The Business of Online Travel

A look a the internet travel industry through the lens of three companies: Airbnb, Booking.com and Expedia

Continuing with our series of looking at industries that should inevitably experience healthy growth well into the foreseeable future, this piece will take a look at the market for online travel. While we will provide a general overview of the industry at large, we think the online travel market is best understood through not only three of the best companies in the sector, but perhaps three of the best companies in the world; AirBnB, Booking and Expedia. This piece will take a look at the story of each of the three companies, why they are uniquely positioned in the online travel industry, look at their current investments and strategies, and also look at their financial statements and provide a valuation model for each of them.

TLDR:

AirBnB, Booking and Expedia are all, in their own ways, exceptional companies. They are inevitably linked to overall travel demand and thus will experience a degree of cyclicality in their earnings. When travel was ground to a halt during Covid, their businesses suffered but have since rebounded strongly. This has been great for their companies but has perhaps made it a bit harder to estimate normalized earnings. If you are looking for a way to play travel demand from a capital returns perspective, these are definitely companies worth taking a look at as they are highly levered to the overall travel environment. If you are looking for quality businesses to buy for the longer term, these are also worth your time. AirBnB perhaps contains the most upside potential as they have been innovative in unlocking new supply and new paradigm for travel for both travelers and hosts and there is still a fairly long runway for their potential growth. They do face various risks, including regulation and a slowdown in overall travel or the short term rental market, as well as a fairly rich valuation at the present moment so their potential upside comes with a fair degree of uncertainty. In terms of the modern era of tech startups though, they are a standout for many reasons - exceptional leadership (founder is still the CEO and routinely takes to Twitter to address user feedback and new product features) as well as a healthy balance sheet and fairly significant free cash flow generation. Booking is a solid balance of healthy growth, a strong balance sheet and solid operational metrics. If they are able to execute on their strategic plans over the next 3-7 years they do seem positioned to earn above market returns. Expedia lags AirBnB and Booking in operational metrics (lower total sales and worse margins) but the story seems to lie in driving more profitable growth, leveraging AI and creating a more comprehensive experience for travelers planning their trips, expanding margins via more customers starting and ending their experience on Expedia’s platform and returning capital to shareholders in the form of buybacks.

AirBnB (on a reverse DCF) is fairly valued for a 10% IRR if you believe they will continue growing pre-tax profit at 32% for the next 5 years and can sustain a ~20% EBIT margin during that time. The company has a strong balance sheet with $6.1B in net cash ($8.1B in cash against $2B in debt) another $2.8B in short term investments and $6B in funds held on behalf of guests. We believe Brian Chesky to be an exceptionally strong leader, focused both on the operating metrics of the business and the granular nuances of the company’s products that drive them. He has outlined the product strategy for the company and continues to take to social media to address user concerns and feedback. The questions surrounding the story with AirBnB are:

To what degree will regulation dampen their revenue growth?

How serious are some of the common concerns? These include but are not limited to: the company being increasingly levered to the short term rental market as management companies buy properties to rent them out on AirBnB. The lack of transparency surrounding fees and the final booking cost of rooms on the platform.

Can the company continue to grow into the current valuation? There is no doubt they are an exceptional company, and perhaps one of the best of the recent era of new tech companies, but they are valued to continue growing sales over 30% per year and stabilize operating margins at around ~20%. This may cause some investors to exercise caution and potentially wait for a pullback (that could possibly coincide with a weakling travel environment.)

How serious is the competition? Booking and Expedia both are developing alternative accommodation offerings and are looking to compete for guests with AirBnB. This may be a question of are these companies taking share from a static pie? Or is the overall market growing at such a clip that Booking and Expedia can gain share while AirBnB remains the leader and still experiences healthy growth.

With exceptional leadership, an innovative business model, a strong balance sheet and free cash flow margin, AirBnB appears poised to be the market leader in its niche in online travel for the foreseeable future. The company currently trades at 15x earnings(maybe a bit distorted due to a one time net income boost due to a tax break), 31x EV/EBITDA and 17x EV/FCF. The company has a very health balance sheet, with a strong net cash portion and is using a stock buyback program ($2.5B announced in May 2023) to somewhat offset dilution from stock based compensation.

Booking (on a reverse DCF) is fairly valued for a 10% IRR if they can continue growing pre-tax profit at 16.5% per year for the next 5 years and if they can sustain a ~30% EBIT margin over that time frame. The company has a healthy balance sheet with $13.2B in cash and $475mm in net debt. The company has strong management with a history of market leadership and strategic, accretive acquisitions that has all led to Booking becoming the market leading online travel platform that it is today. They are focused on continuing to grow their core business, driving more users to their connected trip platform and integrate generative AI into their products in a way that both delights users and increases profitability. The questions surrounding Booking include:

How resilient can the company stay in the case of a recession and overall slowing travel demand?

Can the company continue to maintain superior margins to Expedia? Historically, this was because Booking mainly operated in Europe and could charge higher commissions with their agency business model (whereas Expedia operated more in the US and couldn’t command as high of a take rate through their merchant model because chains like Hilton and Marriott controlled a lot of supply and therefore had more bargaining power.)

Can Booking deliver on it’s long term vision to “make booking and experiencing travel easier, more personal and more enjoyable, while delivering better value to our traveler customers and supplier partners?” This vision includes making the customer experience better, their launch of their Connected Trip platform strives to help users book their entire trip (hotels, plane tickets and car rentals) on Booking’s platform.

Can this goal of having users start their trip planning process on Booking’s platforms help reduce ad spend? (Booking and Expedia are heavily reliant on search ads to drive users to their respective platforms.)

Can the company leverage AI effectively in ways that augment the user experience and truly benefit their customers and supplier partners?

The company currently trades at 20x earnings, 15x EV/EBITDA and 13.5x EV/FCF. Management is focused on profitable growth as well as retiring shares, with almost $20B left in the company’s recently authorized buyback program. The company is a strong mix of high single digit to low double digit growth, 30% operating margins, healthy balance sheet, competent management with a good balance between investing for the future and prioritizing shareholder returns. In terms of investors looking for high quality growth companies at a fairly reasonable price, Booking certainly fits this billing.

Expedia would appear overvalued (on a reverse DCF) as it would need to grow pre-tax profit at 25% over the next 5 years (vs 10 year average of 16%) to justify it’s current valuation and maintain historical EBIT margins of around 7%. The company has $5B of cash on hand with a modest net debt position of $1.2B billion. The company has lower margins than Booking due to lower take rates on their merchant model (where they buy inventory wholesale from hotels and resell it online) due to a large portion of their lodging business being US based, but they are actively expanding into Europe and the rest of the world and increasingly adding agency model business (traditionally, Expedia dominated the US market with a primarily merchant model and Booking was the leader in Europe with a primarily agency model but both businesses have been venturing into one another’s territory both on the business model front and geographically.) The questions surrounding Expedia’s story include:

Similar to the question about Booking, can the company remain resilient during periods of weakening travel demand? This is a concern to some degree for any company that experiences cyclical trends in their business, as they must capitalize on tailwinds and build cash buffers and other mechanisms to survive the inevitable downturns.

Can the company’s efforts to combine their various travel platforms under a single loyalty program, OneKey, lead to high customer satisfaction, increased user retention and lead to more customers starting and ending their journey on Expedia’s platforms. This is a key point of focus for investors as the company is able to earn incredible gross margins (82% average over the last 10 years) but a significant portion of operating expenses are due to the company (and the overall industry) being reliant on search ads as the primary means of acquiring customers.

Will the company’s efforts to leverage AI (something management has highlighted on their recent earnings calls and calls their efforts “industry leading”) pay off both in the form of increased customer satisfaction and increased profits via sales growth, higher margins or (perhaps ideally) a combination fo the two?

Does the company’s efforts to drive additional vacation rental share via VRBO prove to be materially accretive to the top and bottom lines? While on the surface it may appear this is a direct threat to AirBnB’s business model, it may be the case that the market for alternative accommodations is sufficiently large where these three companies can all have a share of an increasingly big market.

Will management’s capital allocation efforts be sufficient to drive adequate total shareholder return? Since the company is priced more richly than Booking with similarly growth and lower margins, they will need to be smart allocators of capital in order to deliver reasonable returns for shareholders. Their recently announced $5B buyback program is evidence that management is attuned to this reality.

The company currently trades at 22x earnings, 10x EV/EBITDA and 9x EV/FCF. If they are able to drive more profitable growth through investing in initiatives like OneKey and by leveraging AI to create better, more personalized travel experiences and also create more of a reason for customers to plan their entire trip on Expedia platforms (thus lowering their search ad spend) it may make for an interesting margin expansion story.

Introduction

The online travel industry, marked by the emergence of platforms such as AirBnB, Booking.com, and Expedia, revolutionized the way consumers approach travel. Each company has a distinct history that contributed to the industry's evolution.

Booking and Expedia were both founded in 1996, Booking as a way to book hotels throughout Europe online (which made it popular initially with American consumers who were early users of the consumer internet and because at the time, you had to call hotels to book rooms which presented a challenge for Americans traveling to Europe who didn’t speak the language of the country to which they were traveling) and Expedia as an internal division of Microsoft, with the goal of creating a site to provide bookings for airline tickets, hotel reservations, car rentals, cruises, and vacation packages. The idea was to use the power of the internet to simplify the process of booking travel, providing consumers with direct access to a wide range of travel options. Global Distribution Systems existed (computerized systems, initially pioneered by airline companies, that travel agents could use to book reservations) but there were no consumer friendly front-ends for users to access these systems online. AirBnB emerged later, founded in 2007, the founders (who were broke and decided to rent out air mattresses in their apartment to conference attendees because all the hotels in San Francisco were booked) envisioned a world where anyone could rent their spare guest room or couch to interested travelers.

Fast forward to 2023 and these three companies have come to dominate the online travel industry.

Over the last 12 months, AirBnB saw 438 million nights and experiences booked on their platform (growing 14% year over year as of last quarter and 32% over 2019, a comp that travel companies use to indicate where their business was pre-covid) with a gross booking volume of $71.3 billion (growing 17% yoy and 89% vs 2019), which translated to $9.6B in revenue and $2.25B in operating profit (23% operating margin). They have averaged 32% revenue growth since becoming a public company and that includes 2020 where sales fell by almost 30%.

The last 12 months for Booking.com have seen over 1 billion room nights booked (growing 15% as of last quarter, healthy growth in their rental car and airline ticket segments as well, which are smaller by the numbers but becoming more important as Booking seeks to become a platform where consumers can book entire trips) and gross bookings of over $146B (growing 21% year over year on a constant currency basis) from both their agency and merchant segments. The agency business model is similar to the analogue travel agent model - the platform facilitates a trip and Booking earns a commission (this was Booking’s initial business model but recent years have seen them expanding into the merchant model which has become a very meaningful portion of their total revenue) whereas the merchant model is a wholesale transaction where the online site buys room from hotels wholesale and marks them up on their platform and earns the difference (this was Expedia’s initial model, and when you consider that they are not responsible for the inventory (if the room doesn't sell they don't pay) and don’t need to pay the hotel until 30 days after the stay (and with an average booking time of 2 months in advance, Expedia holds customer cash for 90 days, a great negative working capital cycle) you can almost see why the Expedia board passed up up on buying Booking.com in the early 2000s, more on this later.) As of last quarter, merchant and agency bookings represented 56% and 44% of Booking’s revenue respectively. The $146B of gross bookings translated into $20.6B of revenue and $6.3B of operating profit (30% operating margin.) Booking.com has averaged 16% sales growth over the last 10 years, including 2020 where they saw a 54% decrease in revenue due to the pandemic.

For Expedia, the last 12 months have seen 344 million room nights booked across their online platforms and $72.7B of gross booking volume which translated to $12.5B of revenue and $1.3B of operating profit ( ~11% operating margin.) Expedia has averaged around 16% sales growth over the last 10 years including 2020 which saw a 57% decline in revenue due to covid.

These companies are ultimately levered to travel demand which itself is dependent on the business cycle and while this can cause results to be cyclical, these companies all have strong operating models and have proven resilient over the years which has led to them emerging as the leaders in the online travel business. There has been a considerable amount of consolidation in the industry over the years which has led to greater operating leverage and more value to accrue to Booking and Expedia, as their scale creates significant barriers to entry for any would-be competitors. AirBnB’s success is due to many factors but one critical component is that they weren't necessarily directly competing with Booking and Expedia as much as they were unlocking new (and exciting!) supply entirely. Ultimately, a marketplace’s product is matching supply and demand and the companies that provide the best experience for consumers will earn the highest conversion rates.

These companies all face various risks. For AirBnB, these risks include potential changes to the innovation and lodging tax as well as potential headwinds from regulation that may require hosts to apply for a license to list their “alternative accommodation”, restricting the number of nights a unit can be rented and requiring units to meet certain safety standards. The risks for Booking and Expedia have less to do with the potential regulation AirBnB may face (to some degree, a model that is as innovative as AirBnB will inevitably face pressure from regulators, as they have disrupted the status quo) and more to do with overall travel demand and the potential for another covid level exogenous shock that grounds travel to a halt (maybe a bit more of a threat to Expedia in the scenario where they are liquidity constrained as they carry more debt and have lower margins than Booking.) Another thing to note is the degree to which Booking and Expedia need to spend marketing dollars on Google Search ads to be the first result when someone searches “hotels in Rome.” They would love for consumers to begin and end their journey on their own platforms vs starting on Google which costs both companies billions per year in advertising spend (online travel is one of the largest spenders on search ads as a category and both companies spend billions per year on these ads, which eats into their operating margin.) AirBnB has a bit of a relative advantage in this regard as their customers tend to start their searches on the AirBnB app or website. Even in the face of the various risks, if you like businesses where even if you had nearly unlimited capital to put to work, it would be hard to compete with them, these three companies are worth taking a look at. In this piece, we will explore each company’s history, recent commentary by their management teams, take a look at their financials, build a valuation model and try to get a sense of why they are uniquely positioned in the online travel industry.

AirBnB

Overview

AirBnB, Inc., together with its subsidiaries, operates a platform that enables hosts to offer stays and experiences to guests worldwide. The company's marketplace model connects hosts and guests online or through mobile devices to book spaces and experiences. It primarily offers private rooms, primary homes, or vacation homes. The company was formerly known as AirBed & Breakfast, Inc. and changed its name to AirBnB, Inc. in November 2010. AirBnB was born in 2007 when two Hosts welcomed three guests to their San Francisco home, and has since grown to over 4 million Hosts who have welcomed over 1.5 billion guest arrivals in almost every country across the globe. Every day, Hosts offer unique stays and experiences that make it possible for guests to connect with communities in a more authentic way. Whether the available space is a castle for a night, a sailboat for a week, or an apartment for a month, AirBnB is the easiest way for people to showcase these distinctive spaces to an audience of millions. By facilitating bookings and financial transactions, AirBnB makes the process of listing or booking a space effortless and efficient. With 4,500,000 listings in over 65,000 cities in 191 countries, AirBnB offers the widest variety of unique spaces for everyone, at any price point around the globe.

Key Metrics

Why they are uniquely positioned in the online travel industry

AirBnB's unique position in the online travel industry can be attributed to several strategic advantages and business model innovations that have allowed it to disrupt traditional accommodation sectors and maintain a competitive edge.

Peer-to-Peer Business Model:

AirBnB's platform capitalizes on the sharing economy, allowing individuals to rent out their private spaces to guests. This peer-to-peer model has fewer barriers to entry compared to traditional hotels, which require significant capital investment. It enables AirBnB to offer a vast and diverse inventory without the costs associated with owning or leasing properties.

Diverse Inventory:

The company offers a broad range of accommodations, from shared rooms to luxury villas, providing options for various customer preferences and price points. This inclusivity caters to budget travelers, experience seekers, and those looking for unique stays, expanding AirBnB's market reach.

Global Reach:

AirBnB operates globally, with listings in more than 220 countries and regions. This extensive reach allows travelers to find accommodations in virtually any destination, including areas underserved by traditional hotels, which can be a significant draw for users.

Local Experiences:

Unlike hotels, many AirBnB properties offer a local and personalized experience, which appeals to travelers seeking authenticity. This community-centric approach can lead to higher customer satisfaction and repeat business.

Technological Innovation:

AirBnB has consistently leveraged technology to improve user experience. Its platform includes features like smart pricing algorithms, search filters, and a robust review system that fosters trust and safety among users. Its investment in AI and machine learning further enhances personalization and recommendation accuracy.

Brand Strength and Community Engagement:

The AirBnB brand is synonymous with alternative lodging and experiences. Strong branding efforts have resulted in high brand equity. The company's community-driven approach, which includes host-guest interactions and a shared sense of belonging, builds loyalty and advocacy among its users.

Cost Structure:

AirBnB has a relatively lean cost structure. It doesn't own the properties listed and has lower overhead costs compared to traditional hotels. This efficiency enables competitive pricing and the ability to scale quickly in response to market demands.

Adaptability and Crisis Management:

AirBnB has demonstrated adaptability in the face of industry disruptions, including the COVID-19 pandemic. It quickly pivoted to promote local and longer-term stays to address the decline in tourism and travel restrictions, showing resilience and a capacity to innovate under pressure.

Regulatory Engagement:

Despite facing regulatory challenges, AirBnB has engaged proactively with policymakers and has worked toward finding mutually beneficial solutions, such as agreeing to collect tourist taxes and enforce rental caps in certain cities.

Sustainable and Responsible Travel:

With an increasing number of travelers prioritizing sustainable and socially responsible travel, AirBnB's model of using existing resources (people's homes) aligns well with these values. The platform encourages economic benefits for local communities by enabling hosts to generate income directly.

AirBnB's innovative business model, technological leadership, global reach, and strong brand presence have uniquely positioned it to succeed in the online travel industry. These attributes allow AirBnB to capture diverse market segments, adapt to changing consumer behaviors, and maintain a competitive edge in a dynamic market.

History

AirBnB's history is a testament to innovation and rapid expansion within the travel industry.

Initial Concept and Founding (2007-2008):

The AirBnB concept was born in 2007 when Joe Gebbia and Brian Chesky, then roommates in San Francisco, needed to pay their rent. They decided to rent out three airbeds in their living room and offer breakfast to their guests, which were attendees of a local design conference.

The official founding of AirBnB occurred in August 2008, with Brian Chesky, Joe Gebbia, and Nathan Blecharczyk (the technical architect behind the site) coming together. The original website was called AirBedandBreakfast.com.

Early Growth and Funding (2009-2011):

In the early days, the founders struggled to gain traction. They famously sold novelty cereal boxes to fund their operation during a financial crunch.

By 2009, AirBnB had participated in Y Combinator, a startup accelerator that provided them with much-needed seed funding.

In 2011, the company saw significant growth, with a $7.2 million Series A funding round from Greylock Partners and Sequoia Capital. In the same year, AirBnB announced its 1 millionth booking.

International Expansion and User Growth (2012-2015):

AirBnB began expanding internationally, acquiring German clone Accoleo in 2011, and opening several international offices including in London, Paris, Barcelona, Milan, Copenhagen, Moscow, and São Paulo.

By 2012, AirBnB was offering lodgings in 192 countries and had hit 10 million nights booked.

The company continued to raise more funding, securing hundreds of millions of dollars, which valued the company in the billions.

Product Expansion and Branding (2016-2019):

AirBnB diversified its offerings, introducing AirBnB Experiences in 2016, which allowed travelers to book activities hosted by locals.

The company also underwent a rebranding, adopting a new logo in 2014 that it called the Bélo, symbolizing belonging.

Regulatory Challenges and Adaptation (2010s):

As the company grew, it faced regulatory hurdles in various cities around the world. Cities like New York, San Francisco, and Berlin struggled with how to regulate the short-term rental market.

AirBnB responded by cooperating with authorities, agreeing to enforce limits on how many days a year hosts can rent out their properties in certain cities and collecting tourist taxes directly.

IPO and Market Maturation (2020-2021):

AirBnB went public in December 2020, with one of the most anticipated IPOs of the year. Despite initial concerns due to the COVID-19 pandemic's impact on travel, the company's stock soared on its first day of trading.

As of September 2021, AirBnB had over 4 million hosts with about 5.6 million listings scattered across the globe, having served more than 1 billion guests

Throughout its history, AirBnB has not only grown in terms of listings and global reach but has also influenced the hospitality industry and local economies, often becoming a point of discussion regarding the impact of short-term rentals on housing markets and community dynamics.

Recent Management Commentary

Brian Chesky, the CEO & Co-Founder, highlighted a record high net income (even without the tax benefit) and free cash flow during this quarter, as well as buying back $500mm of stock

We had over 113 million Nights and Experiences Booked. Revenue of $3.4 billion grew 18% year-over-year. Net income was $4.4 billion. Now this includes a onetime income tax benefit from the release of a valuation allowance of $2.8 billion. But even excluding this tax benefit, adjusted net income was $1.6 billion, our highest ever and represented an adjusted net income margin of 47%. And free cash flow for the quarter was $1.3 billion. In fact, on a trailing 12-month basis, our free cash flow was $4.2 billion, which is also our highest ever. And because of our strong cash flow and balance sheet, we repurchased over $500 million of our stock. Now during the quarter, we saw a number of positive business highlights. First, we have added nearly 1 million active listings this year. Our supply grew 19% in Q3 compared to a year ago. We once again saw double-digit supply growth across all regions with the highest growth in regions with the highest demand. Urban and nonurban supply increased at nearly the same rate, and we saw relatively similar supply growth among individual professional hosts with the majority of new listings exclusive to AirBnB.

He also highlighted that it was a record travel season, a possible indication of where overall travel demand is at in terms of the overall business cycle

Second, Q3 was a record travel season on AirBnB. Nights and Experiences Booked grew 14% in Q3 compared to a year ago. We saw an acceleration of nights growth across all geographies, and we are particularly encouraged by the growth of first-time bookers during Q3, and we saw more nights than ever booked in the AirBnB app with 53% of gross nights booked in the app compared to 48% in the same period last year. And finally, international expansion markets are gaining momentum. Cross-border nights book increased 17% in Q3 compared to a year ago. In Asia Pacific, our business has fully recovered to pre-pandemic level. And we're seeing significant growth in Asia Pacific markets such as Taiwan, Thailand and Indonesia, all experiencing year-over-year nights growth above 30% on an origin basis.

He discussed the comapny’s commitment to making the experience better for hosts

Now we've been able to achieve these results by continually making progress on our 3 strategic priorities. First, we're making hosting mainstream. We've been focused on making hosting as popular as traveling and our Q3 results show that our approach is working. We ended the quarter with the highest number of active listing, and we saw strong active listings growth across all regions of the market types. And hosts are benefiting. During Q3 alone, AirBnB host earned more than $19 billion. We'll continue growing supply by raising awareness around hosting, making it easier to get started and improving the overall experience for a host.

He also touched on the company’s response to criticism of the product, something we believed to be evidence of his founder mindset still being present this far into AirBnB’s journey which we believe is important for AirBnB’s overall culture as well as their business goals. There are various complaints about the service, high cleaning fees and less than transparent display pricing being amongst them, and it is at least somewhat comforting for shareholders to see a CEO so involved in the iteration of the company’s product and so focused on making improvements on every level

Second, we're reflecting our core service. We've collected millions of pieces of feedback on how to improve AirBnB. And 2 years ago, we started doing twice a year of product releases to address this feedback. And since then, we've launched more than 350 new features and upgrades across our entire service. And in the past year alone, this has included things such as improved customer service, total price display and new tools to help host set more competitive prices. These upgrades are paying off for both guests and host. For example, we redesigned our tool and we made it easier for hosts to add discounts and promotions. And now almost 2/3 the host offer weekly or monthly discount. We also added a new feature called similar listings that let hosts see listing prices in the area, so they know what to charge. And since we launched the similar-listings tool, nearly 1 million hosts have used this feature. In mid-September, we shared progress we've made to help lower cleaning fees, reduce prices and improved search and reliability. We have even more improvements coming as part of our November 8 winter release next Wednesday where we'll introduce dozens of new features aimed at making AirBnB more reliable.

And finally, our third strategic priority is expand AirBnB beyond their core. Now we made significant progress in the past few years in building a strong and profitable business. And in addition to laying the foundation for new services and offerings, we've been focused on international expansion. We are investing in underpenetrated international markets, and we're seeing great results. Following the success, we've seen in recent quarters in Germany and Brazil, Korea has now become one of our fastest growing countries compared to 2019 with gross nights booked 54% higher than they were in Q3 2019 on origin basis. As international travel continues to recover, we're building greater momentum for AirBnB in underpenetrated markets.

Financials

Valuation

AirBnB Income Statement

AirBnB DCF Valuation

Booking.com

Overview

Booking Holdings Inc. provides travel and restaurant online reservation and related services worldwide. The company operates Booking.com, which offers online accommodation reservations; Rentalcars.com that provides online rental car reservation services; and Priceline, which offer online travel reservation services, and consumers hotel, flight, and rental car reservation services, as well as vacation packages, cruises, and hotel distribution services. It also operates Agoda that provides online accommodation reservation services, as well as flight, ground transportation and activities reservation services. In addition, the company operates KAYAK, an online meta-search service that allows consumers to search and compare travel itineraries and prices, comprising airline ticket, accommodation reservation, and rental car reservation information; and OpenTable for booking online restaurant reservations. Further, it offers travel-related insurance products, and restaurant management services to consumers, travel service providers, and restaurants; and advertising services. The company was formerly known as The Priceline Group Inc. and changed its name to Booking Holdings Inc. in February 2018. The company was founded in 1997 and is headquartered in Norwalk, Connecticut.

Key Metrics

Why they are uniquely positioned in the online travel industry

Booking.com's unique positioning in the online travel industry is driven by a combination of strategic business practices, extensive market penetration, and customer-centric features.

Broad and Diverse Accommodation Listings:

Booking.com is known for offering one of the most extensive ranges of accommodation options among all online travel agencies. This includes hotels, hostels, apartments, vacation homes, and even more unique properties like treehouses and igloos, catering to a wide variety of traveler preferences and budgets.

Strong Global Presence:

The platform's extensive global presence, with a vast array of properties in almost every country, makes it a go-to option for international travelers. This global reach is crucial for capturing market share in both popular and emerging travel destinations.

User-Friendly Platform:

Booking.com has invested heavily in creating a user-friendly interface that simplifies the booking process. Features such as free cancellation, no booking fees, and a best-price guarantee have been key to attracting and retaining customers.

Strategic Marketing and Branding:

The company's aggressive marketing strategies, including performance-based and brand advertising, have significantly increased its visibility and brand recognition. Booking.com has effectively utilized online marketing channels to drive traffic and conversions, making it one of the most recognized names in online travel.

Data-Driven Personalization:

Booking.com uses data analytics and machine learning algorithms to offer personalized recommendations and dynamic pricing. These technologies enhance the user experience by tailoring options to individual user preferences and willingness to pay.

Customer-Centric Services:

The platform's focus on customer service, with 24/7 support in multiple languages, builds trust and loyalty among users. Their robust review system further aids customers in making informed decisions, contributing to repeat bookings.

Investment in Technology and Innovation:

Booking.com continues to invest in technological advancements, such as artificial intelligence and augmented reality, to improve search functionality, customer engagement, and the overall booking experience.

Strong Supply Chain Relationships:

The company has established strong relationships with property owners and managers, offering them tools and services to maximize their bookings and revenue. This supply-side focus ensures a steady inventory of accommodation options for customers.

Agile Response to Market Trends:

Booking.com has shown agility in responding to emerging market trends, such as the rise in demand for alternative accommodations and sustainable travel options, by diversifying its listings and implementing sustainability initiatives.

Competitive Pricing Strategy:

Through a competitive pricing strategy that often includes the option for free cancellation and pay-later services, Booking.com has positioned itself as a customer-friendly platform that offers flexibility and value.

Booking.com's combination of an extensive inventory, global reach, customer-focused features, and technological prowess uniquely positions it to remain a leader in the online travel industry. These strengths align well with the evolving needs and behaviors of modern travelers, providing Booking.com with a robust platform for growth and success in a competitive market.

History

Booking.com's journey to becoming one of the leading figures in the online travel industry is characterized by strategic growth, technological innovation, and market adaptation.

Early Days (1996-1999):

Booking.com has its roots in a small startup named Bookings.nl, founded in 1996 by Geert-Jan Bruinsma, a student from the Netherlands who wanted to connect travelers with hotels.

The initial concept was to provide a platform that enabled Dutch hotels to offer their rooms to an online audience, and for Dutch customers to find accommodations easily.

Expansion and Rebranding (2000-2005):

In 2000, Bookings.nl merged with another similar service, Bookings Online, which operated as Bookings.org. After this merger, the company rebranded to Booking.com.

The newly formed Booking.com rapidly expanded its inventory and started including properties outside the Netherlands, covering a more significant part of Europe.

In 2003, the company launched its first mobile application, an early move into the mobile space which would later become vital for the travel industry.

Acquisition by Priceline and Global Growth (2005-2010):

In 2005, Booking.com was acquired by Priceline Group (now known as Booking Holdings) for $133 million. This acquisition provided the resources for further expansion. One could argue this is amongst the most valuable acquisitions of all time.

Post-acquisition, Booking.com accelerated its growth, adding more properties worldwide and becoming a go-to platform for international travelers.

Technological Advancements and Market Leadership (2011-2015):

Booking.com made significant investments in technology, improving user experience with features like instant confirmations and customer reviews.

The platform's user-friendly interface and extensive property listings helped solidify its position as a market leader in the online accommodation booking sector.

By the early 2010s, Booking.com had become one of the world’s largest e-commerce companies in the travel sector.

Continued Innovation and Challenges (2016-Present):

Booking.com has continued to innovate by integrating new types of accommodations like homes, apartments, and unique stays like castles and igloos.

The company faced and adapted to various challenges, including regulatory changes in Europe and competition from other platforms and direct hotel bookings.

Despite these challenges, Booking.com has maintained a robust presence in the market, aided by its extensive inventory and strong customer service.

Corporate Evolution:

Booking.com is part of Booking Holdings Inc., which also owns other travel industry giants like Priceline, Agoda, Kayak, and OpenTable.

The company's mission has evolved to not just connect travelers with hotels but to make experiencing the world easier for everyone

Recent Management Commentary

Glenn Fogel, President, CEO & Director of the company, spoke about a strong environment for travel demand and how Booking’s business benefitted during the third quarter:

I am encouraged by the strong results we are reporting today and by the strong leisure travel demand environment that we continue to see. In the third quarter, our traveler customers booked 276 million or more than 0.25 billion room nights. Which was an increase of 15% year-over-year and we had gross bookings of $40 billion, which was an increase of 24% year-over-year. Room night growth versus 2019 was 24% in Q3. Both room nights and gross bookings were record quarterly amounts for the company and both came in ahead of our previous expectations. Third quarter revenue of $7.3 billion grew 21% and adjusted EBITDA of $3.3 million increased 24%, both versus Q3 last year and both exceeded our prior expectations. Finally, our non-GAAP earnings per share in the quarter grew 36% year-over-year and was nearly 60 that's 6-0, 60% higher than in the third quarter of 2019. Our earnings per share growth benefited from our improved profit levels, as well as our strong capital return program, which reduced our end-of-quarter share count by 10% versus the third quarter 2022. Now turning to October. We estimate that room night growth was about 8% year-over-year and about 20% versus 2019. Excluding Israel, we estimate these growth rates would have been about 9% and 22%, respectively. We saw a significant negative impact on our business in Israel, and there was some impact on travel trends outside of Israel.

Nevertheless, we were encouraged to see global room night growth improve towards the end of the month. Overall, we continue to see resiliency in global leisure travel demand. And as we take a very early look ahead to 2024, we see strong growth on the books for travel that will take place in the first quarter of next year. Though a high percentage of these bookings are cancelable. Given current trends, we expect customers and consumers will continue to prioritize travel over other discretionary spend in 2024.

He highlighted important initiatives that the company is investing in, including integrating AI into their product offerings (maybe relevant, Booking was mentioned on Amazon’s earnings call as a company that is building generative AI experiences on AWS)

I firmly believe we are well positioned to continue our work attracting customers and partners to our platform, while making progress on several important initiatives, which will help strengthen our business over the long term. These initiatives include: one, advancing our Connected Trip vision; two, further integrating AI technology into our offerings; three, continuing to grow alternative accommodations and four, building more direct relationships with our traveler customers. Starting with the Connected Trip. This is our long-term vision to make booking and experiencing travel easier, more personal and more enjoyable, while delivering better value to our traveler customers and supplier partners. In the third quarter, we saw an increase in the percentage of transactions, which we count as connected trips, meaning 2 or more travel components within a trip. But still a small percentage of our total transactions today, it is encouraging to see an increasing number of our travelers booking more elements of their travel with us.

Glenn spoke about their efforts to continue growing their airline ticket business and the company’s plans to appeal the European Commission blocking their acquisition of Etraveli

Outside of accommodations, one of the most important elements of travel is Flex, and we continue to focus on further developing our flight offering on Booking.com. In the third quarter, air tickets booked increased 57% year-over-year, driven by the growth of Booking.com's flight offering. To provide some context on how this has developed over the last few years, the 9 million tickets booked on our platforms during the third quarter, were more than 5x the number of air tickets booked through us in Q3 2019. This significant growth of our flight offering at Booking.com over the last 4 years was achieved through our successful partnership with Etraveli. As previously announced, our proposed acquisition of Etraveli was blocked by the European Commission in September, a decision we will appeal. While we strongly disagree with the EC's decision to block the deal, our commitment to building the flight vertical at Booking.com has not changed. In fact, we have extended our partnership agreement with Etraveli through at least the end of 2028. Which means we anticipate continuing to work with them on improving Booking.com's flight offering over the coming years. We believe offering a compelling flight product alongside our accommodation, ground transportation and attraction offering, helps to create a better, easier and more comprehensive travel booking experience for our travelers and more opportunities for our partners.

He also discusses the company’s efforts to build out Connected Trip, which ideally would be an AI companion that helps travelers at every step of their trip planning process. He noted ways that the company is already seeing success in their efforts to integrate Generative AI

We will continue to build out our Connected Trip vision, which we believe will ultimately result in increased customer and supplier engagement with our platform. As we discussed last quarter, we have always envisioned AI technology at the center of the Connected Trip. We have a long history of investing in AI technology and incorporating it in our platforms across our company. I previously spoke about the hard work, our team has been doing to integrate Generative AI into our offerings in innovative ways, including Priceline Generative AI travel assistant, named Penny and Booking.com's AI Tripplanner. It is still very early days. But both teams are gaining valuable insights on booker questions, concerns and behavior, as the tools continue to interact with customers. At Priceline, we're seeing some encouraging signs of lower customer service contact rates. And we're exploring other areas across our business, where we believe we can use Generative AI tools to increase productivity. For example, our brands are running projects using Generative AI to enhance the productivity of our software developers with encouraging results so far. And we look forward to using these tools more widely in the future. I remain confident in our company's ability to benefit from AI developments by improving our products for our customers and operating more efficiently over time. Turning to our supply partners. We strive to be a trusted and valuable partner for all accommodation types on our platform.

He also noted Booking’s efforts to increase alternative accommodations on their platform, a space that is currently led by AirBnB but one that both Booking and Expedia are entering and trying to capture market share

We look to add value for our partners by delivering incremental demand and developing products and features to help support their businesses. During the quarter, some of our partners at Booking.com experienced delayed payments due to a planned upgrade to our finance and payment platforms in early July. We've now cleared the backlog of outstanding payment issues related to the system upgrade. We plan to provide compensation to partners who experienced an extended delay, and we recorded this in our Q3 results. We plan to communicate to all partners who were impacted by these payment delays within the next few days. We continue to focus on strengthening our alternative accommodation offering at Booking.com by increasing supply and raising awareness among travelers. In the third quarter, alternative accomodation room nights grew at about 24% year-over-year, which was faster than our traditional hotel category. Alternative accommodations represented about 33% of Booking.com's total likes, which is about 3 percentage points higher than Q3 2022. We are seeing continued momentum in terms of alternative accommodation, supply growth, both globally and in the U.S. with global listings reaching about 7.2 million by the end of the third quarter. Which is about 9% higher than Q3 last year. We aim to build on this progress by continuing to improve the product for our supply partners and travelers, particularly in the United States. For our travelers, we remain focused on building a better experience that leads to increasing loyalty, frequency, spend and direct relationships over time.

Financials

Valuation

Booking.com Income Statement

Booking.com DCF Valuation

Expedia

Overview

Expedia Group, Inc. operates as an online travel company in the United States and internationally. The company operates through Retail, B2B, and trivago segments. Its brand portfolio includes Brand Expedia, a full-service online travel brand with localized websites; Hotels.com for marketing and distributing lodging accommodations; Vrbo, an online marketplace for the alternative accommodations; Orbitz; Travelocity; Wotif Group; CheapTickets; ebookers; Expedia; Hotwire; CarRentals.com; Classic Vacations; and Expedia Cruise. The company's brand portfolio also comprises Expedia Partner Solutions, that offers private label and co-branded products through third-party websites; and Egencia that provides travel services to businesses and corporate customers. In addition, its brand portfolio consists of Trivago, a hotel metasearch website, which send referrals to online travel companies and travel service providers from hotel metasearch websites. Further, the company provides loyalty programs, hotel accommodations and alternative accommodations, and advertising and media services. It serves leisure and corporate travelers, that includes travel agencies, tour operators, travel supplier direct websites and call centers, consolidators and wholesalers of travel products and services, online portals and search websites, travel metasearch websites, mobile travel applications, and social media websites, as well as traditional consumer ecommerce and group buying websites. The company was formerly known as Expedia, Inc. and changed its name to Expedia Group, Inc. in March 2018. Expedia Group, Inc. was founded in 1996 and is headquartered in Seattle, Washington.

Key Metrics

Why they are uniquely positioned in the online travel industry

Expedia Group's unique positioning within the online travel industry can be attributed to a strategic confluence of comprehensive service offerings, technological innovation, and a diversified business model.

Diversified Portfolio of Brands:

Expedia Group encompasses a variety of well-known travel brands, including Expedia.com, Hotels.com, Hotwire, Trivago, Orbitz, Travelocity, and Vrbo, among others. This diversified portfolio allows the company to capture a wide range of consumer segments across different geographies and market niches, from budget to luxury travel, and from hotels to vacation rentals.

End-to-End Travel Services:

Unlike some of its competitors that focus solely on accommodations, Expedia offers an extensive array of travel services, including flights, car rentals, cruises, vacation packages, and activities. This full-service approach enables cross-selling and bundling strategies, creating value for customers and driving higher transaction volumes.

Advanced Technology and Data Analytics:

Expedia has made significant investments in technology to facilitate efficient and user-friendly search and booking experiences. Utilizing data analytics, the company can personalize offerings and dynamically price services, enhancing customer satisfaction and loyalty.

Strong Supplier Relationships:

Expedia has fostered strong relationships with airlines, hotels, and other travel service providers, securing competitive rates and inventory. These partnerships are crucial for providing customers with a wide range of options and ensuring pricing competitiveness.

Global Reach and Local Expertise:

With localized websites in over 70 countries, Expedia combines global scale with local presence, understanding and catering to regional travel preferences and behaviors. This localized approach is key to capturing domestic travel markets, which are substantial in many regions.

Customer Loyalty Programs:

The company's loyalty programs, such as Expedia Rewards, incentivize repeat bookings through points accumulation that can be redeemed for travel discounts. This enhances customer retention and lifetime value.

Strategic Acquisitions and Integrations:

Expedia's history of strategic acquisitions has expanded its capabilities and market reach. The integrations of acquired companies have allowed Expedia to leverage new technologies and inventory, maintain a growth trajectory, and diversify revenue streams.

Innovative Mobile Platform:

With a strong emphasis on mobile user experience, Expedia provides a seamless booking experience across devices. Given the increasing prevalence of mobile bookings in the travel industry, this is a significant competitive advantage.

Brand Recognition and Marketing Expertise:

Expedia Group has invested heavily in marketing and brand-building efforts across its portfolio, resulting in high brand recognition and trust among consumers. Effective marketing campaigns have driven user acquisition and engagement.

Financial Flexibility:

Expedia Group's financial strength affords it the flexibility to invest in growth opportunities, technology, marketing, and respond to market disruptions, as evidenced by its ability to navigate through the impacts of the COVID-19 pandemic.

Crisis Management and Adaptability:

The company's response to the COVID-19 pandemic highlighted its ability to adapt quickly to changing market conditions, by offering flexible cancellation policies and focusing on domestic travel and alternative accommodation options when international travel was limited.

Expedia's broad brand portfolio, comprehensive service offerings, technological capabilities, and global footprint uniquely position it to succeed in the online travel industry. These factors enable the company to meet diverse customer needs, adapt to market changes, and continue to expand its market share.

History

Expedia's history is a story of technological innovation, strategic acquisitions, and industry leadership in the online travel sector.

Founding and Microsoft Era (1996-1999):

Expedia was created as a division of Microsoft in October 1996, marking one of the first forays of a major tech company into online travel services. The service was launched on Microsoft Network (MSN) to provide online bookings for airline tickets, hotel reservations, car rentals, cruises, and vacation packages.

The idea was to use the power of the internet to simplify the process of booking travel, providing consumers with direct access to a wide range of travel options.

Spin-Off and Public Offering (1999-2001):

In 1999, Expedia was spun off from Microsoft in a successful public offering, allowing it to operate as an independent company and focus more intensely on the travel industry.

Microsoft retained a controlling interest after the spin-off but later divested its shares, giving Expedia the independence to grow its business.

Expansion and Acquisitions (2001-2005):

In 2001, USA Networks Inc. (later renamed IAC/InterActiveCorp) acquired a controlling stake in Expedia. Under IAC's ownership, Expedia began a series of acquisitions, including Travelscape and VacationSpot, which helped it to expand its service offerings.

Expedia continued to grow its platform and user base, becoming one of the largest online travel agencies (OTAs) in the world.

Growth as a Travel Giant (2005-Present):

In August 2005, IAC spun off Expedia as a separate entity, which included Tripadvisor in its portfolio at the time.

Expedia Group expanded its influence in the travel industry by acquiring a range of other travel sites, including Hotels.com, Hotwire, Travelocity, Orbitz, Trivago, and HomeAway, among others.

The company developed a comprehensive travel platform that provided everything a traveler might need, from reviews and advice to bookings for all aspects of travel.

Technological Innovation and Market Leadership (2010s):

Expedia invested heavily in technology to refine its search capabilities, making it easier for consumers to find and book the travel options that best suited their preferences.

The company also embraced mobile technology, developing apps and mobile-optimized services that catered to the growing number of travelers using smartphones and tablets to plan and book their travels.

Recent Developments and COVID-19 Impact (2020-2021):

Like many travel companies, Expedia faced challenges due to the COVID-19 pandemic, which caused a significant downturn in travel. However, the company has been working on strategies to adapt to the changing landscape and prepare for the recovery of the travel industry.

Expedia has continued to invest in its platform, focusing on flexibility and user experience to remain competitive and meet the evolving needs of travelers.

Throughout its history, Expedia has been at the forefront of the online travel industry, continuously evolving to meet the changing demands of the market. As an investment analyst, understanding Expedia's adaptability, technological prowess, and strategic acquisitions provides valuable insight into its market position and potential for future growth.

Recent Management Commentary

Peter Kern, Vice Chairman & CEO, highlighted a strong overall demand for travel during the third quarter, consistent with the tone in both AirBnB and Booking’s earnings calls. He also talked about finishing migrating VRBO (Expedia’s alternative accommodation platform) to their single front end stack which leaves the company strongly positioned to focus on accelerating growth vs rebuilding their tech.

Our third quarter results came in ahead of our expectations with record revenue and EBITDA. This was particularly gratifying, considering the fires in Maui, which had a disproportionate impact on our Vrbo business and put pressure on the top line overall. Travel demand otherwise remained solid with broad trends consistent over the last few months. North America and Europe demand remained stable with more pronounced growth in APAC and Latin America. Prices also remained stable by and large. Hotel and Vrbo ADRs are holding up in each region, but mix effects are leading to a slight year-over-year decline in overall lodging ADRs. Conversely, we have seen some modest price pressure in air and car. We are also keeping a close eye on the escalating violence in the Middle East, which appeared to have some impact on global travel in early October. More relevant to our specific performance, I'm happy to share that we've just completed the final leg of our Vrbo migration onto our single front-end stack with the conclusion of our global launch of the new Vrbo app this past Monday in the U.S. This marks the last of our major migrations associated with our multiyear transformation. It has been a long, complex journey, but well worth the effort as we are now in a position to accelerate into the future without the drag of transformation work that forced us to go backwards in order to go forwards.

He also spoke about Expedia’s AI efforts and their OneKey rewards program, which is a way for users to earn points across all of Expedia’s online platforms

We are now in a position to dramatically increase our test-and-learn capacity and feature release velocity while also providing a scalable and efficient base to operate upon. We continue to utilize our industry-leading AI and ML capabilities to radically improve all aspects of our traveler experience. And with the launch of One Key and our increasing ability to understand the long-term value of our travelers, we can now begin to drive faster, more profitable growth. Moving on to the key pillars of our performance, starting with our category-leading B2B business, which remains on track for a strong year with Q3 revenue growing 26% versus last year. We're winning new deals, increasing wallet share with existing partners, and launching new products and features to support our growth. Demand from China, in particular, continues to pick up with Q3 bookings from China Partners up over 150% year-on-year. We anticipate continued strength from B2B going forward, driven by our continuing push into the addressable market along with the advantages that our platform improvements will bring to the B2B business, whether in core technology, the application of AI and machine learning or in service and payments.

As we unify stacks, this will also further enhance the capabilities on offer for our B2B partners. But as pleased as I am with the continued growth of our B2B business, I'm even happier to see our B2C business picking up momentum with year-over-year revenue growth in Q3, accelerating over 400 basis points sequentially. This is what we've all been working so hard for, so it's very gratifying to see these results beginning to improve. Another major milestone for us was the U.S. launch in July of One Key, our new loyalty program. One Key unifies our major brands of Expedia, Hotels.com and Vrbo, allowing our members to earn and burn one simple currency, OneKeyCash across our vast marketplace. As I've mentioned before, getting dividends from a program like this will take some time, given the frequency with which most consumers travel. That said, we are very happy with the early results and traction One Key has with our members. We have already migrated over 82 million members to the program. And with the addition of Vrbo to the mix, we have seen 34% growth in new members over the last year. We have already seen many members using OneKeyCash across brands, including on Vrbo and have been pleased that Hotels.com members have not been unduly impacted and have already been using OneKeyCash to shop for other products on Expedia.

He discussed the company’s efforts to increase the percentage of bookings that occur within the company’s apps (which is a long term goal to reduce google ad spend and improve operating margins.) Expedia has a goal of making the experience of planning group travel more seamless and also believes that the launch of their OneKey platform and how they are leveraging AI will lead to higher consumer satisfaction, more return customers and therefore improved operating metrics for years to come.

Overall, these promising results have given us solid learnings that will be useful as we launch One Key in other countries next year. And with the Vrbo migration complete, we can now more fully lean into the core differentiation that One Key gives Vrbo in the vacation rental space. One Key, along with our ongoing efforts to more generally attract higher lifetime value customers, is accelerating our mix of loyalty members, app users and app members. And the percentage of bookings coming through our apps continues to grow and was up approximately 300 basis points sequentially in the third quarter, which ultimately contributed to our year-over-year marketing leverage in our B2C business for the third quarter. We have also been releasing exciting products and features that remove more and more friction from the planning and booking process. In September, we announced our Fall Release, showcasing a series of new features and products, squarely aimed at solving complex traveler problems and enhancing engagement. In case you missed it, I'll give you a few of the highlights. We have simplified group travel planning, providing for the first time one place for friends and family to collaborate on a group trip to see one another selections and add saved options across air lodging, car rentals and activities, significantly using the group planning process and creating a better and more successful trip for everyone.

Products like these not only enhance the consumer experience, but allow us to utilize a consumer's own network of friends and family to expand our reach. We've also launched tools to aid research into a given destination, hotel prices, weather, best times to visit, crowd levels and even generative AI-powered tools to determine the best neighborhoods to stay, giving the traveler one place to research where and when to stay in their dream location. We now also leverage generative AI to scrape reviews to answer traveler questions about amenities and property details, so no more sorting through hundreds of reviews to find out how strong the WiFi is, the quality of the pool or whether you're going to like the breakfast. We also launched the first project of its kind, EG Labs, which allows interested customers to test our AI-powered beta products, allowing them to play a hand in how we shape the future of travel. I could literally go on and on, but the takeaway is no one in travel is innovating faster than us and with so much important platform work behind us and with our leading capabilities and machine learning and AI, we will out-innovate in the space for many years to come.

The company is focused on faster and more profitable growth, as well as their high level strategy of providing the best possible product for their users.

We have literally worked for years and given up many short-term opportunities to get to this place, and I don't believe anyone is in a better spot technologically, which is not only exciting for our existing business but sets us up to go back on offense in many more markets next year. In closing, I'm pleased to see our solid execution in Q3 and through 2023 so far. While the geographic mix of business distorts global growth rates, we believe that we have held up or grown hotel gross booking share in virtually all of our key markets and with Vrbo finally completing its migration and the key differentiator of One Key, we expect our vacation rental share to improve going forward. In addition, we are finalizing our plans for '24, where we expect to drive faster and more profitable growth. Our high-level strategy is not going to change, best product, best loyalty program, best marketplace and best service. But instead of spending most of the year doing surgery on our own business, we will be focused on growth, innovation and efficiency. I'm excited for 2024 and beyond and for what we will bring to our travelers, partners and shareholders

Financials

Valuation

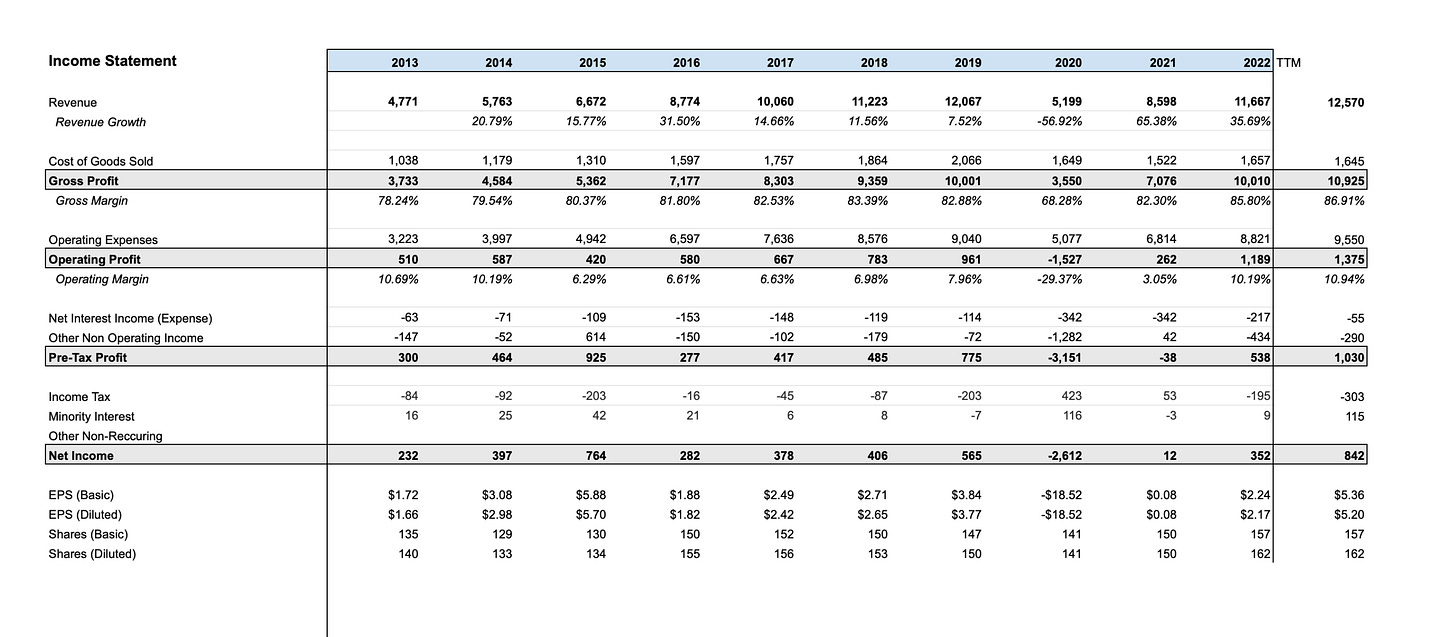

Expedia Income Statement

Expedia DCF Valuation

Conclusion

In conclusion, the online travel industry has come to be dominated by a small group of companies that can leverage their massive scale to provide the best experiences for customers who are looking to book travel plans online. AirBnB unlocked new supply with their innovative marketplace model for guests and hosts and has created and captured a lot of value as a company. They appear well positioned for the future but are also priced to continue growing at very high rates over the coming years. With exceptional leadership, a strong balance sheet and a combination of improving operational metrics and a thoughtful capital allocation strategy, the company is certainly one that investors looking for quality growth should place on their watchlist. Booking is perhaps the most solid of the three - healthy growth, a good balance sheet and strong margins. If they can execute on managements vision for the near to mid term future, shareholders can likely expect above market returns from the current price. Expedia appears ok on growth, but lags on margins vs AirBnB and Booking and will need to increase profitability or return capital to shareholders via buybacks for the current valuation to make sense. If Expedia can drive more users to their platforms (vs Google) and leverage AI (something AirBnB and Booking are also actively investing in) there may be a possibility for a margin expansion story to unfold. If you are looking for a way to play travel demand (you expect travel to reaccelerate, for instance) these companies are the way to go as they are all inevitably levered to the overall level of travel demand.

These three companies are all great examples of businesses that leveraged the internet to provide better services to consumers while also creating significant value for shareholders in the process. In terms of companies where it would be difficult to compete with even if you had unlimited capital to do so, these three are definitely in that category as they leverage the network effects from their massive scales to continue growing year over year. While AI may enable new ways of startups attempting to enter the online travel market, these companies are actively investing in the technology as well and in general, we believe it would be it would be extremely difficult for a new entrant to compete in the online travel business (there may be a larger threat from existing large internet companies making a move into the space but it would be tough for a new startup to directly compete.)

Thats all for now. If you enjoyed this piece, consider sharing it and subscribing and please feel free to reach out on Twitter (@netcapgirl) with any thoughts or feedback.

Thank you for your work. As a provider of about 30 Costa Rica vacation condominium rentals to booking.com, Airbnb and Expedia, I find that booking.com is my favorite provider. It charges a 15% commission, allows me to charge my customers directly so I control my cash flow, and on average provides a "high quality" customer. Airbnb comes in second with roughly a 14% commission, a payment model that pays me during the customer's stay, but with a generally "cheaper" or more cost conscious customer. Expedia comes in a distant third with a 20% commission, a delayed payment model for the most part, and a customer profile similar to booking.com, but with far fewer customers. These comments speak only to the lodging segment of each business, and only in Costa Rica, but lead me to value the lodging segment's revenues more highly for booking.com and Airbnb than for Expedia.

This might be unhelpful, but, it was an observation....In thinking about about holiday travel, i thought, is there a metric of any kind to gauge stress levels in society. I came across the following chart... it's called the OFR Financial Stress Index.. https://www.financialresearch.gov/financial-stress-index/#:~:text=The%20OFR%20Financial%20Stress%20Index,valuation%20measures%2C%20and%20interest%20rates. My sleep deprived eyes are probably getting the better of me, but i swear Expedia and AirBnB, on the 1yr, have a inverse correlation? Separately, I am super excited about AI, but I've been waiting to hear about developments on Machine Learning's progress with regards to mathematical problems in general. My biggest problem with Bard, has been having to recheck the outputs. I don't have the vocabulary as to why, but I think that until maths learning for ML/AI improve, getting to far ahead with the AI narrative might be a recipe for disaster. I'm not a programmer or a mathematician or an analyst, so I could very well be wrong or in doomer mode. But that's my take, if it counts for anything. This was an enjoyable read.