The Electrified Road Ahead

A look at the supply chain for electric vehicles & the inevitable future investment and government support for the industry

Executive Summary

Introduction

Overview

Supply Chain

Policy Support

Conclusion

Relevant Companies

If you have been noticing more and more electric vehicles on the roads these days, you’re not alone. 14% of all cars sold in 2022 were EVs, up from 9% in 2021 and 5% in 2020. While a large share (60%) of all sales come from China, sales in the US rose 55% year over year, bringing the US’ share of global EV sales to around 8% (the third highest in terms of sales with Europe being the second.) With a combination of fiscal support in the form of tax credits and other incentive programs, growing demand from consumers (data from the International Energy Agency suggests that 14 million EVs will be sold in 2023, a 35% year over year increase) and increased investment efforts from automakers and their suppliers to support this demand, a future with more and more electric vehicles feels inevitable. How can investors best understand this electrified road ahead of us and profit from this inevitable future? This piece is written with the goal of providing an overview of what is happening in the Electric Vehicle industry with a focus on highlighting the many steps involved in the complex supply chain. We will discuss 8 key stages of the EV supply chain and highlight relevant companies along the way.

From the International Energy Agency:

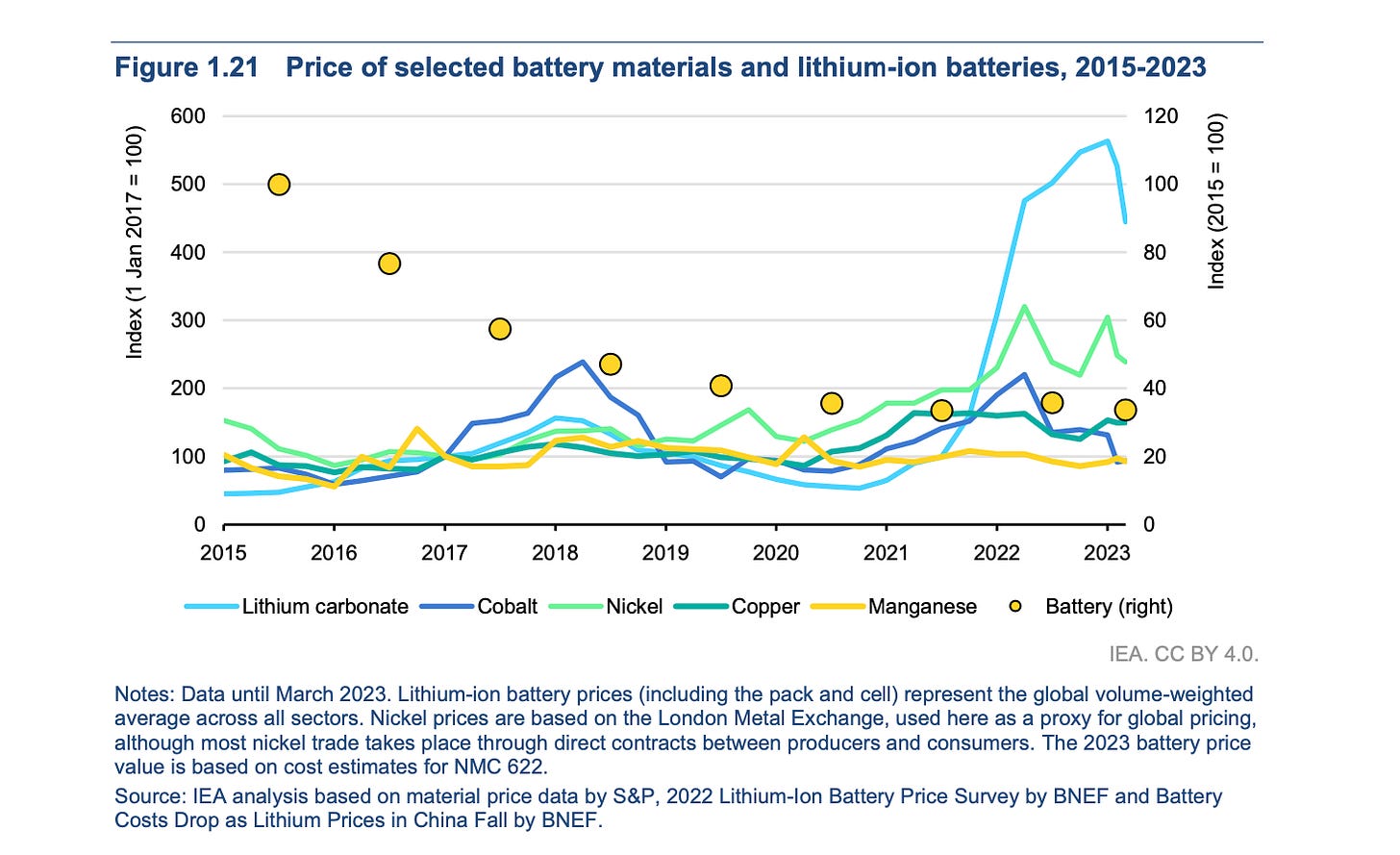

The increase in demand for electric vehicles is driving demand for batteries and related critical minerals. Automotive lithium-ion (Li-ion) battery demand increased by about 65% to 550 GWh in 2022, from about 330 GWh in 2021, primarily as a result of growth in electric passenger car sales. In 2022, about 80% of lithium, 30% of cobalt and 10% of nickel demand was for EV batteries. Only five years prior, these shares were around 15%, 10% and 2%, respectively. Reducing the need for critical materials will be important for supply chain sustainability, resilience and security, especially given recent price developments for battery material.

New alternatives to conventional lithium-ion are on the rise. The share of lithium-iron-phosphate (LFP) chemistries reached its highest point ever, driven primarily by China: around 95% of the LFP batteries for electric LDVs went into vehicles produced in China. Supply chains for (lithium-free) sodium-ion batteries are also being established, with over 100 GWh of manufacturing capacity either currently operating or announced, almost all in China.

The EV supply chain is expanding, but manufacturing remains highly concentrated in certain regions, with China being the main player in battery and EV component trade. In 2022, 35% of exported electric cars came from China, compared with 25% in 2021. Europe is China’s largest trade partner for both electric cars and their batteries. In 2022, the share of electric cars manufactured in China and sold in the European market increased to 16%, up from about 11% in 2021.

EV supply chains are increasingly at the forefront of EV-related policy- making to build resilience through diversification. The Net Zero Industry Act, proposed by the European Union in March 2023, aims for nearly 90% of the European Union’s annual battery demand to be met by EU battery manufacturers, with a manufacturing capacity of at least 550 GWh in 2030. Similarly, India aims to boost domestic manufacturing of electric vehicles and batteries through Production Linked Incentive (PLI) schemes. In the United States, the Inflation Reduction Act emphasizes the strengthening of domestic supply chains for EVs, EV batteries and battery minerals, laid out in the criteria to qualify for clean vehicle tax credits. As a result, between August 2022 and March 2023, major EV and battery makers announced cumulative post-IRA investments of at least USD 52 billion in North American EV supply chains – of which 50% is for battery manufacturing, and about 20% each for battery components and EV manufacturing.

The supply chain for electric vehicles (EVs) is a complex network that involves various stages and components. Here’s a high-level overview:

Raw Materials: The supply chain begins with the extraction and processing of raw materials like lithium, cobalt, nickel, and other minerals used in battery production. These materials are often sourced from different parts of the world.

Battery Manufacturing: Battery cells are produced by assembling the processed materials in specialized facilities. These battery cells are a crucial component of EVs, as they store and supply electrical energy.

Vehicle Assembly: After manufacturing the battery cells, the vehicle assembly process takes place. This involves integrating the battery packs, electric motors, and other EV-specific components into the car’s chassis.

Tier 1 Suppliers: Numerous tier 1 suppliers provide specialized components like electric drivetrains, charging systems, electronics, and other parts necessary for the EV’s operation.

Tier 2 and Tier 3 Suppliers: These suppliers provide a wide range of components and parts that go into making the various systems and sub-assemblies for the electric vehicles.

Distribution and Logistics: Once the vehicles are assembled, they are distributed to dealerships and customers. Logistics play a significant role in transporting parts and vehicles efficiently throughout the supply chain.

Charging Infrastructure: The EV supply chain also involves the establishment and maintenance of charging infrastructure, including public charging stations, fast-charging networks, and home charging units.

After-Sales Support: After-sales support and service networks are vital for maintaining and repairing EVs, which includes spare parts supply and service centers.

Raw Materials

The transformation from conventional combustion engines to electric propulsion hinges on a range of critical raw materials, each playing a pivotal role in the EV ecosystem. These elements, often referred to as battery minerals, include lithium, cobalt, nickel, and graphite. The journey of these minerals begins in resource-rich areas scattered across continents.

1. Lithium: The "White Gold"

Lithium is the cornerstone of EV batteries, offering high energy density and light weight. The lithium triangle formed by Argentina, Bolivia, and Chile holds the largest known reserves. Extracting lithium involves solar evaporation in salt flats, followed by chemical processing.

“Lithium demand has almost doubled since 2017 to 130 kt (kilotons) in 2022, of which demand for EV batteries accounts for 80%, up from 47% in 2021, 36% in 2020 and only 20% in 2017. Lithium is also used in the production of ceramics, glass and lubricants. Batteries are now the dominant driver of demand for lithium and therefore set the price. The availability of lithium supply is of particular concern because it is irreplaceable for Li-ion batteries and there are no commercial alternative battery chemistries available at scale today that meet the performance of Li- ion batteries.” - IEA

2. Cobalt: The Complex Dilemma

Cobalt, though essential, poses ethical and supply challenges due to its concentration in politically unstable regions. The Democratic Republic of Congo dominates cobalt production. Efforts are underway to reduce cobalt usage in favor of more sustainable chemistries.

“Cobalt demand was 187 kt in 2022, of which the EV battery share was 30%, up from 24% in 2021 and 18% in 2020. Cobalt is also used in superalloys, hard metals and catalysts. The cobalt intensity of Li-ion batteries has decreased significantly over recent years as battery makers moved to higher nickel content chemistries to achieve higher energy densities and lower costs (cobalt is the most expensive constituent per kg of Li-ion battery metal).” - IEA

3. Nickel: The Powerhouse

Nickel-rich cathodes enhance battery energy density. Indonesia and the Philippines are key suppliers of nickel, with Tesla striking deals to secure long-term supplies. As EV adoption surges, nickel demand is set to soar.

“Nickel demand is dominated by stainless steel production. Total demand was 2,640 kt in 2021, of which the share of EV-related demand was 10%, up from 7% in 2021 and 4%2020. Batteries require Class 1 nickel (>99.8% purity), while Class 2 nickel (<99.8% purity) cannot be used without further significant processing. Nickel-based cathodes are the dominant EV battery chemistries today and are expected to remain so in the future due to the demand for longer driving range EVs particularly in Europe and the United States. There is almost seven times more nickel than lithium by weight in an NC811 battery, therefore, EV Li-ion battery prices are most sensitive to nickel prices. This is of significant current concern given the war in Ukraine because Russia is the world’s largest supplier of Class 1 battery-grade nickel, producing around 20% of global supply.” - IEA

“The increase in battery demand drives the demand for critical materials. In 2022, lithium demand exceeded supply (as in 2021) despite the 180% increase in production since 2017. In 2022, about 80% of lithium, 30% of cobalt and 10% of nickel demand was for EV batteries. Just five years earlier, in 2017, these shares were around 15%, 10% and 2%, respectively. As has already been seen for lithium, mining and processing of these critical minerals will need to increase rapidly to support the energy transition, not only for EVs but more broadly to keep up with the pace of demand for clean energy technologies.15 Reducing the need for critical materials will also be important for supply chain sustainability, resilience and security. Accelerating innovation can help, such as through advanced battery technologies requiring smaller quantities of critical minerals, as well as measures to support uptake of vehicle models with optimized battery size and the development of battery recycling.” - IEA

4. Graphite: The Conductive Element

Graphite serves as an anode material in batteries, facilitating the movement of lithium ions. Natural graphite production centers on China, followed by Brazil and Canada. Synthetic graphite is also gaining prominence.

5. Manganese is relevant to electric vehicles primarily due to its use in the production of lithium-ion batteries, which are the most common type of batteries used in EVs. Here are a few reasons that manganese is used in the EV supply chain:

Battery Cathodes: Manganese is a key component of the cathode material used in lithium-ion batteries. In particular, manganese is often used in lithium manganese oxide (LiMn2O4) or lithium nickel manganese cobalt oxide (NMC) cathodes. These cathode materials are chosen for their stability, high energy density, and cost-effectiveness, which are crucial factors in the design and performance of EV batteries.

Improved Safety: Lithium manganese oxide cathodes, in particular, are known for their thermal stability and improved safety characteristics compared to some other cathode materials. This safety feature is highly desirable in EV batteries to reduce the risk of thermal runaway or battery fires in the event of a malfunction or accident.

High Energy Density: Manganese-based cathodes can provide a relatively high energy density, which is essential for extending the driving range of electric vehicles. High energy density batteries can store more energy in a given volume or weight, allowing for longer trips between charges.

Cost Efficiency: Manganese is more abundant and less expensive than some other cathode materials, such as cobalt. This can contribute to cost savings in battery production, which is a significant factor in making EVs more affordable for consumers.

Hybrid and Plug-in Hybrid Vehicles: Manganese-based cathodes are also used in hybrid and plug-in hybrid vehicles, which combine internal combustion engines with electric propulsion. These vehicles benefit from the energy storage capabilities of manganese-based batteries to support electric driving modes.

Recycling: As the EV industry grows, there is a growing interest in recycling materials from end-of-life batteries to reduce waste and environmental impact. Manganese can be recovered and reused from recycled lithium-ion batteries, contributing to sustainability efforts in the EV sector.

It's important to note that not all lithium-ion batteries for EVs use manganese, as different manufacturers may use various cathode chemistries based on factors like performance requirements, cost considerations, and environmental goals. Some batteries may use cathode materials that contain nickel, cobalt, or iron in addition to or instead of manganese, depending on the specific battery design and intended application.

6. Copper is also relevant to electric vehicles in several ways:

Electric Wiring and Conductivity: Copper is an excellent conductor of electricity, which makes it essential for the wiring and electrical components of electric vehicles. Copper wiring is used to transmit electric power from the battery to the various components of an EV, including the electric motor, lights, sensors, and the charging system. Its high conductivity minimizes energy losses during transmission.

Electric Motors: Electric vehicles rely on electric motors for propulsion. These motors often use copper windings to create magnetic fields and generate motion. Copper's high electrical conductivity and thermal conductivity are advantageous for optimizing the efficiency and performance of electric motors in EVs.

Batteries: While the main components of lithium-ion batteries, which are commonly used in electric vehicles, include lithium, cobalt, nickel, and other materials, copper is also used in the battery's conductive components. Copper is used in the current collectors, connectors, and bus bars within the battery pack, ensuring efficient electricity flow within the cells.

Charging Infrastructure: Charging infrastructure for electric vehicles also relies on copper wiring and connectors. Charging stations and cables are made with copper components to efficiently transmit electricity from the grid to the EV's battery.

Thermal Management: Copper is known for its high thermal conductivity. In EVs, copper is used in various thermal management systems to dissipate heat generated by the electric motor and the battery pack. This helps maintain optimal operating temperatures, which is critical for the efficiency and longevity of the vehicle's components.

Electric Vehicle Production: Copper is used in the manufacturing process of electric vehicles. It's used in various parts and components, including wiring harnesses, connectors, and other electrical elements that are integral to the assembly of an electric vehicle.

Recycling: As the electric vehicle industry grows, there is an increasing focus on recycling materials to reduce environmental impact. Copper is a recyclable material, and recycling practices are becoming more critical in the EV industry to recover and reuse copper from end-of-life EV components.

The journey from extraction to EV battery assembly involves a complex supply chain that transcends borders and industries. It's an orchestra of miners, processors, manufacturers, and recyclers working in harmony.

1. Mining and Extraction:

Miners extract raw materials from mines, often using environmentally sensitive methods. Cobalt mining in the DRC has faced scrutiny due to concerns about child labor and unsafe conditions.

“The five key battery materials are lithium, nickel, cobalt, graphite and manganese. Lithium is extracted from two very different sources: brine or hard rock. Lithium brines are concentrated salt water containing high lithium contents and are typically located in the high elevation areas of Bolivia, Argentina and Chile in South America with Chile being the largest producer. Brine deposits often contain large quantities of other useful elements such as sodium, potassium, magnesium and boron which offsets some of the cost of pumping and processing brine. Lithium hard rock (spodumene) is primarily mined in Australia. Novel processes are being developed to extract lithium from unconventional resources such as geothermal brine. Currently, the top-five lithium suppliers account for about half of global lithium production. Major lithium suppliers include a mixture of large chemical and mining companies including: Sociedad Química y Minera de Chile SA (Chile); Pilbara Minerals (Australia); Allkem (Australia); Livent Corporation (United States); and Ganfeng Lithium Co. (China). Unlike for other battery metals, lithium extraction companies tend to be specialized in lithium mining and chemical companies. Nickel is found primarily in two types of deposit – sulfide and laterite. Sulfide deposits are mainly located in Russia, Canada and Australia and tend to contain higher grade nickel. It is more easily processed into Class 1 battery-grade nickel. Laterite, however, tends to contain lower grade nickel and is mainly found in Indonesia, Philippines and New Caledonia. Laterite requires additional energy intensive processing to become battery-grade nickel. Nickel production is less concentrated than lithium with about nine companies supplying half of global nickel production. Key nickel suppliers include: Jinchuan Group (China); BHP Group (Australia); Vale SA (Brazil); Tsingshan (China); Nickel Asia Corporation (Philippines); and Glencore (Switzerland).

Cobalt is predominantly mined as a by-product of copper or nickel mining. Over 70% of cobalt is produced in the Democratic Republic of Congo (DRC) and Glencore (Switzerland) is the largest global producer. Other key cobalt suppliers include: Jinchuan Group (China); CN Molybdenum (China); and Chemaf (DRC). Artisanal and small-scale mining is responsible for 10 – 20% of cobalt production in the DRC.

Graphite is the dominant anode material and can be found naturally or produced synthetically. Natural graphite mining is dominated by China (80%), though global production is becoming more diversified, with many greenfield graphite mining projects being developed including in Tanzania, Mozambique, Canada and Madagascar.

Manganese resources are more widely distributed around the world than the other battery metals and remain available at relatively low cost. There is a general expectation that there will not be an ore shortage in the near term. The leading producers of manganese ore include South Africa, Australia, Gabon and China.” - IEA

2. Refining and Processing:

Raw materials undergo refining and processing to achieve the chemical composition required for batteries. This stage is crucial for ensuring the quality and safety of EV batteries.

“Batteries require high purity materials and therefore high-grade sources, as well as significant refining, is required to reach sufficient quality battery chemical precursors. These refining processes typically involve heavy industrial processes based on heat or chemical treatment (typically pyrometallurgy and/or hydrometallurgy) to refine the raw ore into the usual required chemicals, lithium carbonate or hydroxide, or cobalt and nickel sulfate. Adding complexity, certain raw materials are more or only suitable for the production of battery precursors. For instance, lithium carbonate is produced from lithium brine, which is useful for wider lithium demand, however, unsuitable for use in leading high-nickel Li-ion batteries. Lithium hydroxide is more suitable for high-nickel chemistries and is more easily produced from spodumene hard rock sources. Similarly, battery production typically requires nickel sulfate, typically only synthesized from Class1nickel, which is most economically produced from nickel sulfides. Class 2 nickel can be processed into Class 1 nickel but requires significant additional processing.

New processing technologies, however, are increasing the flexibility of nickel processing routes. These include:

High-pressure acid leaching (HPAL) is a process which is able to produce Class 1 nickel from lower grade laterite resources.

Mixed hydroxide precipitate (MHP), an intermediate product in nickel refining, can be further refined into nickel sulfates at low cost from laterite resources.

Nickel matte (a battery-grade nickel precursor) can be produced from laterite resources, but is more emissions- intensive than conventional production routes.

Raw material processing is highly concentrated. For example, in lithium carbonate and hydroxide production, five major companies are responsible for three-quarters of global production capacity. Often the refining is done by the mining company together with the extraction. For example, Ganfeng, a Chinese mining company, has evolved to include processing and refining lithium and is increasingly focussed on boosting their lithium hydroxide production. In other cases, it is exported to third parties to do the refining, with many processing companies in China, such as Chengxin Lithium Group or Zhejiang Huayou Cobalt. This is particularly the case for Australian spodumene as almost no miners yet produce integrated lithium chemical supply.

While manganese resources are widely distributed, production of high-purity manganese sulfate raises concerns around geographical concentration of supply. China currently accounts for around 90% of the global production capacity, raising the need for new, diversified manganese refining capacity. New manganese sulfate projects are starting to come online in Australia, Europe, Indonesia and the United States.” -IEA

3. Manufacturing Battery Components:

Battery manufacturers like CATL, LG Chem, and Panasonic produce cells using refined materials. The choice of cathode chemistry (NMC, NCA, LFP) influences the mineral mix.

“Batteries are composed of several highly specialized components including cathode and anode materials, electrolytes and separators. These components require advanced materials chemistry and engineering for their production. The most complex processing is required to form the battery active materials from the high purity chemicals produced from raw material processing, such as lithium hydroxide and nickel sulfate. These materials are further processed using specialized syntheses to produce active materials for the cathode and anode. The leading cathode active materials for Li-ion are transition metal oxides including lithium cobalt oxide, lithium nickel manganese cobalt oxide (NMC), lithium nickel cobalt aluminum oxide (NCA) and lithium iron phosphate (LFP). Seven companies are responsible for 55% of global cathode material production capacity. Key players include: Sumitomo (Japan); Tianjin B&M Science and Technology (China); Shenzhen Dynanonic (China); and Ningbo Shanshan (China).

The dominant anode active material is graphite which can be natural or synthetic. Producing graphite anode materials is more mature and established than cathode material production given graphite has been the dominant anode for a long time, though both graphite types require sophisticated processing. Flake natural graphite is used in batteries and is processed into spherical graphite to be more homogenous for use as anode material. Synthetic graphite is produced from refining hydrocarbon materials such as coke. To improve graphite anode performance, small and increasing fractions of silicon are being added to the graphite anode to increase energy density. Anode material production is even more highly concentrated with four companies responsible for half of global production capacity. The largest players include: Ningbo Shanshan (China); BTR New Energy Materials (China); and Shanghai Putailai New Energy Technology (China). The top-six companies are all Chinese and account for two-thirds of global production capacity.

Separators are engineered microporous membranes, typically made of polyethylene or polypropylene and often ceramic coated for improved safety for EVs. Separator production is also concentrated with five companies responsible for half of the global production capacity. Key players include: Zhuhai Enjie New Material Technology (China); Shanghai Putailai New Energy Technology (China); and SK IE Technology (Korea). Electrolytes are made of a salt and solvent and both require synthesis and then mixing. Jiangxi Tinci Central Advanced Materials in China alone produces 35% of global electrolyte salt. The top electrolyte producing companies include: Zhangjiagang Guotai-Huarong New Chemical Materials (China); Shenzhen Capchem Technology (China); and Ningbo Shanshan (China). Most companies that engage in cell component manufacturing are highly specialized and only produce those components.” - IEA

4. Automotive Assembly:

Automakers incorporate batteries into vehicles, with EV manufacturing differing significantly from traditional assembly lines. Battery packs influence vehicle design, safety, and performance.

5. End-of-Life Recycling:

As EVs proliferate, end-of-life recycling becomes vital. Efficient recycling can recover valuable materials like cobalt, nickel, and lithium, reducing the industry's environmental footprint.

Supply Chain Challenges and Future Trends

The EV supply chain isn't without challenges. Geopolitical tensions, ethical concerns, and supply constraints can disrupt material availability. However, the industry is actively addressing these issues through innovation, sustainable practices, and diversification of supply sources.

1. Sustainable Sourcing:

Industry stakeholders are focusing on ethical sourcing and minimizing the environmental impact of mining and extraction processes.

2. Technology Advancements:

The pursuit of solid-state batteries, reduced cobalt chemistries, and improved recycling methods is reshaping the materials landscape.

3. Diversification:

Strategic partnerships and investments in resource-rich regions aim to diversify material sources and reduce dependency on single suppliers.

The EV revolution rests on a complex yet interconnected network of raw material suppliers, processors, manufacturers, and innovators. Understanding this intricate web is essential for investors, policymakers, and enthusiasts alike as we navigate the electrified future.

Relevant Companies:

Lithium: Albemarle Corporation, SQM (Sociedad Química y Minera de Chile)

Cobalt: Glencore plc, China Molybdenum Co., Ltd.

Nickel: PT Vale Indonesia Tbk, Norilsk Nickel

Graphite: Syrah Resources Limited, China National Building Material Group Corporation (Sinosteel Corporation)

Battery Manufacturers:

Contemporary Amperex Technology Co. Ltd. (CATL)

LG Chem

Panasonic Corporation

Samsung SDI Co., Ltd.

SK Innovation

Automakers:

Tesla, Inc.

General Motors

Volkswagen Group

BMW Group

Nissan Motor Corporation

Ford Motor Company

Hyundai Motor Group

Rivian Automotive, Inc

Battery Manufacturing

At the core of every electric vehicle lies a sophisticated energy storage system designed to provide the required range and performance. Lithium-ion batteries, the dominant technology, have transformed the automotive landscape due to their high energy density, longevity, and relatively lightweight nature.

1. Raw Material Sourcing and Refinement:

The journey commences with sourcing crucial materials like lithium, cobalt, nickel, and graphite from mines across the world. These raw materials undergo refining processes to attain the required purity and composition, ensuring the battery's optimal performance and safety.

2. Electrode Preparation:

The battery's electrodes are prepared by coating thin sheets of copper or aluminum foil with active materials. The anode is coated with a layer of graphite, while the cathode is coated with materials like lithium cobalt oxide (LiCoO2), lithium iron phosphate (LiFePO4), or lithium nickel cobalt manganese oxide (NMC).

3. Cell Assembly:

Cell assembly involves layering the anode, separator, and cathode, followed by winding or stacking these layers to form the cell. A separator prevents direct contact between the anode and cathode, preventing short circuits. An electrolyte is added to enable ion movement.

“Producing the battery cells is a multi-step process with two broad stages: electrode manufacturing and cell fabrication. Though cell manufacturers have different cell designs, the cell manufacturing processes are similar, use mature technologies and are well established. These processes are energy intensive, being conducted in highly controlled clean and dry room conditions to avoid any impurities and moisture. Using low-carbon sources of electricity is key to reducing emissions in cell production. First electrodes are produced by mixing cathode or anode active materials with a binder, solvent and additives before coating on aluminum (cathode) or copper (anode) foil current collectors. The electrodes are rolled (calendared) and subsequently dried. The cell is then created by stacking the electrodes with a separator in between.

Manufacture of the battery pack may be completed either by the cell manufacturer or by the automaker. Cells are first housed together in module frames, then the battery pack is assembled through integration of modules, the battery management system, electronics and sensors, all encased in a final housing structure.

Battery cell production is a capital-intensive process and production is highly concentrated, with the top-three producers in 2021, CATL (China), LG Energy Solution (Korea), and Panasonic (Japan), accounting for 65% of global production. Cell manufacturers from Japan and Korea tend to be established conglomerates having decades of experience making batteries for consumer electronics. There are also Chinese companies that began producing batteries for consumer electronics in the 1990s and then specialized in batteries for EVs such as CATL and BYD. A third wave of new battery makers is taking shape in Europe and North America, but today they are mostly in planning or upscaling stages. With recent supply chain strains many battery makers and automakers are becoming increasingly involved in the mining and processing of critical minerals to ensure access to production; Tesla, CATL and LG Energy Solution have all become directly involved in upstream stages.” -IEA

4. Formation and Testing:

The cells undergo a formation process to stabilize their performance. Rigorous testing ensures quality and safety standards are met. Faulty cells are discarded, maintaining the integrity of the battery pack.

5. Battery Pack Assembly:

Battery packs are assembled by connecting multiple cells in series and parallel configurations. The pack includes cooling systems, electronics for monitoring and balancing, and safety mechanisms to prevent overcharging or overheating.

6. Integration into EVs:

Automakers incorporate battery packs into vehicle architectures, impacting vehicle design, weight distribution, and overall performance. The pack's placement and integration are crucial for safety and efficiency.

Battery manufacturing isn't without challenges, but innovative solutions are driving progress:

1. Scale and Efficiency:

Meeting the growing demand for EVs requires scaling up production while maintaining efficiency and quality.

2. Sustainable Sourcing:

Industry stakeholders are actively seeking sustainable and ethical sourcing of battery materials, aiming to reduce environmental and social impacts.

3. Solid-State Batteries:

Solid-state batteries promise improved energy density, safety, and longevity, with potential to reshape the battery landscape.

4. Recycling and Second Life:

Developments in recycling technologies aim to recover valuable materials from used batteries, reducing waste and environmental impact.

5. Innovations in Chemistry:

Advancements in battery chemistries, such as high-nickel cathodes, are pushing the boundaries of energy density and cycle life. Solid State batteries are also an interesting trend that we explore a bit more below.

Global Players in Battery Manufacturing

Several companies lead the charge in battery manufacturing, each contributing to the evolution of EV technology:

Contemporary Amperex Technology Co. Ltd. (CATL): A Chinese giant renowned for its lithium-ion battery prowess and collaborations with major automakers.

LG Chem: A South Korean company with a significant presence in the EV battery market, supplying to global automakers.

Panasonic Corporation: Known for its partnership with Tesla, Panasonic is a key player in supplying batteries for electric vehicles.

Samsung SDI Co., Ltd.: Samsung's battery division is actively shaping battery technology with innovations and collaborations.

SK Innovation: A South Korean company involved in the production of EV batteries and development of next-generation battery technologies.

Looking to the Future of Batteries

Over the summer, Samsung announced that they had completed construction of a pilot plant for solid state batteries and plans to complete a prototype in the second half of the year. Solid state batteries are sort of a “dream battery” because of their high energy density and safety. Samsung has a goal for these batteries to be able to go almost 500 miles on a single charge and to be able to be charged over 1000 times in their life cycle, they have a target to commercialize these solid state batteries by 2027. Toyota has also been working on similar technology, hoping to to reduce the number of processes that is required to make battery materials so that they can make solid state batteries at a similar or even lower cost than liquid based lithium ion batteries. Inevitably, the winners in this space will be able to harness chemistry to optimize the energy density, power, number of cycles and cost of the battery as well as its form factor. This is a space that is certainly worth watching and a possible topic for us to explore in a future in depth piece. The intersection of physical inevitabilities and financial market realities is where we hope to provide value from a research perspective.

Silicon Carbide

Earlier this year, Tesla sent shockwaves through the silicon carbide industry by announcing they planned to use 75% less silicon carbide in future power modules. While it sounds severe (and sends the stocks of SiC companies tumbling), it is likely that silicon carbide will remain relevant to the automotive market in at least the short to mid term, due to it being the best material for high power and high voltage devices.

Why is Silicon Carbide relevant to electric vehicles?

1. Power Electronics: SiC is a wide-bandgap semiconductor material that has superior electrical properties compared to traditional silicon (Si) used in power electronics. SiC-based power electronics components, such as diodes and transistors, can operate at higher temperatures, voltages, and frequencies while minimizing energy losses. This leads to more efficient power conversion in EVs, which can increase overall vehicle efficiency and extend battery range.

2. Energy Efficiency: The use of SiC power electronics can significantly improve the energy efficiency of EVs. They reduce switching losses and conduction losses in electronic components, resulting in less heat generation and more power being delivered to the vehicle's electric motor. As a result, the vehicle requires less energy to perform the same tasks, which can increase the driving range on a single battery charge.

3. Faster Charging: SiC-based power electronics can enable faster charging of EVs. These components can handle higher power levels and operate efficiently at higher frequencies, allowing for rapid battery charging without excessive heat generation. Fast-charging stations using SiC technology can deliver more power to the EV's battery, reducing charging times.

4. Lighter and Smaller Components: SiC devices are smaller and lighter than their silicon counterparts for the same power rating. This is especially beneficial for EVs, as it can lead to weight reduction and space savings, which can be used for other components or increase passenger and cargo space.

5. Extended Battery Life: SiC power electronics can help extend the life of EV batteries. The improved efficiency and reduced heat generation mean that the battery operates under less stress during charging and discharging cycles, which can slow down degradation and increase the overall lifespan of the battery pack.

6. Regenerative Braking: SiC-based power electronics can enhance regenerative braking systems in EVs. These systems capture and store energy when the vehicle decelerates or brakes, which can then be used to recharge the battery. SiC components can improve the efficiency of this energy conversion process, maximizing the energy recovered during braking.

7. Thermal Management: SiC's ability to operate at higher temperatures with lower losses reduces the demand for complex and heavy thermal management systems. This can lead to more compact and lightweight EV designs, as well as cost savings in the production of cooling systems.

In summary, SiC plays a crucial role in improving the performance, efficiency, and range of electric vehicles by enabling more efficient power electronics and faster charging, reducing heat generation, and contributing to overall system optimization.

Tesla in particular has been laser focused on making its entry level vehicles more accessible and for all it’s benefits, SiC is an expensive material. Tesla may be exploring ways “to stretch the performance of the SiC substrate through more advanced system designs and higher integration. While it is unlikely that a single technology could decrease SiC by 75%, a variety of advances in packaging, cooling (i.e. double sided and liquid cooling), and trench device structure could enable more compact, better-performing devices. Tesla will no doubt be exploring such opportunities, and the 75% figure could refer to a highly integrated inverter design that reduces its use of die from 48 to 12. However, if this were to be the case, it would not equate to such an aggressive reduction in SiC material as has been suggested, because each die would need to be larger in size to handle higher powers.

Meanwhile, other OEMs who are releasing 800V vehicles in 2023-24 will still rely on SiC, which is the best candidate in this space for high-power and high voltage-rating devices. Therefore, there will likely be no short-term impacts on SiC penetration for OEMs.” (Yole Intelligence)

Also from Yole -

“While the push towards higher integration will result in minimal impact on the device market, there could be an impact on wafer shipments. Despite not being as dramatic as many initially thought, each scenario predicts a decrease in SiC demand, which could impact semiconductor companies.

However, this could increase the supply of material to other markets that have been growing alongside the automotive market in the last five years. The automotive market was and is the main driver of SiC and will retain its large market share going forwards (Yole Intelligence predicts the sector to reach $8 billion by 2028), but the industrial, energy (driven by renewables) and transport (high voltage) sectors are all expected to grow significantly in the next few years – which will all but be helped by lower costs and more access to supply of material.”

Vehicle Assembly

Next we’ll discuss the many steps involved in assembling electric vehicles, focusing on the integration of battery packs, electric motors, and other EV-specific components that define the driving experience of the future.

1. Battery Pack Integration:

The journey begins with the integration of the heart of the EV – the battery pack. The battery, comprising numerous cells, is placed within a structurally designed enclosure that ensures safety, cooling, and optimal weight distribution. This step requires meticulous engineering to determine the ideal placement, protecting the battery while minimizing its impact on the vehicle's center of gravity.

“The battery pack is integrated into the EV by the automakers, where it is connected with the electric motor, on-board charger module, high voltage distribution box, electric transmission and thermal systems, depending on the vehicle architecture. Automakers focussing only on EVs must develop greenfield factories, while for incumbent automakers pre-existing vehicle assembly factories can be retooled and repurposed for EV production. EV manufacturing is currently concentrated in a small number of OEMs, with the top-six companies responsible for 52% of production in 2021. This is a slight decrease from 2020 where the top-six were responsible for 55%. The three largest producers, Tesla (United States), VW Group (Germany) and BYD (China), accounted for a third of EV production in 2021. The rapid growth of BYD has been particularly impressive, it was not even among the top-six producers in 2020, but ranked as the third-largest producer of EVs in 2021.” - IEA

2. Electric Motor Integration:

Electric vehicles derive their power from electric motors, which replace traditional internal combustion engines. The integration of the electric motor involves precise positioning within the vehicle's chassis to ensure efficient power delivery and drivability. Depending on the vehicle's design, the motor might be placed in the front, rear, or even on each axle for all-wheel drive configurations.

3. Power Electronics and Inverters:

Power electronics play a crucial role in controlling and optimizing the flow of electricity between the battery, motor, and other vehicle systems. Inverters convert direct current (DC) from the battery to alternating current (AC) for the motor. These components are carefully integrated to ensure seamless communication and energy management.

4. Thermal Management Systems:

Electric vehicles rely on effective thermal management systems to regulate temperatures within the battery, motor, and power electronics. Liquid or air cooling systems prevent overheating, ensuring the longevity and performance of critical components.

5. Chassis Integration:

The vehicle's chassis, or structural frame, provides the foundation for the entire assembly. EV-specific chassis designs accommodate the unique weight distribution, incorporating reinforced sections to support the battery and ensure rigidity.

6. Wiring and Electronics:

The intricate web of wiring and electronics connects all components, facilitating communication between the battery, motor, sensors, and various vehicle systems. Electric vehicles require sophisticated electronic architectures to manage power flow, charging, regenerative braking, and other functions.

7. Interior and User Experience:

Interior assembly involves incorporating EV-specific features such as advanced infotainment systems, digital instrument clusters, and energy usage displays. Attention to detail is crucial to enhance the user experience and align with the vehicle's eco-friendly ethos.

8. Safety and Quality Checks:

Rigorous safety and quality checks are conducted at various stages of assembly to ensure the vehicle meets regulatory standards and performance expectations. These checks encompass everything from crash tests to functional assessments of the powertrain and electronics.

9. Final Testing and Quality Assurance:

Before an electric vehicle leaves the assembly line, it undergoes comprehensive testing to verify its performance, safety features, and battery health. Functional and performance tests assess acceleration, braking, energy consumption, and more.

The assembly of electric vehicles presents unique opportunities and challenges:

1. Integration Expertise:

Integrating complex electric powertrains requires specialized engineering expertise, particularly in terms of thermal management and electronic architecture.

2. Battery Safety:

Ensuring the safe integration and protection of high-voltage battery systems is paramount for EVs' success.

3. Lightweight Materials:

Electric vehicles often employ lightweight materials to offset the weight of the battery, further requiring advanced assembly techniques.

4. Enhanced User Experience:

EVs offer an array of digital features that require seamless integration for an intuitive and enjoyable user experience.

Tier 1 Suppliers

Tier 1 suppliers hold a pivotal role in the EV ecosystem, responsible for delivering advanced solutions that define the performance, efficiency, and user experience of electric vehicles. These suppliers possess the expertise to design, engineer, and manufacture complex components that propel EVs into the future.

1. Electric Drivetrains:

The heart of an electric vehicle, the electric drivetrain, includes components like electric motors, power electronics, and transmission systems. Tier 1 suppliers design and produce these integrated systems that govern power delivery, torque, and energy efficiency, shaping the driving experience.

Leading Tier 1 Suppliers:

BorgWarner Inc.

Aisin Seiki Co., Ltd.

Magna International Inc.

Siemens AG

2. Battery Systems:

Tier 1 suppliers play a critical role in crafting battery systems that define the range, charging speed, and longevity of electric vehicles. These systems include battery packs, thermal management solutions, and energy management systems.

Leading Tier 1 Suppliers:

LG Chem

CATL (Contemporary Amperex Technology Co. Ltd.)

Panasonic Corporation

Samsung SDI Co., Ltd.

3. Charging Systems and Infrastructure:

As EV adoption rises, charging systems and infrastructure become essential. Tier 1 suppliers contribute to charging solutions, including hardware, software, and network management systems that enable efficient and rapid charging.

Leading Tier 1 Suppliers:

ABB Ltd.

Siemens AG

Schneider Electric SE

ChargePoint, Inc.

4. Electronics and Connectivity:

Electric vehicles rely heavily on advanced electronics and connectivity solutions to manage power distribution, energy flow, and communication between various vehicle systems.

Leading Tier 1 Suppliers:

Delphi Technologies (Aptiv PLC)

Continental AG

Infineon Technologies AG

Bosch Automotive Solutions

5. Infotainment and User Experience:

Tier 1 suppliers contribute to the user experience by developing infotainment systems, touchscreen interfaces, advanced driver assistance systems (ADAS), and connected vehicle technologies.

Leading Tier 1 Suppliers:

Harman International Industries, Inc. (a Samsung company)

Panasonic Corporation

Visteon Corporation

Denso Corporation

6. Lightweight Materials and Components:

Given the focus on efficiency, Tier 1 suppliers contribute lightweight materials, such as advanced composites and aluminum, to reduce vehicle weight and improve energy efficiency.

Leading Tier 1 Suppliers:

Magna International Inc.

Novelis Inc.

Toray Industries, Inc.

SGL Carbon SE

Tier 1 suppliers encounter several challenges while striving for excellence:

1. Innovation Pace:

Keeping up with rapid advancements in EV technology demands continuous innovation in design, materials, and manufacturing processes.

2. Scalability and Supply Chain:

As demand for electric vehicles increases, Tier 1 suppliers must ensure the scalability and resilience of their supply chains to meet production targets.

3. Collaboration and Compatibility:

Components from different Tier 1 suppliers must seamlessly integrate to ensure the vehicle's overall functionality and performance.

4. Regulatory Compliance:

Meeting global safety and emissions regulations poses challenges in the design and production of electric vehicle components.

Tier 1 suppliers are the architects of the electric vehicle renaissance, driving innovation through their specialized components that power, connect, and enhance electric vehicles. As the EV landscape evolves, these suppliers will continue to redefine the driving experience, pushing the boundaries of technology and sustainability.

Tier 2 & 3 Suppliers

While Tier 1 suppliers take the spotlight, Tier 2 and Tier 3 suppliers are the backbone of the electric vehicle ecosystem. They specialize in delivering a wide range of components, each contributing to the seamless functioning of EVs' complex systems. From intricate sensors to resilient materials, these suppliers leave an indelible mark on electric mobility.

1. Components for Electric Drivetrains:

Tier 2 and Tier 3 suppliers contribute to the drivetrain ecosystem by providing motors, inverters, and power electronics components. These players craft specialized parts that optimize energy conversion, enhancing overall efficiency and performance.

2. Battery Components and Materials:

Beyond the battery pack itself, suppliers at these tiers provide materials for anode and cathode electrodes, separators, electrolytes, and thermal management solutions. Their innovations shape battery chemistry and longevity.

3. Wiring and Connectors:

The complex network of wiring and connectors that interconnects various systems relies on components supplied by Tier 2 and Tier 3 suppliers. Their contributions ensure reliable communication and power distribution throughout the vehicle.

4. Thermal Management and Cooling Solutions:

Efficient thermal management is crucial for the safe and optimal operation of EVs. These suppliers deliver cooling systems, heat exchangers, and advanced materials to regulate temperature and prevent overheating.

5. Interior and Comfort Systems:

Tier 2 and Tier 3 suppliers provide interior components such as seats, dashboard components, infotainment systems, climate control systems, and interior lighting that enhance the driver and passenger experience.

6. Safety and Driver Assistance Systems:

Suppliers at these tiers contribute to advanced driver assistance systems (ADAS), sensors, cameras, LiDAR, and radar components that enable features like adaptive cruise control and lane-keeping assistance.

7. Suspension and Chassis Components:

Steering systems, suspension components, shock absorbers, and chassis components are sourced from Tier 2 and Tier 3 suppliers. These components influence ride comfort and handling.

8. Exterior Body Components:

From panels to lighting systems, Tier 2 and Tier 3 suppliers provide the exterior components that shape the vehicle's aesthetics, aerodynamics, and visibility.

Tier 2 and Tier 3 suppliers encounter distinct challenges and innovations:

1. Customization and Diversification:

The diverse needs of EV manufacturers demand flexible and customizable solutions, requiring suppliers to offer a wide range of components.

2. Quality Control and Standards:

Ensuring high-quality components that meet stringent automotive standards is paramount for maintaining safety and performance.

3. Innovation and Collaboration:

Tier 2 and Tier 3 suppliers need to stay abreast of technological advancements and collaborate closely with Tier 1 suppliers to ensure seamless integration.

4. Sustainability and Efficiency:

Suppliers are increasingly focusing on sustainable materials and manufacturing processes to align with the environmental ethos of electric mobility.

The evolution of electric vehicles relies heavily on the intricate contributions of Tier 2 and Tier 3 suppliers. Their specialized components, systems, and sub-assemblies are the unsung heroes that enable the electric revolution to flourish.

Acknowledging the pivotal role played by these suppliers in creating a cohesive ecosystem unveils the complex interplay between innovation, collaboration, and dedication. As the electric mobility landscape advances, Tier 2 and Tier 3 suppliers remain the silent architects of the transformation, shaping the vehicles that are propelling us into a sustainable and electrifying future.

Distribution and Logistics

The journey of an electric vehicle doesn't conclude on the assembly floor; it's a continuation, orchestrated by the intricate web of distribution and logistics. The seamless movement of components, sub-assemblies, and completed vehicles from suppliers to dealerships is a harmonious symphony that demands precision, adaptability, and sustainability.

1. Parts and Component Logistics:

The EV supply chain begins with the movement of components and parts from Tier 1, Tier 2, and Tier 3 suppliers to the assembly plants. This process involves efficient sourcing, inventory management, and just-in-time delivery to minimize storage costs and ensure timely availability.

2. Vehicle Distribution:

Once assembled, electric vehicles are transported to dealerships or directly to customers. The distribution process requires meticulous planning to optimize routes, ensure on-time delivery, and maintain the quality and integrity of the vehicles during transit.

3. Challenges and Innovations:

a. Charging Infrastructure for Transport:

EVs often need to be transported over long distances, necessitating charging infrastructure along routes to maintain optimal battery levels. The establishment of charging stations at distribution centers and along transportation routes is a key innovation.

b. Range Considerations:

Balancing the range capabilities of electric vehicles with transportation distances is crucial. Innovations include route optimization to minimize stops and maximize distance covered within a single charge.

c. Vehicle Loading and Unloading:

Ensuring safe loading and unloading of EVs requires specialized equipment and training due to the unique characteristics of electric vehicles, such as high-voltage systems.

d. Supply Chain Visibility:

Real-time tracking and monitoring technologies provide supply chain stakeholders with visibility into the status and location of vehicles during transportation, enhancing efficiency and accountability.

e. Last-Mile Delivery:

For urban areas, the challenge lies in last-mile delivery to dealerships or customers' doorsteps. Electric delivery vehicles are emerging as an eco-friendly solution, aligning with the ethos of electric mobility.

f. Regulatory Compliance and Customs:

Navigating international borders requires compliance with various regulations and customs procedures. Innovations in digital documentation and tracking streamline these processes.

4. Sustainable Logistics:

a. Green Transport Solutions:

Promoting sustainability in logistics involves adopting electric or hydrogen-powered trucks for transportation, reducing emissions and the carbon footprint.

b. Multimodal Transport:

Combining various modes of transportation, such as rail and sea, can reduce the environmental impact of long-distance vehicle transport.

c. Collaboration and Consolidation:

Collaboration among manufacturers, logistics providers, and transport companies can lead to consolidated shipments and optimized routes, reducing waste and emissions.

d. Packaging and Recycling:

Sustainable packaging and recycling practices minimize waste and contribute to the circular economy by repurposing materials.

Charging Infrastructure

The electrification of transportation hinges on the availability and reliability of charging infrastructure. This network serves as the lifeblood of electric mobility, enabling EV owners to recharge their vehicles conveniently and efficiently. The landscape of EV charging infrastructure encompasses various types and levels of chargers, each catering to diverse user needs.

1. Types of Charging Infrastructure:

a. Level 1 Charging (Residential Charging):

Level 1 charging involves plugging an EV into a standard household electrical outlet. While it's the slowest charging option, it's ideal for overnight charging at home, providing about 3-5 miles of range per hour of charging.

b. Level 2 Charging (Residential and Public Charging):

Level 2 charging stations deliver power at a faster rate, typically through a dedicated charging unit installed at homes or public locations. This option provides approximately 10-20 miles of range per hour of charging.

c. DC Fast Charging (Public Charging):

DC fast charging, or Level 3 charging, is the most rapid option available. It's commonly found at public charging stations and offers high-power charging, delivering 60-80 miles of range in just 20 minutes.

2. Importance of Charging Infrastructure:

a. Range Anxiety Mitigation:

A widespread charging network alleviates range anxiety by assuring drivers of available charging options during long journeys.

b. Encouraging Adoption:

An extensive and reliable charging infrastructure incentivizes potential EV buyers, knowing that charging won't be a hindrance to their daily routines.

c. Sustainable Transportation:

Charging infrastructure complements the environmental benefits of EVs by relying on renewable energy sources, reducing emissions, and supporting the transition to clean energy.

3. Challenges and Innovations:

a. Infrastructure Investment:

Setting up charging infrastructure demands significant investment in terms of capital and installation.

b. Charging Speed and Convenience:

Innovations are focused on faster charging technologies, battery technology advancements, and enhancing user experience through app-based charging information and remote management.

c. Grid Capacity and Stability:

Rapid adoption of EVs could strain the power grid. Smart charging solutions that manage load distribution and time-of-use pricing are being explored to optimize grid stability.

d. Urban and Rural Accessibility:

Balancing the distribution of charging stations in urban centers and rural areas is essential for comprehensive EV adoption.

e. Interoperability and Standardization:

Creating uniform standards for charging connectors, payment systems, and access methods ensures a seamless experience for all EV owners.

4. Innovations and Future Prospects:

a. Ultra-Fast Charging:

Research is ongoing to develop ultra-fast charging technologies that could provide hundreds of miles of range within minutes.

b. Wireless Charging:

Inductive and wireless charging technologies aim to eliminate the need for physical cables, enabling effortless charging.

c. V2G (Vehicle-to-Grid) Integration:

V2G technology enables EVs to return energy to the grid, contributing to grid stability and providing an additional revenue stream for EV owners.

d. Charging Integration with Renewable Energy:

Combining charging stations with solar panels and energy storage systems can offer sustainable and grid-independent charging solutions.

The electrified future hinges on the transformative power of charging infrastructure. This intricate network has the potential to reshape transportation, making EVs a viable choice for drivers across the globe. From residential to public charging stations, and from fast chargers to wireless solutions, the innovation in EV charging infrastructure underscores the dynamic journey towards sustainable mobility.

After Sales Support

The shift to electric vehicles demands a new paradigm of after-sales support that caters to the unique needs of EV owners. This support covers a spectrum of services, from routine maintenance to addressing technical concerns, ensuring a seamless and satisfying ownership journey. This stage is crucial for many reasons but especially for inspiring customer satisfaction and loyalty.

1. The Significance of After-Sales Support:

a. Range of Services:

After-sales support encompasses a wide array of services, including regular maintenance, battery health checks, software updates, repairs, and technical assistance.

b. Building Consumer Confidence:

Comprehensive after-sales support instills confidence in consumers, reassuring them that their EV ownership experience will be well-supported.

c. Customer Loyalty and Brand Reputation:

Providing excellent after-sales support fosters customer loyalty, contributing to positive word-of-mouth and enhancing the reputation of EV manufacturers.

2. Challenges and Innovations:

a. Specialized Training:

Service technicians need specialized training to diagnose and repair electric vehicle components, including high-voltage systems.

b. Battery Health Management:

Developing effective strategies for battery health management is crucial to prolong the lifespan of EVs and maintain optimal performance.

c. Charging and Infrastructure Support:

Helping EV owners navigate charging options, install home charging stations, and troubleshoot charging-related issues is essential.

d. Remote Diagnostics and Telematics:

Innovations in remote diagnostics and telematics enable proactive monitoring of vehicle health and identifying potential issues before they escalate.

e. Spare Parts Availability:

Ensuring the availability of genuine spare parts is vital for timely repairs and maintenance.

3. Innovations and Future Prospects:

a. Predictive Maintenance:

Using data analytics and AI, manufacturers can predict maintenance needs, optimizing scheduling and reducing downtime.

b. Mobile Service Units:

Mobile service units equipped to handle routine maintenance and minor repairs at the customer's location enhance convenience.

c. Augmented Reality Support:

AR technology can assist technicians in diagnosing and repairing complex issues by providing real-time visual guidance.

d. Over-the-Air Updates:

Software updates sent directly to the vehicle enable continuous improvement and new feature introduction without requiring a visit to the service center.

e. Enhanced Customer Engagement:

Manufacturers are using digital platforms to engage with customers, providing them with information, tips, and support throughout their ownership journey.

After-sales support is the bridge between innovation and ownership in the electric vehicle realm. The seamless integration of maintenance, technical assistance, and innovative solutions plays a pivotal role in driving the EV revolution forward.

Government Incentives for EVs

Increasingly, policy across the world is aiming to boost the manufacturing of electric vehicles, not just their deployment. Governments are finding various ways to support the entire supply chain for EVs, as the efforts are seen as a “win win” by furthering sustainability goals in line with net zero by 2050 (or a comparable emissions target) and boosting domestic economic production.

In China (the largest market for electric cars) support for the EV industry has been going on for some time. Over the past ten years the Chinese Government has made various efforts on both the supply and demand side to support domestic companies as well as engaging in joint ventures with international automobile companies. Support has been particularly stimulative at the local level which has led to the development of some major EV companies growing and succeeding in China. Individual regions have also set targets for EV goals, for instance Chongqing has a goal of producing and selling more than 10% of China’s new energy vehicles and Jilin is aiming for an annual production capacity of 1 million EVs a year by 2025. Goals that are supported by the Chinese Government’s investment plans.

In the United States, the Inflation Reduction Act (which was passed in August 2022) included tax incentives and various funding programs for clean energy initiatives. Overall, there was $369B designated for climate investments. The Clean Vehicle Tax Credit makes some changes to current EV incentive programs. It states that starting in 2023, the final assembly of the electric vehicle must occur in North America, and that vehicles must have a 7 kWh battery or greater (to exclude low-range plug-in hybrid electric vehicles [PHEVs]), be under 6.35 t gross vehicle weight (GVW), and have a suggested retail price of less than $80k for vans, SUVs and pickup trucks, or $55k for other vehicles. In order to qualify for the incentive, the EV buyer’s household income must be below the limit set by the US Internal Revenue Service. These conditions open eligibility for an incentive of up to $7500 per vehicle: $3750 if the battery meets the critical mineral requirement, and another $3750 if it meets the component requirement. Furthermore, from 2025, vehicles with any critical minerals from “foreign entities of concern” will not be eligible for the credit, and vehicles with battery components from such entities will be ineligible from 2024.This critical mineral requirement stipulates that: 1) in 2023, 40% or more of the battery critical minerals must be extracted or processed in the United States or a US free trade country, or have been recycled in North America, gradually increasing to 80% in 2027 and beyond; and 2) in 2023, 50% of the value of the components in the battery must be manufactured or assembled in North America, gradually increasing to 100% in 2029 and beyond. (Data from the IEA)

The update also removed the sales cap of 200k, which allows General Motors and Tesla to participate in the program. The average listed price of the models registered for the program is just below the $55k and $80k limits for cars and SUVs respectively, indicating the manufacturers intent to participate in the program even if it means cutting prices. There is also an additional $1B for heavy duty vehicles. The Inflation Reduction Act also contains supply side tax credits for advanced manufacturing, providing subsidies for domestic battery manufacturing of up to $35 per kWh and another $10/kWh for model assembly. With average battery prices in 2022 around $150/kWh, these subsidies may account for almost a third of battery prices. Also, in January of this year, the United States signed a memorandum of understanding with The Democratic Republic of Congo and Zambia, with a commitment to develop a productive supply chain for electric vehicles from mining to assembly.

As far as efforts in Europe go, in February 2023, “the European Union presented the Green Deal Industrial Plan, which has four pillars related to progress on net zero-related projects: faster permitting, financial support, enhanced skills, and open trade. The plan also includes provision for the creation of a Critical Raw Materials Act, the proposal for which was issued in March 2023, with a focus on security of supply, extraction and environmental standards, as well as recycling.

The faster permitting for facilities, including battery production, will be formalized via the proposed Net Zero Industry Act, providing simplified and predictable planning approvals. As well as loosening rules on state aid until 2025, the financial support package of the plan attempts to allow faster access to essential subsidies and loans, to compensate businesses for high energy prices, to help ensure liquidity, and to reduce electricity demand. The plan also aims to reskill workers affected by the green transition, and to establish Net Zero Industry Academies. Lastly, the trade element focuses on improving the resilience of the EU’s supply chains, opening trade with new partners and attracting private investment.

In March 2023, the European Union proposed the Net Zero Industry Act, which aims to meet 40% of the European Union’s needs for strategic net zero technologies with EU manufacturing capacity by 2030. These technologies explicitly include battery and storage technologies, and for batteries the aim is for nearly 90% of the European Union’s annual battery demand to be met by EU battery manufacturers, with a combined manufacturing capacity of at least 550 GWh in 2030, in line with the objectives of the European Battery Alliance. These announcements came just as CO2 standards for car sales over 2030-2035 tightened under the Fit for 55 package.” - IEA

There are efforts from countries all across the world to put forth similar government programs to increasingly incentivize the development and production of electric vehicles, as well as secure their supply chains for the critical minerals required for production. For brevity sake we only highlighted the efforts of China, Europe and the US here, but lots of other countries across the globe are creating their own fiscal programs to stimulate electric vehicle initiatives.

Conclusion: Navigating the Electric Road Ahead

In the search for the inevitable, in both technology and financial markets, it’s hard to find a trend that has as many concurrent tailwinds as electric vehicles. If you were to say “inevitably, there will be a much larger number of EVs on the road in 5-10 years” it would be difficult to debate that statement. There are of course concerns, a main one for consumers (particularly in the US) is the range that EVs can travel on one charge and how long it takes to charge the vehicle. However, with investment from the entire automotive industry (as they attempt to catch up to Tesla’s massive lead in the space) and serious fiscal programs designed to support the industry with subsidies and tax incentives amongst other benefit, it is hard to imagine the industry not experiencing strong secular growth, at least in the near to mid term horizons. This overview was meant as a general primer to the electric vehicle supply chain, and was written as I conducted research in my own “search for the inevitable.” From the mining of the critical materials (this process seems to be inherently inflationary and is evident by looking at price charts of the minerals) to their refining and eventual assembly, the supply chain for electric vehicles is certainly complex, but is also a battleground that is sure to contain some great investments for those who can do the work to uncover what companies stand to be the largest beneficiaries of all the committed investment capacity, both from industry and the government. There is also the question of some second order effects in the future that are definitely worth exploring - what % of EVs vs ICE (internal combustion engine) vehicles wi there be when EVs reach 100% in some markets? What will the long term impact of self driving EVs be? Right now, utilization of cars is relatively low but this may change as autonomous driving becomes increasingly common. This may have an impact on oil markets and also things like parking garages. Also, how does the electric grid need to evolve in order to handle EV charging at scale? What is the resale value of EVs? What does the distribution look like in terms of consumers buying an EV for their first car vs their second or third? Is there an ample supply of mechanics and parts for servicing electric vehicles? These are all topics that merit further exploration and discussion in a future piece, as we look to find the best way to invest in these larger trends. I hope you found this overview somewhat informative, I’ll try to explore some of these themes more in depth in a future post where I focus more on the company level and which companies might be good investments on certain time horizons (I’ll try to do the same with the networking and telecom piece, as it reflects how I do research when I am attempting to first identify the large scale trend and then zoom in and try to understand stand which companies will inevitably be the winners). If you enjoyed this piece, please consider subscribing and don’t hesitate to reach out on Twitter @netcapgirl.

Relevant Companies

Battery Manufacturers:

CATL (Contemporary Amperex Technology Co. Ltd.)

LG Chem

Panasonic

SK Innovation

BYD Company Limited

Automakers:

Tesla, Inc.

General Motors

Volkswagen Group

BMW Group

Nissan Motor Corporation

Ford Motor Company

Hyundai Motor Group

Rivian Automotive, Inc

Semiconductor Providers:

NVIDIA Corporation

Qualcomm Incorporated

Infineon Technologies AG

Texas Instruments Incorporated

Broadcom Inc.

Charging Infrastructure:

ChargePoint, Inc.

Tesla Superchargers Network

EVgo Services LLC

ABB Ltd.

Siemens AG

Materials and Mining:

Albemarle Corporation

BHP Group Limited

Rio Tinto Group

Glencore plc

Energy Storage Solutions:

Enphase Energy, Inc.

Sonnen GmbH

AES Corporation

Stem, Inc.

Fluence Energy, LLC

Utilities and Grid Infrastructure:

Duke Energy Corporation

E.ON SE

Enel S.p.A.

Dominion Energy, Inc.

National Grid plc

Automotive Technology and Software:

Mobileye (Intel Corporation)

Aptiv PLC

BlackBerry Limited

Daimler AG (Mercedes-Benz)

Rivian Automotive, Inc.

Geopolitics and Critical Minerals:

China Molybdenum Co., Ltd.

Albemarle Corporation

Ganfeng Lithium Co., Ltd.

SQM (Sociedad Química y Minera de Chile)

Rio Tinto Group

Renewable Energy Providers:

NextEra Energy, Inc.

Vestas Wind Systems A/S

Orsted A/S

Enel Green Power S.p.A.

First Solar, Inc.

Great read Sophie, really enjoyable

Very detailed, appreciate how this piece and the telecom one had a nice masterlist of companies