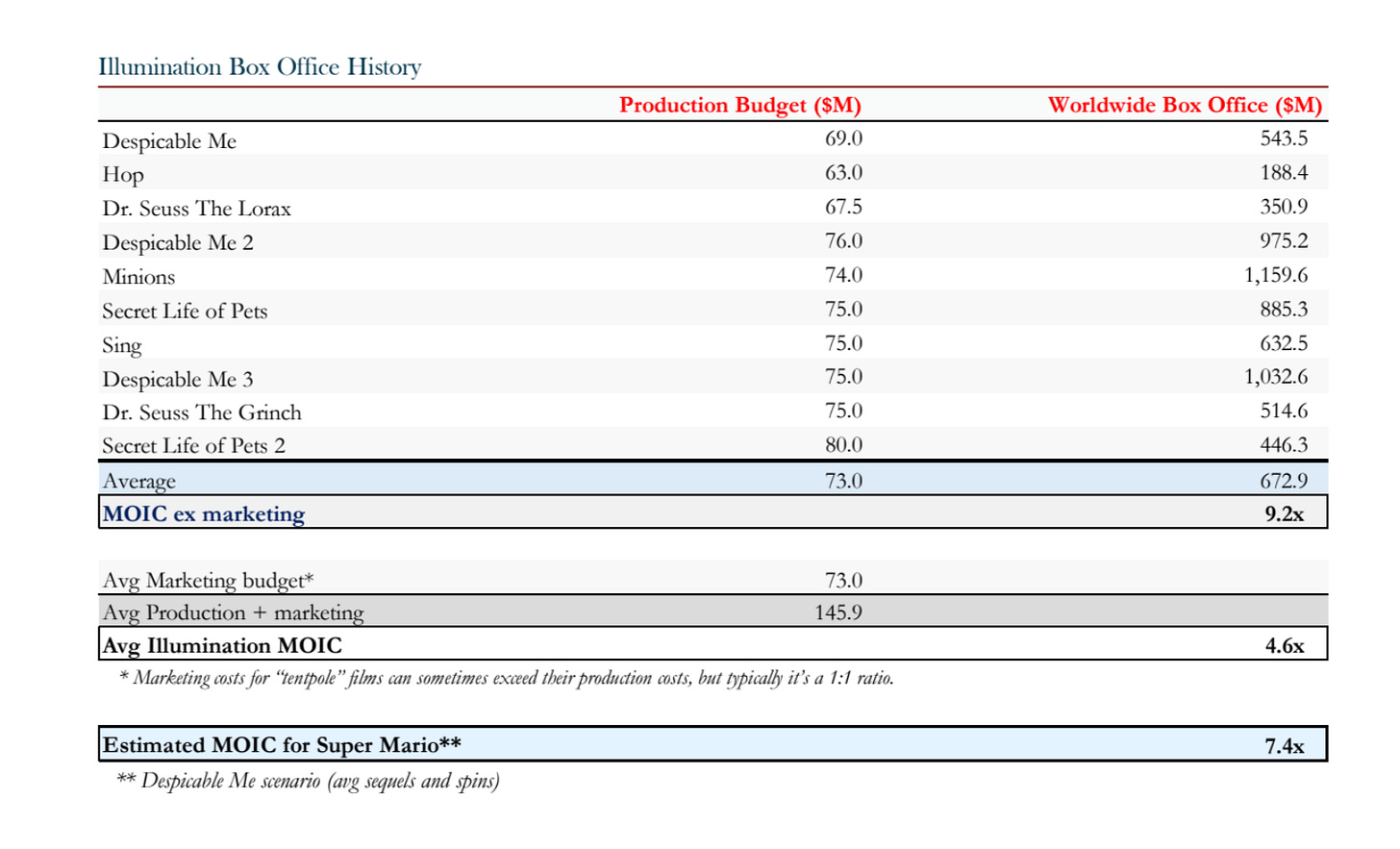

All of the above is focused on Nintendo’s core business, that is, the sales of consoles and games, as well as software subscriptions. The above valuation places almost no value on the potential for Nintendo to license its vast (and generally beloved) intellectual property to other ventures. Two such ventures that are currently underway are the Mario Movie, in partnership with Illumination, the studio that created Despicable Me (expected to do ~$140mm in its first 5 days in the US) and the Super Nintendo World theme parks, developed in partnership with Universal Studios. These ventures seem to represent a commitment from Nintendo to investing in opportunities where it can license its existing IP and partner with companies who have experience in a given niche (be it movies or theme parks or something else in the future) in order to deliver delightful experiences for fans across the world. The initial reception from the Mario Movie is encouraging (one of the benefits of having such beloved IP is their content can resonate with fans of all ages, much in the way Disney can appeal to both parents and their kids) and Crossroads includes some comps for MOIC from movies as well as Nintendo’s expected take rate from ticket sales at the four planned theme parks.

IP Licensing - Mario Movie & Universal Theme Parks

Licensing definitely represents a significant opportunity to generate additional recurring revenue, at little risk to the company, which makes for an interesting potential catalyst for those considering an investment.

Changes to Corporate Governance Laws in Japan

Basically, since Pension Funds are large owners of Japanese stocks, it’s in the government’s (and the public’s) best interest to align management incentives with shareholders (a large % of which, are Japanese workers via their pensions) and they are enacting changes to corporate governance laws that promote returning capital to shareholders. Japan has long had a culture of companies holding large cash balances, as traditionally, companies have been run for the benefit of employees and are expected to last through many generations (so a conservative approach to cash management and overall capital allocation has been the norm). As a result, investors have usually been less willing to pay high multiples for Japanese companies with large cash balances, as they don’t expect that cash to be returned to them, in the way they might expect if they were investing in a US or European company with a similar cash balance. Since the public has such a large interest in Japanese stocks via their pensions, it is in Japan’s best interest to bring their equity market valuations in line with those in the US and Europe.

Nintendo has generated ~$14B USD of free cash flow in the years since they launched the Switch and roughly 75% of that has been returned to shareholders via dividends and share buybacks (historically, Nintendo has paid out ~33% of its consolidated operating profit as a dividend). So while Nintendo has a history of returning some cash, it is still sitting on a pile of roughly $13B USD of cash & short term investments, which could be used to invest in future projects, or returned through an increase in their dividend and/or additional share buybacks.

The generational shift from risk averse cash hoarding towards a management suite more aligned with shareholders seems to be underway, and an interesting development is the appointment of Illumination’s CEO, Chris Meledandri, to the company’s board of directors, potentially reflecting a long term commitment to expanding the ways in which the company licenses its intellectual property. Overall, the change in corporate governance laws in Japan seem to present a tailwind Nintendo’s share price, as management will have to be more aligned with shareholders going forward (it also opens the door for potential activism).

Ownership of Equity in The Pokemon Company, Niantic & Others

Another interesting point to note is that Nintendo is not forced to disclose its equity stake in companies in which it owns less than 20%. Nintendo owns ~33% of The Pokemon Company(TPC), which is reported to have earned $320mm USD in net profit on $1.6B USD of revenue last year. Pokemon is one of the fastest growing franchises in the world, and since Nintendo owns similar stakes in both Creatures and GameFreak (both of whom are 33% owners of The Pokemon Company) they may indirectly own a 50% stake of TPC. With a multiple of 30x earnings (a fast growing company with a wide moat, high margins and beloved intellectual property) gets us a $10B valuation and would make Nintendo’s stake worth $5B. Nintendo also owns 13% of Pokemon GO developer, Niantic. Niantic is a really interesting company, a developer of augmented reality technology and AR enabled games, was last valued at $9B USD in 2021 in its latest round of funding, making Nintendos’s stake worth an estimated ~$1.17B USD. Nintendo also owns stakes in Bandai Namco, Dena and interestingly enough, the Seattle Mariners, worth approximately $250mm, $200mm and $170mm respectively. The market doesn’t seem to place any value on these assets that are worth at least $6.79B USD (the disclosures are a bit opaque, they report $3.6B of “other assets” on their balance sheet but i’m not sure if this is the carrying cost of these investment stakes, they also report gains on “share of profit of entities accounted for using equity method” on their income statement but this does not seem to reflect the full value of their equity stakes).

Summary, Conclusion & My Personal Thoughts

I did my best to be conservative with my future assumptions. I've never liked the dichotomy of growth vs value investing (i’ve often found that a lot of the “value” of an investment is found in understanding the future growth of a business) but I guess i’d consider myself a growth investor (though I was trained in the ways of more “classic” value investing, focusing on stable FCF growth, reliable margins, a strong moat, durable economic advantages etc). I like businesses that look relatively cheap on a 3-5 year time horizon when you factor in their expected growth. I mostly invest in businesses where I think I have somewhat of an edge in terms of deeply understanding the business and it’s technology, and potentially see something that maybe the market hasn’t fully come to appreciate yet. I like keeping assumptions conservative anytime I make a financial model as I think even as a “growth” investor, you can do the work to build some kind of margin of safety for your investment. I wanted to be even more conservative than usual here mostly because I personally love Nintendo and didn’t want my bias to cloud my judgment as far as analyzing the business and it’s opportunities. I remember trading Pokemon cards as early as kindergarten and dressing as Ash Ketchum for halloween. I remember long car rides gliding by as I played Pokemon Gold on my Gameboy advance. I remember spending hours learning about different Pokemon, spending hours playing Mario Party and Mario Kart with friends, though I never really got the hang of Super Smash Brothers and would never really put up much of a fight. One remarkable thing, and something that truly feels magical about Nintendo, is that these feelings that were so strong so many years ago, all came back when I bought a Switch. I was a bit late to the party, only buying it for Christmas in 2020, but I was truly blown away by my experience playing Zelda: Breath of the Wild. I’m not a big gamer by any measures, but the experience with the game was so immersive that I felt like I was in actually in Hyrule (is this the metaverse?). The ability to continue to make products that elicit such wonderful feelings amongst users is a rare and remarkable quality of a business. At the risk of being a bit cliche, Nintendo doesn’t just sell consoles & games, they sell magic and magical experiences. They are the rare company that is focused on the highest level of craftsmanship and delivering joyous experiences to their customers through their products and services. How many companies are there that people genuinely love? I think it’s fair to say there’s at least a few people who genuinely love Nintendo, and I think that helps to illustrate how important this inflection point is in the company’s story. A company that is beloved by its customers/users and it’s shareholders is something probably an order of magnitude more rare (Apple and Disney come to mind, both of which have had their respective struggles) but Nintendo certainly has the opportunity to become one of those once in a generation companies, if it is indeed able to execute on it’s strategy to move towards a more stable revenue mix while continuing to deliver a wonderful experience for existing and future Switch users. Their success will be predicated upon continuing to drive sales of Switch products (existing SKUs and new iterations in the future, like the rumored Switch Pro) and first party games, as well as converting more Switch users to NSO subscribers and continuing to improve their online offering. There is also lots of room for the company to increase shareholder value through capital allocation decisions (dividends, buybacks etc.) and through opportunities such as licensing their IP to movies, theme parks and other potential future venture, not to mention the equity stakes they hold in various valuable enterprises.

That being said, there is considerable execution risk facing the company. They will likely need to continue releasing updated versions of the Switch (much as Apple releases incrementally better versions of the iPhone that still run iOS and keep users data with their iCloud account, encouraging customers to stay locked in to the ecosystem) and continuing to deliver exciting new first party games (the sequel to Breath of the Wild is slated for a May 12 release, which should be a positive catalyst for the company’s earnings). They will also need to continue investing in improving their NSO experience and overall online offering, which will mean continued investment in network infrastructure and cloud services, in order to remain competitive with offerings from Sony, Microsoft and others (STEAM for instance). Switch sales may decline. The Switch Pro may flop. The company may be unable to match the success of previous prominent game titles (Mario, Pokemon, Zelda to name a few). The business may see a drop off in online subscribers as users opt for other online offerings that offer better multiplayer experiences or richer DLC to go along with their games. Nintendo notably missed the boat with smartphone games and were largely unwilling to participate in the casino like mechanics of games that relied on in app purchases for their revenue. This definitely cost the company in the short term, but is indicative of a company that is true to its values, which is hopefully worth something in the long term.

All in all, I don’t believe Nintendo is a “value trap” (a company that appears “cheap” on valuation metrics, only to continue to disappoint investors thinking they found value) but I do think management can takes steps to de-risk the business in the future years by conveying their alignment with shareholders and articulating a roadmap towards the stabler revenue mix that would drive longer term margin expansion and more consistent free cash flow in the future. While I think there is considerable uncertainty surrounding the business in the short term, if one is optimistic about management’s ability to execute on their opportunity, I believe there is a reasonable margin of safety at today’s valuation to earn a slightly above market return (our DCF showed a 33% discount to fair value at today’s price using a 6.2% discount rate and 1% terminal growth rate) over the next 5-10 years. As always, nothing in this article constitutes investment advice and in the interest of putting money behind my ideas, I bought a small stake in Nintendo today, representing ~9bp of my personal account. I do believe their is significant opportunity to the upside if the company can execute on the bull case as articulated above, and I would highly recommend that interested investors check out Crossroads Capital letter which goes much further into detail about the business than I did in this piece. Nintendo has the opportunity to evolve into a truly generational company, and for what it’s worth, if the company were to ask for my 2 cents, I would actually recommend pausing the dividend and buyback program, and investing more into driving higher ARPU for each switch user through higher tie ratio, higher spend per game (more DLC) and doing everything they can to increase the attach rate for NSO subs. I would also suggest the company use their cash balance to buy The Pokemon Company in in’s entirety, and perhaps doing the same for Niantic Labs. Which would only serve to further strengthen Nintendo’s position in intellectual property as well as future technology developments (Pokemon GO has to be one of the largest cultural events of all time, I still remember how happy everyone was when it was first released in summer 2016 and still have fond memories playing it on my phone in different places across the world). I would also recommend that management do their best to convey this roadmap to shareholders, with the goal of building a committed, long term base of shareholders, who trust that short term investment will lead to stabler revenue and higher margins. Only once the company has reached maturity with it’s stabler revenue mix (higher % from software sales, more paying NSO subs driving higher revenue, higher overall ARPU etc.) should management focus on returning capital through traditional measures such as buybacks and dividends. I believe this would drive a higher return over a long time horizon than if capital allocation is made the immediate priority.

In conclusion, Nintendo is a special business, with an opportunity to evolve into a company that delights both its users and shareholders. I will be eagerly awaiting their full year results (to be announced May 9 as they ended FY23 March 31) and will probably write a follow up to reassess the opportunity. The launch of the next Zelda game and any announcement of a Switch Pro (or whatever the successor to the Switch ends up being) should also prove to be important catalysts for interested investors, and I believe the opportunity gets less risky the more Nintendo is able to show proof that they can execute on their overall strategy. While earnings growth would be the main driver of returns i’m going to look at in the short term, if the company is indeed able to achieve a stabler mix of revenue, alleviate concerns of “peak Switch” (and change the prevailing investor perception that the company is a “hit driven cyclical” business) and capitalize on opportunities through licensing their IP and their equity stakes in TPC, Niantic and others, all of this combined with the shareholder friendly changes to corporate governance laws in Japanese could also see the company earn a higher multiple than the 8x fwd EBITDA they trade at currently. Thats all for now, thanks as always for reading and please feel free to reach out on twitter if you have any feedback or thoughts.

Appendix:

Great write-up! I have been a Nintendo investor ever since I came across Ryan O'Connor's great investor letter and heard him on a podcast. Really excited about watching the movie next week.

Coincidentally my own DCF model currently has Nintendo at a 50% discount, assuming a low growth scenario of 3% annualy over the next 10 years with some margin expansion due to increasing digital sales.