Compounding Heritage

A look at the luxury market through three storied brands: LVMH, Hermès & Ferrari

Introduction

Continuing with our series of looking at industries that should inevitably experience healthy growth well into the foreseeable future, this piece will take a look at the market for luxury goods. While we will provide a general overview of the industry at large, we think the luxury market is best understood through not only three of the best companies in the sector, but perhaps three of the best companies in the world; LVMH, Hermès and Ferrari. This piece will take a look at the story of each of the three companies, why they are considered the epitome of luxury, look at their current investments and strategies, and also look at their financial statements and provide a valuation model for each of them.

LVMH

LVMH Moët Hennessy Louis Vuitton, commonly known as LVMH, is a world-renowned French multinational luxury goods conglomerate. Founded in 1987, it has emerged as a global leader in luxury fashion, cosmetics, wines, spirits, and jewelry. LVMH's portfolio includes iconic brands like Louis Vuitton, Dior, Moët & Chandon, Hennessy, and many others. With a commitment to innovation and craftsmanship, LVMH has consistently set industry standards for quality and style. The company's success is a testament to its ability to blend tradition with modernity, offering customers exceptional experiences and products that define luxury across the globe.

Over the past decade, LVMH has exhibited a strong upward trend in its stock performance. The luxury conglomerate, known for its premium brands in fashion, cosmetics, and spirits, has experienced consistent growth. LVMH's stock benefited from expanding global luxury markets, particularly in Asia, and its ability to adapt to changing consumer preferences. High demand for iconic brands like Louis Vuitton and Christian Dior contributed to its financial success. While there were occasional market fluctuations and economic uncertainties, LVMH's overall trajectory has been positive, solidifying its position as a leader in the luxury goods industry.

Bernald Arnault, on the inevitability of LVMH (he has bought $215mm worth of LVMH stock since the shares dropped on a disappointing earnings report in July):

Arnault tells the story of coming to the US for the first time and having a cab driver who was talking about Richard Nixon. Arnault asked him if he knew who the French president was.

“No, but I know Christian Dior” replied the cab driver.

This inspired Arnault, working for his family’s construction business at the time, to pursue an acquisition of the struggling group that owned Dior. He is similar to Warren Buffett in a lot of ways, but one key similarity that provides intangible value for LVMH (and the corporation’s strategy for M&A driven growth) is being the desirable buyer for companies that may have not sold otherwise. In France and across Europe, many luxury houses are family businesses that have been passed down through generations. They are often reluctant to part with the business that their ancestors have built from the ground up. LVMH, much like Berkshire, has become a trusted home for companies like this, providing operating leverage for LVMH in the form of having access to potential acquisitions that would not otherwise be on the market, but the owners will come to the table because they have the utmost respect for Arnault, LVMH, and the way he has managed the acquisition of other family owned luxury houses previously. This is similar to how Berkshire has become the preferred buyer for similar businesses in the US, as otherwise skeptical buyers trust Buffett with their company, which is often their life’s work.

Mr. Arnault bought Dior and bought back the licenses that the company was selling, as he felt it was diluting the brand. The very idea of creating a luxury conglomerate was new at the time, but during the merger of Moet Hennessy and Louis Vuitton, both sides wanted Arnault to side with them, as they wanted a sort of shield from an external takeover. Mr. Arnault eventually sided with Moët Hennessy and fired the head of Louis Vuitton. When the people in charge of Moet left, he found himself in charge of LVMH and Dior, laying the foundation for the company he controls today, with over $80B in sales across 75 brands. The company’s origin certainly shares traits with Buffett’s purchase of Berkshire Hathaway, a struggling textile mill at the time, and the two men share a mindset for running their companies. They’re generally fiscally conservative, they look to invest counter-cyclically and think in terms of very long term horizons, where ultimately the performance of the company’s stock should match the performance of the underlying operating businesses owned by the company.

When trying to get a sense of the story, it’s always important to understand both the bull and bear case for any potential investment. It’s helpful to think of yourself like a scientist, searching for an inevitable underlying objective reality amidst lots of information and uncertainty. In the case of LVMH, aside from the natural cyclical risks associated with the consumer discretionary sector (the Chinese market especially, though even amidst economic downturns and recession, their business proves to be resilient due to the nature of their customer base being wealthy individuals and their ability to raise prices and maintain strong gross and operating margins) the biggest risk to LVMH’s continued success is probably the key man risk associated with Mr. Arnault’s planned succession. With LVMH being the product of his life’s work (he was trained as an engineer but has the rare ability to balance the calculated mindset with an artistic one. Both a ruthless business operator and someone who can appreciate the craftsmanship and passion that goes into producing the products his company sells) there is a natural risk that his successor won’t live up to his legacy. For us, that’s ok. The same is true of Berkshire. What is true of both businesses is they would be almost hard to mess up. And furthermore, because of the principled nature of their leadership, we expect the principles and core ethos and values that Mr. Arnault has established during his tenure as CEO to be firmly embedded in LVMH’s DNA. If you can imagine the worst case for the inevitable succession that looms over the company - say an economic downturn and the loss of key leaders of their operating companies, it’s hard to imagine a future where the company isn’t resilient and continues to overcome challenges as it has in the past. We believe that is the inevitable value of compounding heritage, and why LVMH equity should continue to compound at low to mid double digits over the next 10+ years.

In the context of making an investment in a company like LVMH, the question “what is luxury?” inevitably comes to the mind of the investor. One can of course look through the lens of the consumer and experience the desire for the company’s products (to reiterate Mr. Arnault, luxury is “how do we create desire ?”) There are certainly some similarities with how the consumer views the presentation of luxury with how the investor evaluates the investment opportunity. The customer is not just buying a product but buying the timelessness of the brand. The heritage that has compounded across so many years that has created the brand equity that is so valuable today. The customer is also usually relatively inelastic to price increases (and is often the case, higher price creates more demand as it is seen as even more desirable and exclusive.) When viewed through the lens of an investor, this timelessness is an intangible asset that is hard to precisely value. Warren Buffett often looks for businesses that would be hard to compete with even if you could invest the same amount of capital as them. (For instance, if you had the capital to match all that’s been invested in apple, coca cola or american express, would you want to compete with those businesses?) That’s one way to quantify a competitive advantage and that’s certainly the case with Luxury Houses such as LVMH, Hermès and Ferrari. The heritage and timelessness of these companies has created brand equity that would be extremely difficult to replace. Even if a startup had unlimited capital, how long would it take to catch up to these iconic brands that are known all around the world as the epitome of luxury? These intangible values such as heritage, timelessness and brand equity show up in the financial statements as healthy gross margins, strong operating margins and fairly robust free cash flow growth, with what seems like a relatively ample runway for reinvestment at solid rates in the near to mid term future. These attributes are also why the market is comfortable assigning a relatively higher multiple on these businesses than peers within the luxury industry and certainly higher than other consumer goods businesses.

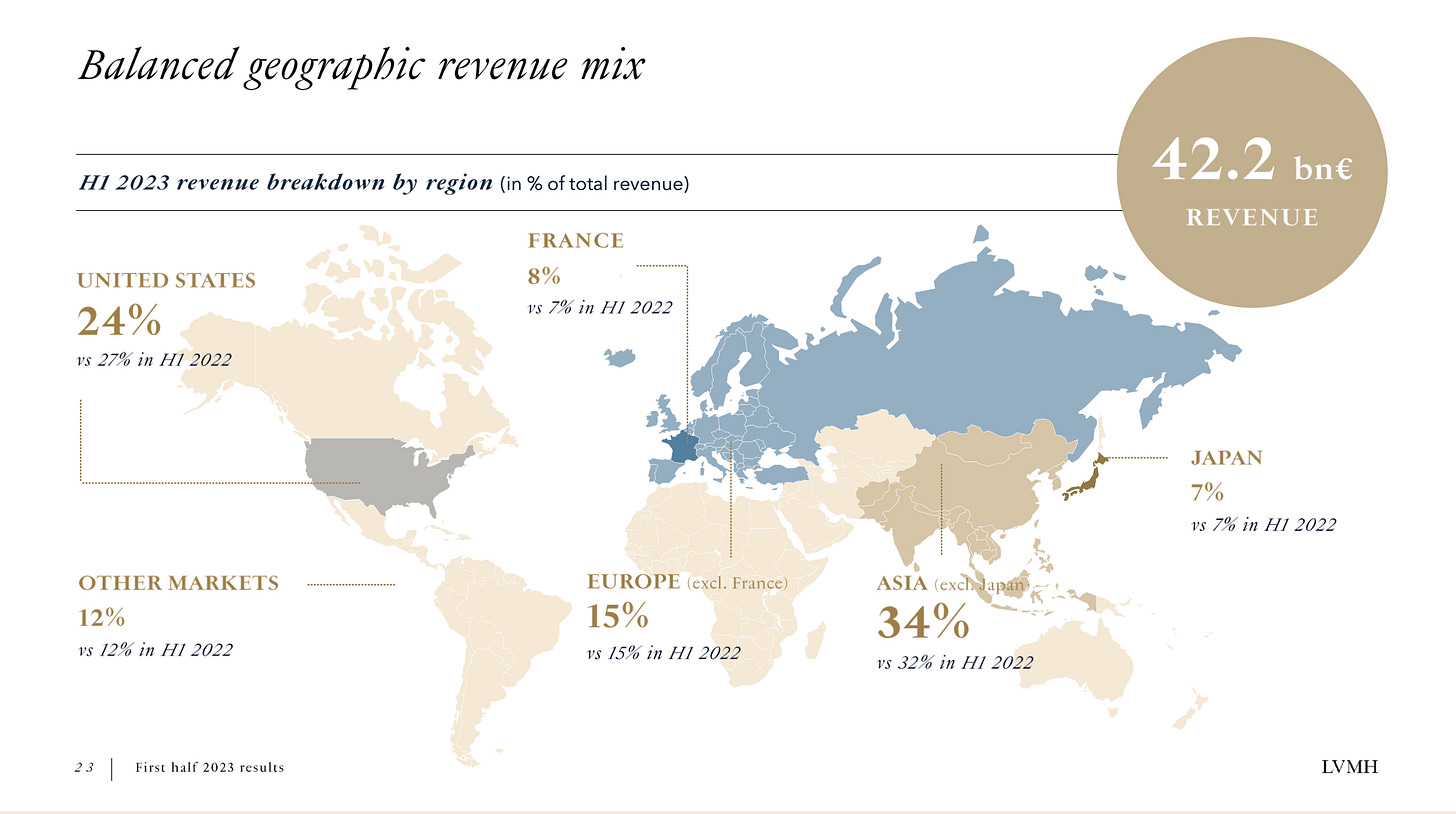

Composition of revenue and earnings by geography

Composition of revenue and earnings by segment and brand

In terms of corporate structure, all the brand CEOs report to Mr. Arnault. He is known to be demanding and detail oriented, while also being known for having a deep appreciation for creative vision and is the rare CEO who can create a culture that balances a passion for the highest level of artistic craftsmanship with a laser-like focus on business performance and optimization. This is core to LVMH’s DNA. There is a bit of a push and pull between brands being fully autonomous and running their own P&L, but at the end of the day, everyone is reporting to a CEO & Founder who is obsessed with quality and operating performance. Similarly to Berkshire, all the individual businesses (of which there are 75+) send capital to management where they make capital allocation decisions. From the financial crisis until now, LVMH deployed $30B+ of capital and earned a return of around ~20% on the incremental invested capital. (Capex averages around 6% of the group’s revenue each year)

LVMH is also focused on investing through the income statement, Mr. Arnault believes (and is evidenced by the continued growth in earnings with consistent margins) this compounds brand equity vs focus on expanding operating margins (which have been stable around ~20%.)

Why it's the epitome of luxury

LVMH is often considered the epitome of luxury for several key reasons:

1. Iconic Brands: LVMH owns and manages some of the world's most prestigious and iconic luxury brands, including Louis Vuitton, Christian Dior, Givenchy, Fendi, Celine, Tiffany, Loro Piana and more. These brands have a rich heritage and are synonymous with luxury, elegance, and exclusivity.

2. Craftsmanship: LVMH brands are known for their exceptional craftsmanship and attention to detail. Whether it's Louis Vuitton's handcrafted leather goods, Dior's haute couture fashion, or Dom Pérignon champagne, the products are often created using traditional techniques and the highest-quality materials.

3. Innovation: While rooted in tradition, LVMH constantly pushes the boundaries of luxury through innovation. For example, Louis Vuitton has introduced high-tech features in its luggage, and Dior has embraced sustainable fashion practices. This blend of tradition and innovation appeals to a wide range of luxury consumers.

4. Exclusivity: LVMH carefully manages the scarcity of its products, creating an aura of exclusivity. Limited editions, bespoke services, and the occasional scarcity of certain products drive desire and demand among luxury consumers.

5. Global Presence: LVMH has a strong global presence, with stores and boutiques in some of the world's most prestigious shopping districts. This global reach ensures that its luxury products are accessible to consumers around the world.

6. Marketing and Branding: LVMH is renowned for its effective marketing and branding strategies. The company invests heavily in advertising and celebrity endorsements, further enhancing the desirability of its brands.

7. Customer Experience: LVMH places a strong emphasis on providing a luxurious and personalized customer experience. From elegant store designs to attentive staff, customers often feel pampered when shopping at LVMH boutiques.

8. Heritage and Tradition: Many of LVMH's brands have a long and storied history, dating back to the 19th century or earlier. This heritage adds to the perception of authenticity and timelessness.

9. Sustainability Initiatives: LVMH has also taken steps to align with modern consumer values by implementing sustainability initiatives. Brands like Louis Vuitton and Dior have embraced eco-friendly practices, demonstrating a commitment to environmental responsibility.

10. Cultural Influence: LVMH and its brands have a significant cultural influence. They are often seen on red carpets, in films, and at high-profile events. This visibility reinforces their status as symbols of luxury and sophistication.

In summary, LVMH's status as the epitome of luxury is the result of a combination of factors, including its portfolio of iconic brands, commitment to craftsmanship and innovation, global reach, marketing prowess, and the ability to create an exclusive and aspirational experience for consumers. This combination of factors makes LVMH a dominant force in the luxury goods industry and a symbol of luxury worldwide.

History / Story

1987-1990: The Birth of LVMH

LVMH was officially created in 1987 when Moët Hennessy, a company known for its champagne and cognac, merged with Louis Vuitton, a renowned French fashion house specializing in luxury luggage and accessories.

In its first year of operation, LVMH reported sales of approximately €4.6 billion, with diverse revenue streams from fashion, spirits, and wines.

The Visionary Leader:

The driving force behind the creation of LVMH was Bernard Arnault, a visionary businessman with a keen interest in luxury goods. Arnault, known for his shrewd acquisitions and brand management, became the Chairman and CEO of LVMH.

Early 1990s: Expansion and Acquisitions

In the early 1990s, LVMH embarked on an ambitious expansion plan, acquiring several luxury brands, including Christian Dior, Givenchy, and Céline.

By 1993, LVMH's sales had grown to over €6.2 billion, reflecting its successful strategy of diversifying its brand portfolio.

Mid to Late 1990s: Global Reach and Profitability

Throughout the mid to late 1990s, LVMH continued to expand its luxury empire, venturing into new markets like Asia.

By 1998, the company's sales had surpassed €10 billion, with a growing global presence and strong profitability.

Early 2000s: Challenges and Recovery

The early 2000s presented challenges for LVMH due to the global economic downturn and a decline in luxury consumption.

Despite these challenges, LVMH's diversified brand portfolio and resilience helped it weather the storm. By 2005, sales had rebounded to approximately €12.6 billion.

Mid-2000s to Late 2000s: Continued Growth

In the mid to late 2000s, LVMH's sales and profitability continued to climb steadily. The company made strategic acquisitions, including the purchase of Bulgari in 2011.

By 2010, LVMH's sales exceeded €20 billion, reflecting its growing presence in emerging markets and the enduring appeal of its luxury brands.

Early 2010s: Emerging Markets and Digital Expansion

LVMH capitalized on the growing middle and upper classes in emerging markets like China and expanded its digital presence.

By 2015, LVMH's sales had reached approximately €35 billion, cementing its status as the world's leading luxury goods conglomerate.

2016-2020: Resilience and Adaptation

LVMH faced various challenges during this period, including changing consumer preferences and geopolitical tensions.

However, the company adapted by investing in e-commerce, sustainability initiatives, and enhancing customer experiences.

By 2020, LVMH's sales exceeded €53 billion, demonstrating its ability to evolve with the times.

2021-2023: Navigating the Pandemic and Beyond

The COVID-19 pandemic posed significant challenges to the luxury industry, with travel restrictions and economic uncertainty affecting sales.

LVMH responded by focusing on digital innovation, online sales, and sustainable practices.

Financials

Valuation

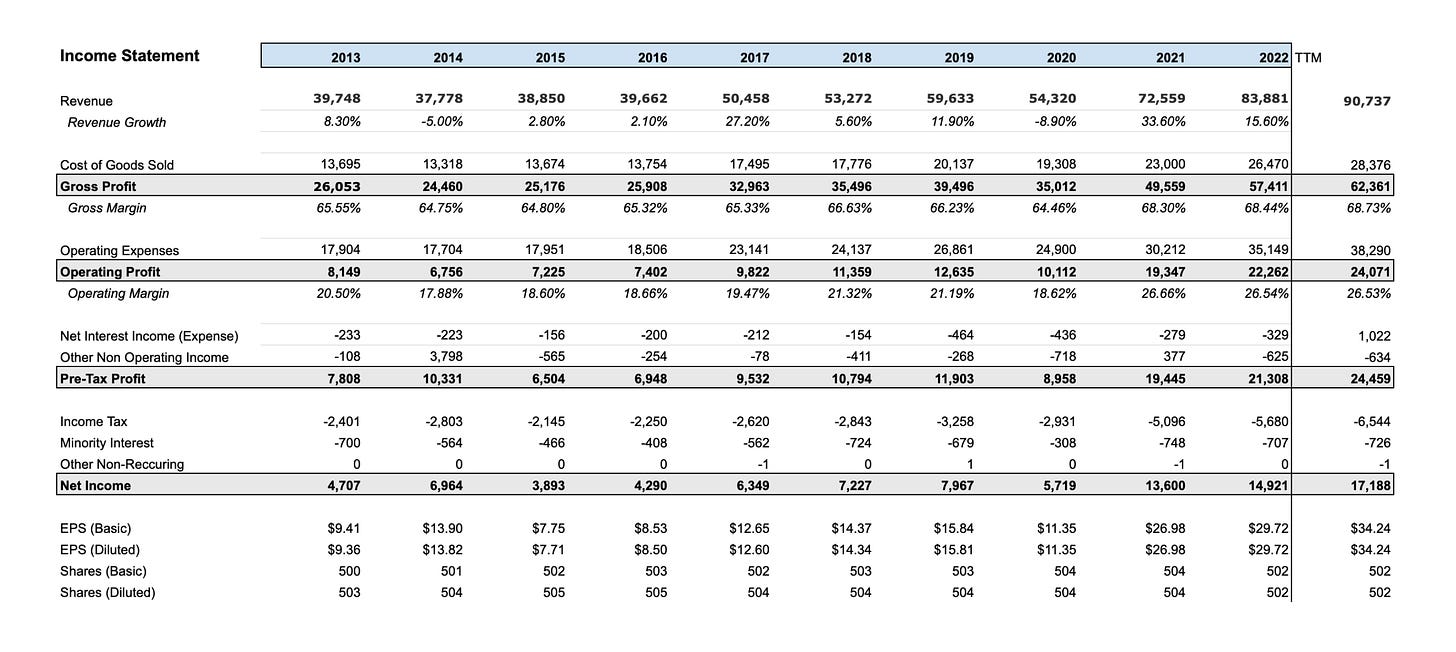

LVMH Income Statement

LVMH DCF Valuation

Hermès

What began as a saddle company in the 1850s has grown into a company that epitomizes luxury at every step of their process. Hermès did nearly $13B of sales last year at a ~70% gross margin, which is incredibly impressive and perhaps even more so considering they deliberately restrict the production volume of the bags and other products that they make.

Hermès approach to luxury is perhaps best understood through their flagship offerings, the Birkin and the Kelly bag. The eponymous bags, named after Jane Birkin and Grace Kelly, respectively, are not only not available online, but customers who want to purchase them must put their names on a waiting list at one of the company’s stores. Once they have been approved to purchase the bags (keep in mind, these bags start anywhere from close to $10k usd with prices going much higher, and can be resold on the secondary market for often 3-4x the purchase price (or more, depending on the year and the specific bag, making them an attractive investment which is an interesting overlap for us as we look at luxury houses from both the consumer and investor lens)) there is an entire ceremony that lasts roughly an hour and a half at one of their flagship stores in major cities across the globe. They serve champagne and cake and strive to make the experience as special as possible for the customer (a sort of hyper individualized experience, a theme we have explored previously at inevitability research.) Usually customers will start with an entry level purchase, such as a scarf, shoes, perfume or a tie. It is customary to begin with one of these items when you put your name on the waitlist for the privilege of purchasing a Birkin or a Kelly. What other brands that you know of put their customers on a waitlist and screen them before permitting them to make a $8k (and often much more) purchase? This is another aspect of how Hermès approaches the entire experience differently and defines luxury in their own way.

Axel Dumas, Executive Chairman of Hermès, on their latest earnings call said: “The 2023 first half results reflect the strength of the pillars of the artisanal model of the house: quality of materials, exceptional know-how and abundant creativity. To support this growth, we continue to invest in our production capacities, in the expansion of our network, while accelerating job creation and training in all of the group’s métiers.”

Financially, Hermès looks maybe more like a software business than a consumer goods or manufacturing business with 70% gross margins and 40% operating margins. They are profitable through all their business segments and the family is careful with reinvestment and focused on being extremely good stewards of capital for the business. In other industries, investors may look at the margin structure and think “why can’t another company come in at a discount and compete some of that away from Hermès?” And the difficulty of doing so is perhaps illustrative of the competitive advantage that Hermès has built up after the many years of compounding heritage. The 100+ years of exceptional decision making and an unrelenting commitment to quality at every step of their supply chain and distribution is reflected in the company’s intangible brand equity and would make it exceedingly difficult for another company to come along and compete. Similar to the case with LVMH, economic theory would suggest that a competitor could create a reasonable substitute and compete away some of Hermès’ best in class margins, but as many companies have found out over the years, this is nearly impossible. Such is the inevitable advantage of the many years that the company has spent compounding its incredible heritage, and creating a world class brand and company in the process.

When it comes to luxury, Hermès is the pinnacle of heritage, craftsmanship, image, and being careful with how they produce and allow supply into the market, all important components of the intangible brand equity of a luxury company and also strong competitive advantages in their own right. When you buy a Birkin or a Kelly, not buying the utility of a bag, you’re buying a piece of history.

How big can Hermès get? What are the risks?

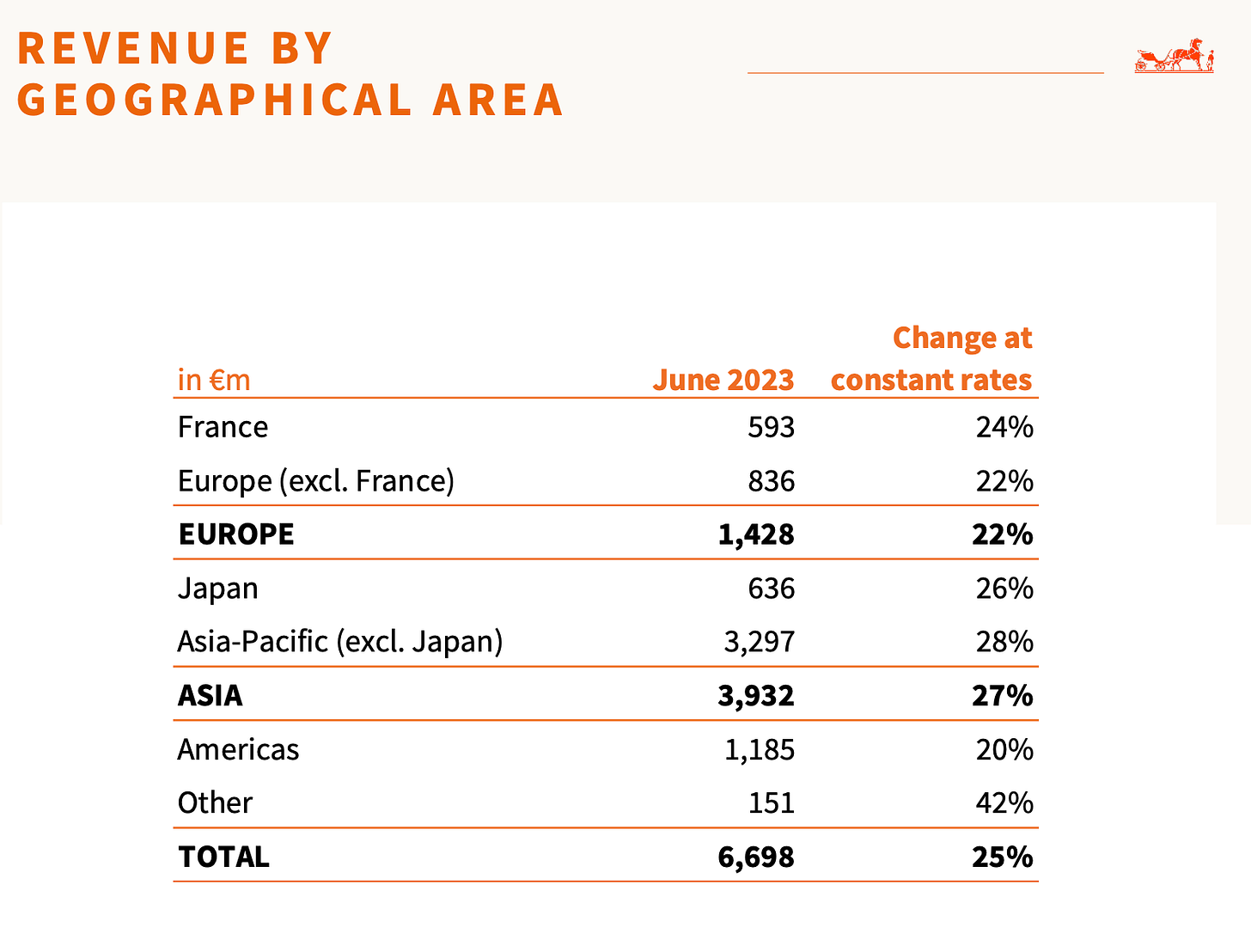

20 years ago, the luxury market was more centralized in the coastal US, capital cities in Europe and Japan. Now Asia is a huge market and the Middle East is experiencing healthy growth. A looming question for all luxury companies is just how big is the size of the overall market? This is a risk factor we will address in the conclusion of this piece. As noted in the graphic below, all geographic segments are experiencing 20%+ growth in the first half of 2023

An example of Hermès' commitment to exclusivity and deliberately restricting supply volume can be seen some years back, when they had an extremely popular beach bag that was flying off the shelves in Japan. While many consumer goods companies would be thrilled with the success and make plans to ramp production volume, Hermès killed the SKU. This example is illustrative of their approach to exclusivity and luxury.

While they have been reluctant to embrace digital sales to the degree of other luxury brands, Hermès’ online presence serves as a sort of digital storefront with the goal of driving customers to their physical retail stores (you can’t buy a new Birkin or Kelly online, for instance.) The average Hermès store is 525 square meters, which means they do about $50k of revenue per square meter. On the supply chain side, Hermès owns their entire manufacturing process and assures quality at every step so that customers know their bag was crafted from a single piece of the finest leather in the hands of France’s most skilled craftsmen at Hermès owned ateliers.

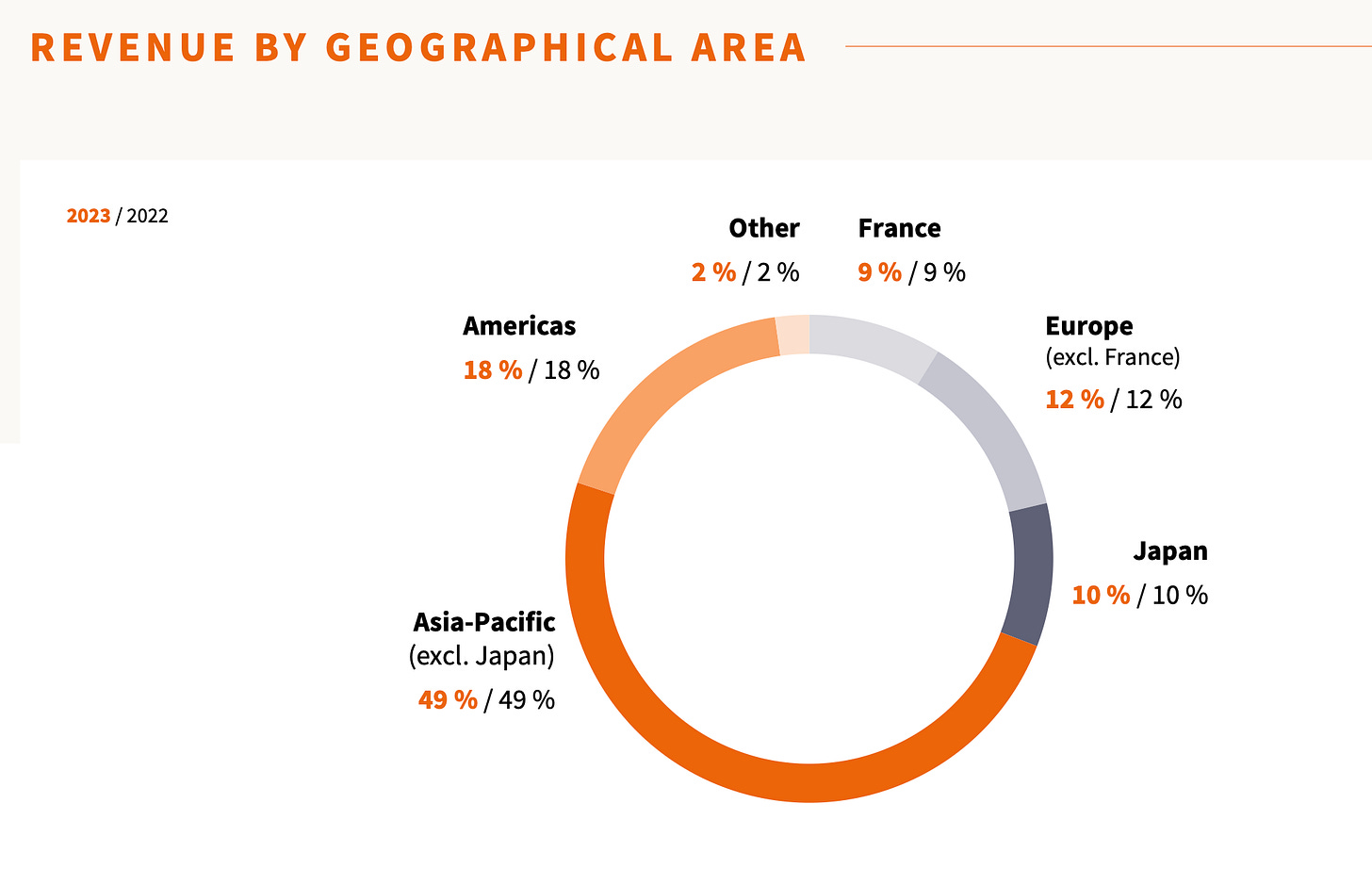

Composition of revenue and earnings by geography

Composition of revenue and earnings by segment

10 year CAGRs

Why it’s the epitome of luxury

Hermès is often considered the epitome of luxury for several compelling reasons:

1. Heritage and Tradition: Hermès was founded in 1837, and its long history is synonymous with artisanal craftsmanship and timeless elegance. This heritage adds an aura of authenticity and tradition to the brand, appealing to those who appreciate a storied legacy.

2. Artisanal Craftsmanship: Hermès is renowned for its commitment to exceptional craftsmanship. The brand's artisans meticulously handcrafted products using the finest materials, from the renowned Birkin and Kelly bags to its silk scarves and leather goods. Each item is a testament to the skill and dedication of its craftsmen and women.

3. Exclusivity and Scarcity: Hermès carefully manages the scarcity of its products, particularly its iconic Birkin and Kelly bags. These items are often in high demand and have long waiting lists, creating an air of exclusivity and desirability among luxury consumers.

4. Quality and Materials: Hermès is uncompromising when it comes to the quality of its materials. The brand sources the finest leathers, silks, and other materials for its products, ensuring durability and a luxurious feel.

5. Timelessness: Hermès products are known for their timeless design. Unlike trendy or seasonal items, Hermès pieces remain stylish and relevant for decades, making them valuable investments for those who seek enduring luxury.

6. Customization: Hermès offers customization and bespoke services for many of its products, allowing customers to personalize their items to their exact preferences. This level of customization enhances the sense of exclusivity and individuality.

7. Limited Editions and Artistic Collaborations: Hermès frequently releases limited-edition collections and collaborates with artists and designers, creating unique and collectible pieces. These collaborations add an element of artistry and creativity to the brand's offerings.

8. Retail Experience: Hermès boutiques are known for their elegant and inviting design, creating a luxurious and personalized shopping experience. The brand's attentive and knowledgeable staff further enhance the customer experience.

9. Sustainability: Hermès has demonstrated a commitment to sustainability by implementing eco-friendly practices and sourcing materials responsibly. This aligns with the values of modern luxury consumers who value ethical and sustainable practices.

10. Cultural Influence: Hermès products are often seen on influential individuals, celebrities, and in popular culture. This cultural visibility reinforces the brand's status as a symbol of luxury and sophistication.

11. Scarves and Silk: Hermès' silk scarves are iconic and have become collectible items in their own right. The intricate designs and quality of these scarves have made them highly sought after by collectors and fashion enthusiasts.

In summary, Hermès' status as the epitome of luxury is the result of a combination of factors, including its rich heritage, commitment to craftsmanship and quality, exclusivity, timelessness, and the ability to create a unique and personalized experience for its customers. These qualities make Hermès a highly regarded and aspirational brand in the world of luxury.

History / Story

1837-1900: Early Beginnings and Saddlery

Hermès started as a harness workshop in Paris, specializing in crafting high-quality leather goods for horse riders. Their attention to detail and fine craftsmanship quickly gained recognition.

1900-1920s: Expansion and Diversification

In the early 20th century, under the leadership of Thierry's grandson Emile-Maurice Hermès, the company expanded its product line beyond saddlery to include leather bags and accessories.

The iconic Hermès Haut à Courroies bag, designed for riders to carry saddles, was created in this period.

1930s-1940s: Silk Scarves and International Expansion

In the 1930s, Hermès introduced silk scarves, which became a global sensation.

The brand also expanded its presence internationally, opening stores in locations like New York, London, and Tokyo.

1950s-1970s: The Kelly and Birkin Bags

In 1956, Grace Kelly famously used an Hermès bag to shield her pregnancy from paparazzi, leading to the bag being named the "Kelly Bag."

In the 1970s, the Birkin Bag was introduced, named after actress and singer Jane Birkin. It quickly became one of the most coveted and iconic luxury handbags in the world.

1980s-1990s: Continued Growth and Succession

Jean-Louis Dumas, a member of the Hermès family, served as the company's artistic director and CEO during this period.

Hermès continued to expand its product range, including the introduction of fragrances and ready-to-wear fashion.

2000s-Present: Resilience and Global Expansion

In the 21st century, Hermès demonstrated resilience during economic downturns and maintained its commitment to artisanal craftsmanship.

The company expanded its global footprint and continued to launch successful products, such as the Hermès Apple Watch collaboration.

Hermès' financial performance has generally shown steady growth over the years, driven by its strong brand reputation and consistent demand for its luxury products.

The company is known for its high margins due to its focus on craftsmanship and exclusivity.

Hermès has earned a reputation as one of the world's leading luxury brands, known for its unwavering commitment to quality, craftsmanship, and timeless design. It's safe to say that Hermès' success is rooted in its ability to maintain these core values while adapting to the changing landscape of the luxury industry.

Financials

Valuation

Hermès Income Statement

Hermès DCF Valuation

Ferrari

Ferrari is among the world’s leading luxury brands focused on the design, engineering, production and sale of the world’s most recognizable luxury performance sports cars. The Ferrari brand symbolizes exclusivity, innovation, state-of-the-art sporting performance and Italian design. Its history and the image enjoyed by its cars are closely associated with its Formula 1 racing team, Scuderia Ferrari, the most successful team in Formula 1 history. From the inaugural year of Formula 1 World Championship in 1950 through the present, Scuderia Ferrari has won 242 Grand Prix races, 16 Constructors’ World titles and 15 Drivers’ World titles. Ferrari designs, engineers and produces its cars in Maranello, Italy, and sells them in over 60 markets worldwide.

Why it's the epitome of luxury

Ferrari is often considered the epitome of luxury for several reasons:

1. Exclusivity: Ferrari maintains a strict limit on the number of vehicles it produces each year, creating an aura of exclusivity and rarity. This limited production approach ensures that owning a Ferrari is a privilege reserved for a select few.

2. Heritage and Racing Pedigree: Ferrari has a storied history in motorsports, particularly in Formula 1 racing. This racing pedigree is deeply ingrained in the brand's DNA, and it adds an extra layer of prestige to its road cars.

3. Design Excellence: Ferrari's design philosophy emphasizes both form and function. The sleek, aerodynamic, and iconic design of Ferrari cars not only enhances their performance but also makes them works of art. The brand's prancing horse logo is instantly recognizable worldwide.

4. Engineering Excellence: Ferrari is renowned for its cutting-edge engineering and innovation. The brand continually pushes the boundaries of automotive technology, producing high-performance vehicles that are celebrated for their precision and handling.

5. Performance: Ferrari cars are known for their blistering speed and exceptional handling. They consistently set benchmarks for performance in the automotive industry, making them aspirational for auto enthusiasts.

6. Customization: Ferrari offers an extensive range of customization options, allowing buyers to tailor their vehicles to their exact preferences. This bespoke approach enhances the sense of individuality and luxury.

7. Legacy of Luxury: Ferrari's brand legacy is synonymous with luxury, sophistication, and an appreciation for the finer things in life. Owning a Ferrari signifies a certain level of affluence and discernment.

8. Resale Value: Ferrari vehicles often maintain strong resale values, thanks to their exclusivity and enduring appeal. This factor further emphasizes their status as luxury assets.

9. Cultural Icon: Ferrari is a cultural icon that transcends the automotive world. It frequently appears in films, music, and popular culture, contributing to its image as a symbol of luxury and success.

10. Ownership Experience: Ferrari provides an exceptional ownership experience, including access to exclusive events, track days, and a global network of Ferrari owners' clubs. This sense of community and prestige enhances the overall luxury ownership experience.

11. Limited Editions and Collector's Items: Ferrari releases limited-edition models and collector's items, such as the LaFerrari and the Enzo, which are highly sought after by collectors and enthusiasts.

12. Brand Loyalty: Many Ferrari owners are fiercely loyal to the brand, often owning multiple Ferraris throughout their lives. This loyalty and passion contribute to Ferrari's status as an epitome of luxury.

In summary, Ferrari is considered the epitome of luxury due to its combination of exclusivity, heritage, design and engineering excellence, performance, customization, and the overall experience it offers to its discerning customers. Owning a Ferrari is not just about having a fast car; it's about being part of a prestigious legacy and embodying a symbol of luxury and high achievement.

History

The story of Ferrari is a captivating tale of passion, racing excellence, and the creation of one of the most iconic automotive brands in the world.

Early Years (1898-1939):

1. Enzo Ferrari, the founder of Ferrari, was born on February 20, 1898, in Modena, Italy.

2. Enzo developed a passion for cars and racing from an early age, and his interest led him to work for Alfa Romeo as a test driver and racing driver in the 1920s.

3. In 1939, Enzo left Alfa Romeo due to a disagreement with the company, and he began Auto Avio Costruzioni, a company specializing in manufacturing aircraft parts. This company later played a pivotal role in Ferrari's history.

Post-World War II (1940s-1950s):

4. After World War II, Enzo Ferrari shifted his focus to racing cars and founded Scuderia Ferrari in 1947. Initially, Scuderia Ferrari was primarily a racing team that used Alfa Romeo cars.

5. The first car to bear the Ferrari name, the 125 S, was built in 1947. It featured a 1.5-liter V12 engine designed by Gioachino Colombo.

6. In 1950, Ferrari entered the Formula One World Championship, and Alberto Ascari drove a Ferrari car to victory in the Silverstone Grand Prix.

7. The 1950s were a period of racing dominance for Ferrari, with wins in prestigious races like the Mille Miglia, Le Mans, and the Formula One World Championship.

1960s-1970s:

8. The 1960s saw Ferrari continue its success in motorsports, with drivers like John Surtees, Phil Hill, and Niki Lauda bringing home titles.

9. Ferrari introduced the iconic 250 GTO in 1962, widely regarded as one of the greatest sports cars ever built.

10. Tragedy struck in 1967 when Enzo's son, Dino Ferrari, passed away at a young age. The Dino brand was subsequently used for a series of V6 and V8 sports cars.

11. In 1973, Ferrari launched the Berlinetta Boxer, the company's first mid-engine road car.

1980s-1990s:

12. The 1980s saw Ferrari continue its success in Formula One, particularly with the partnership between the team and driver Michael Schumacher in the 1990s.

13. Ferrari introduced the iconic F40 in 1987, which became a symbol of supercar excellence.

14. The 1990s also marked a period of financial success, thanks to the booming demand for high-performance sports cars.

21st Century:

15. In 2002, Ferrari launched the Enzo, a hypercar named after the founder, which showcased the brand's technological prowess.

16. Ferrari's Formula One team enjoyed significant success in the 2000s and 2010s, with multiple championships won under the leadership of Michael Schumacher and later drivers like Kimi Räikkönen and Sebastian Vettel.

17. Ferrari expanded its product line to include GT cars like the 458 Italia, 488 GTB, and more recently, the F8 Tributo.

Present Day:

18. Ferrari remains one of the most prestigious and sought-after automotive brands globally. The Prancing Horse logo is synonymous with luxury, speed, and Italian craftsmanship.

19. The brand continues to produce high-performance road cars and is known for its limited-edition models like the LaFerrari and the SF90 Stradale.

20. While staying true to its racing heritage, Ferrari is also exploring electric and hybrid technology for future models to adapt to changing industry trends while maintaining its performance standards.

Ferrari's journey from a racing team to a globally recognized luxury brand is a testament to Enzo Ferrari's vision and passion for automotive excellence. Today, Ferrari represents the pinnacle of automotive craftsmanship, performance, and style, and its iconic cars are celebrated by enthusiasts and collectors worldwide.

Financials

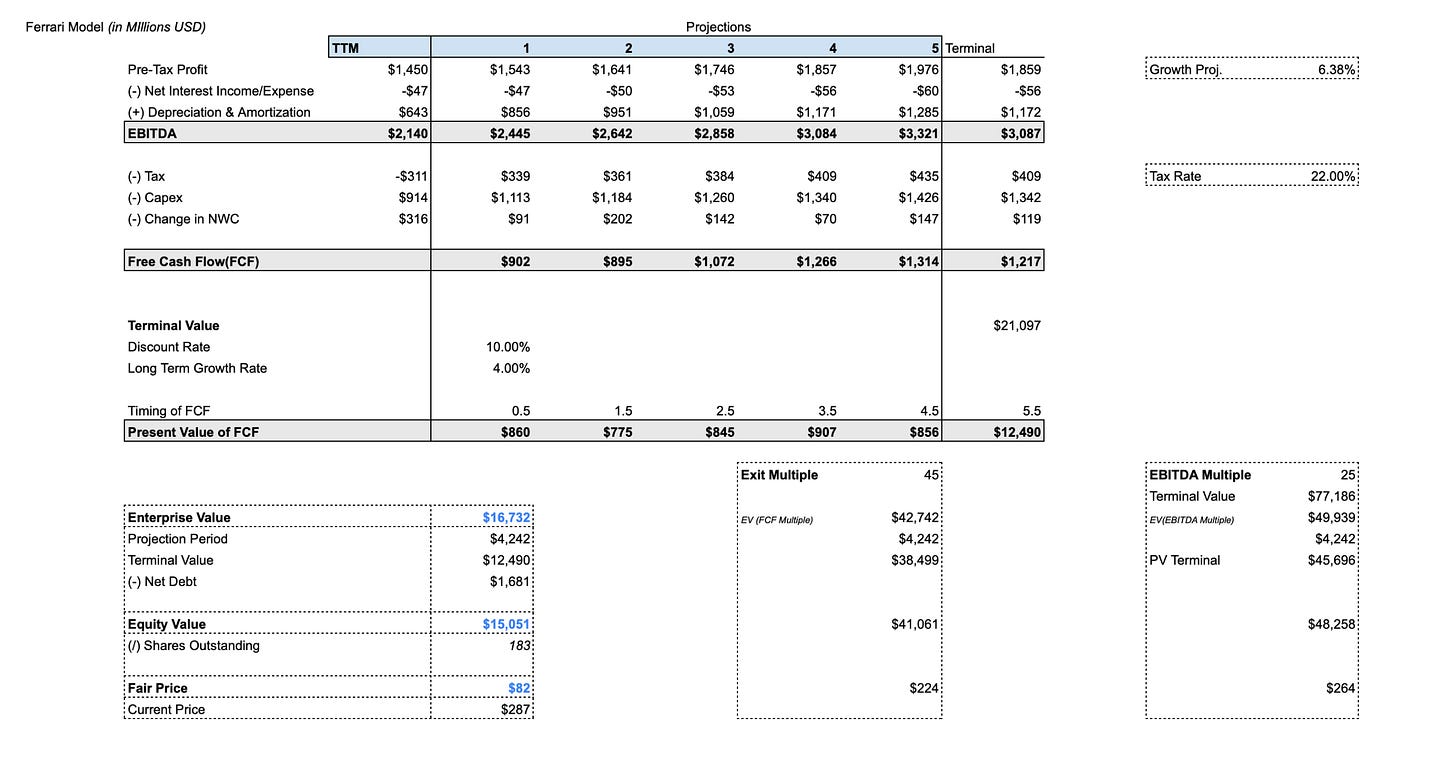

Valuation

Ferrari Income Statement

Ferrari DCF Valuation

Conclusion

What is luxury?

As is evidenced by the sales figures in this piece, certain consumers want something that is meticulously crafted to the highest degree and also want a sense of belonging.There's an element of showing off, sure, but it’s more about being in a sort of “if you know you know” club. Luxury is owning the upstream and downstream aspects of the business to ensure the highest quality at each step. From the supply chain to the distribution down to the minutiae of the customer expended in the stores. Luxury companies follows laws of anti marketing - don’t pander to your customer, don’t increase supply or volume of popular products, cultivate an air of desire and exclusivity, keep the ratio of people who know about your products to people who own them as high as possible (many aspects of this strategy run contrary to how a traditional consumer goods business would think about their marketing efforts.) Perhaps amongst the most important - true luxury brands are selling you something timeless. By buying something from LVMH, Hermès or Ferrari you are buying a piece of the heritage. Heritage that has been preserved over centuries by holding their companies to the highest standards and never compromising on their values. From the company’s perspective, luxury is about, to quote Bernard Arnault, “creating desire.” From an investor’s perspective, luxury is about intangible brand equity, best in class pricing power, world class gross and operating margins and years of above average shareholder returns. From a research perspective, we believe luxury is best understood through these three shining examples of timeless companies that epitomize luxury.

Risks

From an investment perspective, while there are a number of attractive qualities about these businesses and their position in their respective markets (for instance, the luxury industry should experience tailwinds during good economic times and the wealthy, relatively price inelastic consumers should, in theory, prove to be more resilient during economic downturns) there are a number of risks to consider. Valuation is always a consideration and the market certainly places a premium multiple on the earnings of LVMH, Hermès and Ferrari. They trade above their respective indices average multiples and above their peer group as well (LVMH is at 24x earnings, Hermes is at 50x earnings and Ferrari is at 48x earnings, at the time of writing this.) This is somewhat to be expected, as these businesses have proven over many years why they are exceptional, their ability to grow and reinvest at healthy margins has earned the premium multiple that investors pay for shares today. As we look towards the future, one wonders just how much runway there is for the luxury market. If the overall market was to eventually stall out, there is a risk that growth at these companies would do the same. Though unlikely based on their past (these businesses, while required as public companies to release quarterly earnings and forecasts, are always focused on long term time horizons. They think in decades, and this makes sense when they have been around for centuries) a slowdown in the overall growth of the market could cause the companies to ramp production and cut prices, perhaps diluting the tremendous value of their brand equity. We don’t see this being a likely scenario but it is possible nonetheless. A possibly more likely scenario for investors to consider is that growth stalls and the multiples that investors are willing to pay contract. Even with modest growth, a moderate to drastic rerate of earnings or cash flow multiples could severely dampen returns for shareholders. Though to the contrary, the management teams at these respective companies are savvy and perhaps exceptional capital allocators, and with healthy balance sheets, could buy back shares at depressed levels, offsetting some of the damage of the multiple contracting. A perhaps less tangible risk is the risk that overall consumer sentiment shifts harshly against luxury. While probably a low percentage in terms of near term possibility, it is worth consideration nonetheless. If there was some sort of mass movement that was able to shift the consciousness of a generation, it is possible that an entire generation of consumers would not see luxury goods as desirable as generations past.

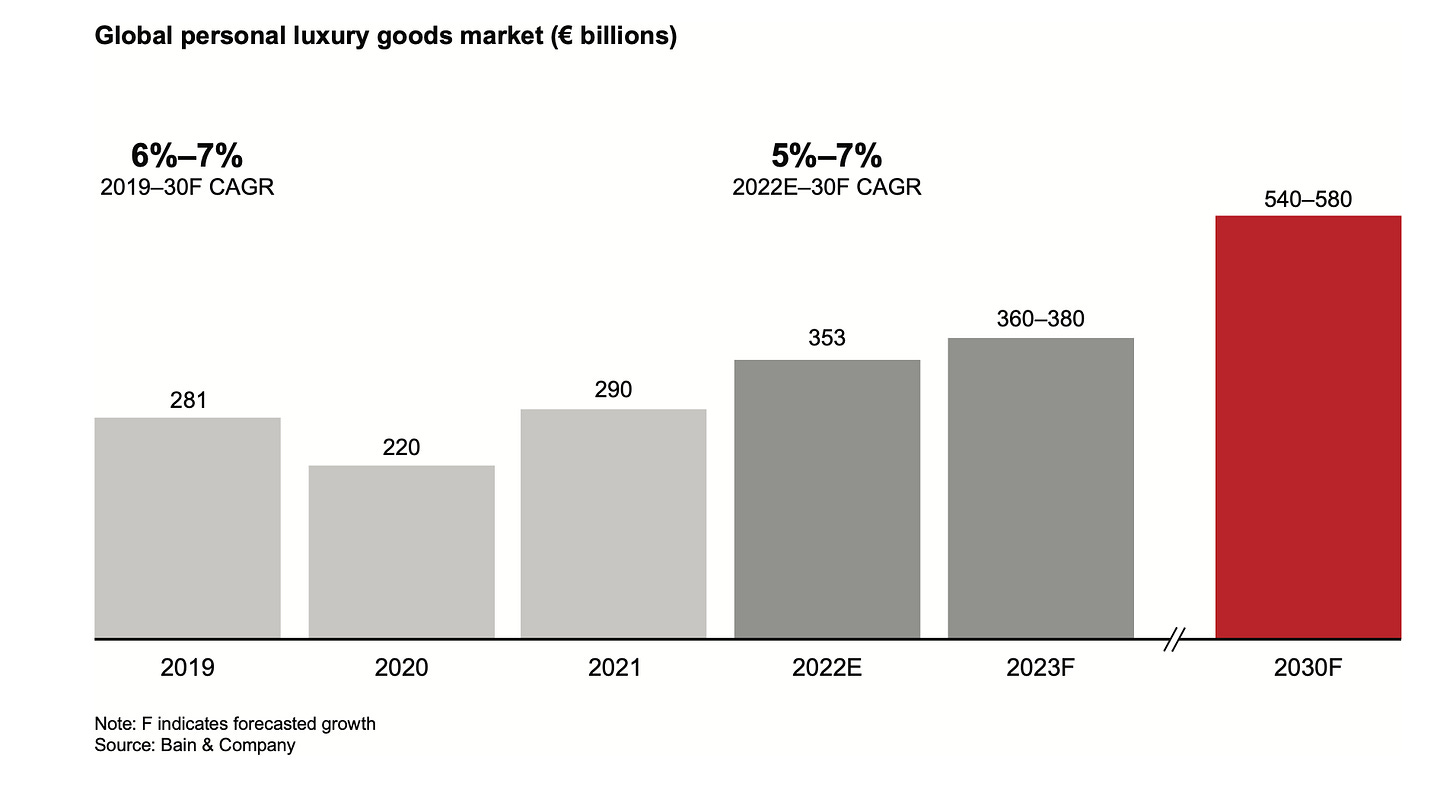

Bain & Company, however, presents an opposing view, finding in their research that GenZ is spending on luxury earlier than millennials did and predicts solid growth throughout most of the next decade.

“The prospects for personal luxury goods out to 2030 are positive. Solid fundamentals are set to boost the market’s value to between €540 billion and €580 billion by the end of the present decade, from an estimated €353 billion in 2022—a rise of 50% or more.

A powerful factor for sector growth this decade will be generational trends. Generation Y (millennials) and Generation Z accounted for all of the market’s growth in 2022. The spending of Gen Z and the even younger Generation Alpha is set to grow three times faster than other generations’ through 2030, making up a third of the market. This reflects a more precocious attitude toward luxury, with Gen Z consumers starting to buy luxury items some three to five years earlier than millennials did (at 15 vs. at 18–20); Gen Alpha is expected to behave in a similar way.

New types of activities, often powered by technology, should also spark an additional €60 billion to €120 billion in sales by 2030, from sources such as the metaverse and brand-related media content.

The luxury market’s consumer base will expand from some 400 million people in 2022 to 500 million by 2030. The share of top customers has been expanding and accounted for some 40% of market value in 2022, compared with 35% last year. These consumers are hungry for unique products and experiences, putting brands’ VIC (very important client) strategies into overdrive.”

“Luxury brands have faced three years of tremendous turbulence and uncertainty, but the industry shows more strength, resilience, and ability to innovate than before . Profit levels that had quickly recovered post-Covid to an average 21% in 2021 have slightly eroded in 2022, down to 19%–21% . While the industry has benefited from increased prices and a continued shift to higher-margin direct channels, the lower profit levels reflect luxury brands’ investment in future growth, particularly through increased marketing spending and ambitious transformation programs . However, the profit erosion also reflects higher energy prices and increased labor costs . None of this has stopped brands from investing in modernizing their operations, especially through more robust information technology infrastructure to support the ongoing digitalization of the industry, and througha reconfiguration of their store networks (primarily through renovation and relocation projects) .

The robust performance in 2022 suggests that growth should stay healthy for the personal luxury goods market in the medium term . We expect that solid market fundamentals will result in annual growth rates between 5% and 7% until 2030 . We therefore forecast that the market value of personal luxury goods will rise to between €540 billion and €580 billion by the end of the present decade, from an estimated €353 billion in 2022—an increase of more than 50% .

Four growth engines will profoundly reshape the luxury market by 2030:

– Chinese consumers should regain their pre-Covid status as the dominant nationality for luxury,growing to represent 38%–40% of global purchases .

– Mainland China should overcome the Americas and Europe to become the biggest luxury market globally (25%–27% of global purchases) .

– Younger generations (Generations Y, Z, and Alpha) will become the biggest buyers of luxury by far, representing 80% of global purchases .

– Online should become the leading channel for luxury purchases with an estimated 32%–34% market share, followed by monobrand stores (30%–32% market share) .”

In Summary

From a financial perspective, these three companies have strong metrics across the board.

LVMH has grown revenues at a 9% CAGR the past 10 years, with 65% gross and 20% EBIT margins, while compounding free cash flow at 15% per year and earning a 13.5% return on invested capital.

Hermes has grown revenues at a 10.5% CAGR the past 10 years, with 69% gross and 34% EBIT margins, while compounding free cash flow at 20% per year and earning a 25% return on invested capital.

Ferrari has grown revenues at a 6% CAGR the past 10 years, with 50% gross and 22% EBIT margins, while compounding free cash flow at 11% per year and earning a 18% return on invested capital.

These numbers are attractive to investors on the surface level, and perhaps even more so when one considers the strength of their respective competitive advantages. Perhaps deservingly so, all these companies are valued at relatively expensive multiples, and conservative investors may want to add these to their watchlists while they wait for a pullback. There are certainly risks - whether the key man risk and succession worries with Mr. Arnault at LVMH or the market growth concerns relevant to Hermès and Ferrari, but investors can sleep well at night knowing they own shares in brands that have successfully compounded their heritage over many years to deliver attractive returns for shareholders. As always, one should do their own due diligence when researching an investment idea and the information in this piece is for research purposes only and is not investment advice. We believe that inevitably, the luxury industry will continue to experience healthy growth through the resilience of their target demographic amidst varying economic conditions and because of the various competitive advantages that have been built over the decades. We recognize the premium multiples that investors are currently paying for the earnings of these companies and while it’s impossible to time the market, we would feel comfortable building positions in these shares at a price that is a bit closer to the fair value in our valuation models. Nonetheless, they are certainly companies that belong on most investors watchlists and are undoubtedly amongst the best companies in the world. Please don’t hesitate to reach out on Twitter with any thoughts or feedback and if you enjoyed this piece, let me know and I will do my best to follow up with more in depth coverage on each company and review their quarterly earnings results.

Thank you for these analyses.

For those who want to invest in luxury but are bearish on China (see other comments below), Ferrari may be a good bet as they get only 10% of their revenues from China against 30% generally for luxury brands. They also have a full order book for the next 2-3 years. The valuation is demanding but you still have a 10% discount vs Hermes.

I really enjoy reading your writing style